Attention Wachovia customers: Wells Fargo just rode on on that stagecoach thing of theirs and stole your bank from Citibank, says the NYT. Rather than pick apart the pieces of Wachovia, Wells Fargo is going to buy the whole darn thing.

wachovia

../../../..//2008/10/03/surprise-wells-fargo-is-buying/

Surprise! Wells Fargo is buying Wachovia, even though Citibank said at the beginning of the week that it was going to. (Check out the full post here.) Unlike Citibank, Wells Fargo will absorb all parts of Wachovia, including its securities and retail brokerage biz, in a “$15.1 billion all-stock merger.” [DealBook] (Thanks to Stephen!)

Happy Ending: Always Look A Gift Check In The Mouth

There’s a happy ending to our story, “Always Look A Gift Check In The Mouth” about the guy who opened up a new bank account just to deposit a check he thought might be fraudulent and indeed, turned out to be. Fred writes:

WaMu And Wachovia Weren't On Texas-Ratio Deathwatch List

Back in July, after IndyMac went under, we posted a list of ten banks that could be “the next to go under.” Interestingly enough, as reader Irene noticed, neither Washington Mutual or Wachovia, two major, sub-prime mortgage saddled, banks that got taken over recently, made the list. The list was based on analyzing the banks’ “Texas-Ratio,” basically the ratio of loans they’ve made to capital they had on hand. None of the banks on the Texas-Ratio watch list, like “The State Bank of Lebo” of Lebo, KS, or “First Priority Bank” of Bradenton, FL, can be found on another list either: the list of banks you’ve heard talked about in the news. Well here’s a newsflash that the media elite passed over while buffing their loafers with their fancy college degrees: The State Bank of Lebo now has an ATM. It’s inside Casey’s General Store. Put that in your pipe and smoke it!

March Madness-Style Bracket Makes Bank Mergers Fun

TechCrunch has posted this “March Madness” style bracket of the recent financial meltdown. It was reportedly created by a general partner at Sansome Partners named Mark Slavonia, says TC.

What Wachovia Customers Need To Do Post-Citigroup Takeover (Hint: Nothing)

What do Wachovia customers need to do now that Citigroup owns your ass? Absolutely nothing. You can do all your online and offline banking just like nothing happened. No temporarily held funds, no chained and locked bank branches. Everything is the same. Even your bank’s regulator remains the Office of the Comptroller of Currency. Down the road there will likely be a few alterations, most of them cosmetic. Read our post “Insiders: Probable 1-Year Timeline For Customers In WaMu To Chase Transfer” for some of the changes you can expect.

Citigroup Buys Wachovia

Part of Wachovia will remain independent — including its massive brokerage business which ballooned after it purchased AG Edwards in 2007, as well as its Evergreen investment management division.

Now That The Largest Bank Failure In U.S. History Is Over, Is Wachovia Next?

The collapse of Washington Mutual and the FDIC-engineered fire sale to JPMorgan Chase has people worried — about Wachovia. Wachovia’s stock is down 45% for the week, and 27% today as bailout talks stalled in Washington and WaMu held a garage sale at the FDIC.

Reach Wachovia Auto Loan Executive Customer Service

The number for Wachovia Auto Loan Executive Customer service is 877-250-2265.

Morgan Stanley Ponders Wachovia Merger

The Morgan Stanley investment bank is considering merging with the Wachovia commercial bank. The point is for the investment bank to have lots of capital on hand in the form of consumers’ deposits. This would return the two back to their structure during the Great Depression, when the two split. Uh, oh, there’s the D word, and we’re not even officially allowed to say the R word yet! Let’s just say Wall Street is getting completely rewritten this week, and while it’s way too early to tell what this means to the average consumer, there will be repercussions. Blood, too, probably.

Customers Claim That Wachovia Is Handing Out Counterfeit Bills

Something shady may be afoot at a Central Florida Wachovia branch…two customers say that a teller gave them counterfeit bills, according to Local 6 news in Orlando. The bank is refusing to give them a refund, claiming that they have no way of knowing if those counterfeit bills are the same ones the teller gave out, but Local 6 says that they’ve learned that Wachovia previously gave a customer with a similar story a refund.

Wachovia: We Just Lost $8.9 Billion!

Wachovia just lost $8.9 billion dollars, and will cut 6,350 workers as the credit crisis keeps on truckin’, says the Associated Press. This is um, a lot more than Wall Street had been expecting. Earlier this month, Wachovia had projected a $2.6 billion loss.

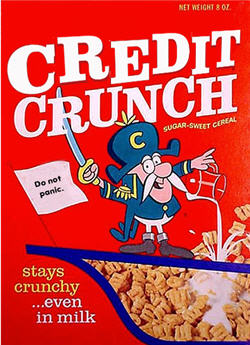

Credit Crunch CEO Bloodletting Claimes Latest Victim: Wachovia's Ken Thompson

Just when you thought it was safe to go back in the water… Wachovia CEO Ken Thompson has been gobbled up in a subprime shark attack after 32 years with the company.

Wachovia Now Being Investigated For Drug Money Laundering

Wachovia, you old rascal! As soon as you wrap up one unsavory scandal, a new possible scandal comes to light. U.S. justice authorities are investigating the bank for possible money laundering through Mexican and Colombian money-transfer businesses. The Wall Street Journal reported on Saturday that “the bank is possibly facing a deferred-prosecution agreement with the US Department of Justice that would subject it to ‘extensive federal oversight,'” but Wachovia denies that any such discussion has taken place.

Wachovia To Pay $144 Million For Bilking "Gullible" Seniors

Wachovia will pay $144 million for helping telemarketers prey upon the elderly. The Office of the Comptroller of the Currency spanked the morally bankrupt institution with one of the largest fines ever levied—but before seeing a penny of settlement money, seniors will need to fill out detailed claim forms and navigate a complex bureaucracy.

Wachovia Opens Bank Account Without Permission, Starts Charging Fees

John can’t understand how Wachovia charged his startup $12 in fees for failing to maintain a minimum balance when his company never opened an account with Wachovia in the first place. Apparently, his former bank manager decamped to Wachovia and, without his permission, opened a new account “to ensure certain money rates,” whatever that means. John isn’t mad, and the bank manager agreed to close the account, but John is a little worried because a collections agency has started calling and the account now lists $24.05 in fees.

Dear Wachovia, My 78¢ Balance Is Not Your Take A Penny Tray

Two readers wrote in with similar complaints: each had left a small overpayment on his credit account, and instead of leaving the balance or issuing a check, the bank zeroed out the balance and pocketed the money. Apparently, banks are now treating small balances like tips.

Round 3: Ticketmaster vs Wachovia

This is round 3 in our Worst Company In America contest, Ticketmaster vs. Wachovia. Their crimes?