A year ago, Virginia-based USA Discounters was in the spotlight after the supposedly discount retailer — which had several locations adjoining military bases and directly marketed its financing to servicemembers — was criticized for charging ridiculously high prices on its products and then suing soldiers in such a way that they could rarely defend themselves in court. The retailer then changed its name to USA Living and promised to not be so evil, even though the lawsuits continued. Now comes news that the retailer is going to close up shop for good. [More]

usury

Faith V. Greed: The Battle Between Faith-Based Organizations And The Payday Loan Industry

“The Bible condemns gaining wealth through usury; and the writers of Scripture warn about gaining wealth through exploiting the poor… [but] The State of Alabama allows Payday lenders to charge an annual interest rate of 456%.” [More]

Would Capping Credit Card Interest Rates Help Or Hurt Consumers?

Many Americans are carrying more than $10,000 in revolving credit card debt, some with an APR of over 20%. But while the idea of putting a more reasonable ceiling on these rates might seem like a way to help get these folks out of debt and back in the black, some say it would likely have no positive effect on the economy at large. [More]

FTC Squashes Payday Site For Putting $54.95 Charge For Empty Debit Card In Fine Print

You’re broke. How would you like a $54.95 debit card? It’s empty, but if you ever do get any money, you can put up to $2,500 on it. Yay. If that doesn’t sound like a bargain, it’s no wonder that one internet marketer of payday loan referral sites was hiding the fact that he was signing you up for these dodo cards via a pre-checked checkbox on the signup form, and the FTC smacked him down for it. [More]

Make Only Minimum Credit Card Payments, And Your Heirs Will Still Be Paying During The Robot Wars Of 3510

Cracked shares a cautionary tale of what will theoretically happen to a person who makes only the minimum payment on a credit card balance of about $10,000. Like all solid financial advice, it begins with an Amazon.com addiction and ends with the Earth being destroyed two thousand years in the future by a power-mad Bank of America. [More]

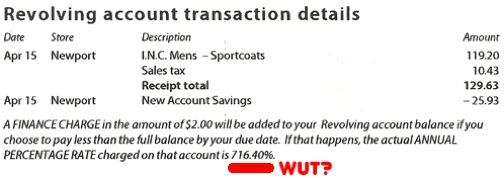

The Variable APR On This Macy's Credit Card Is Either 23% Or 716%

Rick writes: Check out the first bill I received for a Macy’s card I just opened last week (because they offered me 20% off if I did). 716% APR has to be some kind of record. Even loan sharks couldn’t charge that with a straight face.

Stephen Colbert Supports Payday Lending, So You Probably Should Too

Chicago Democrat Luis Gutierrez introduced a bill last month that supposedly reforms out of control payday lending, where interest rates can exceed 300%, but actually gives payday lenders the freedom to charge annual interest rates that can exceed, um, 300%. It doesn’t sound like much of a reform, and in fact Gutierrez has been heavily funded by the payday lending lobby. But luckily for you and me, Stephen Colbert explains why this is all a good thing.

National Usury Limit Could Reduce Number Of People Paying Debt Until They Die

For about 30 years, there has been effectively no limit on the interest rates lenders can charge. This means some loans—especially payday loans, tax refund anticipation loans, overdraft protection loans, and car title loans—can have effective interest rates as high as 3,500%.

Car Title Loans Are Liable To Leave You Taking The Bus

You surely already know better, because you’re a loyal Consumerist reader, but stay far, far away from the form of legalized usury known as car title loans! CNN has published an overview of the industry, noting that APRs frequently exceed 200%, and that added fees and loan “rollover” options help keep borrowers in a cycle of debt.

Ohio Payday Lenders Lie, Bribe The Homeless In Attempt To Overturn Usury Limits

Ohio payday lenders, still smarting from their punch in the face, are turning to lies and deceit to qualify a ballot initiative that would overturn the state’s recently approved usury limits. The industry’s petition gatherers are telling people that the initiative would “lower interest rates,” even though it would raise the maximum allowable APR from 28% to an astounding 391%. They’re also giving dollars to illiterate homeless people who sign the petition.

Arkansas Attorney General To Payday Lenders: Shut Down Or I'll See You In Court

On March 18, Arkansas Attorney General Dustin McDaniel sent letters to 156 payday lenders, ordering them to stop issuing new loans and void any current and past due loans or face legal action. McDaniel charges that the lenders are violating Arkansas’s constitutional prohibition against usurious interest rates.

New Hampshire Gives Payday Lenders The Boot

New Hampshire will become the latest state to keep payday lenders from gouging their patrons. A measure passed by the legislature will cap interest rates on payday loans at 36%, a drastic change for an industry used to bludgeoning underbanked consumers with interest rates exceeding 500%. Payday borrowers spend an average of $793 trying to repay a $325 loan. Let’s see how the economic leeches spin this as a loss for consumers.

Study Says Payday Lenders More Prevalent In Areas Of High Christian Conservative Power

A law professor and associate professor of geography set out to create the most comprehensive map of U.S. payday lenders to date. What they found, to their surprise, was “a surprising relationship between populations of Christian conservatives and the proliferation of payday lenders.” And it’s not a side effect of a poor population that happens to be Christian, according to the authors: “Our research showed that the correlation between payday lenders and the political power of conservative Christians was stronger than the correlation between payday lenders and the proportion of a population living below the poverty line.”

../..//2008/02/08/new-legislation-in-colorado-threatens/

New legislation in Colorado threatens to put a cap on payday lending.

Usury Is Good For You

Usury is good for you. That’s the lesson from an article in today’s WSJ using empirical evidence to defend the practice of charging 200% interest rates.

Payday Loans Die In DC

In a victory for consumers, Washington D.C. effectively outlawed payday lending today with the passage of the Payday Loan Consumer Protection Act capping lending interest rates at 24%.

Support The Credit Card Act Of 2007

The Credit CARD Act Of 2007 is a bill currently before Congress aiming to end some of the credit card industry’s anti-consumer practices. Among H. R. 1461’s proposals: