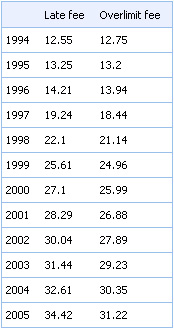

Since 1994, credit card late and overlimit fees have more than doubled. We’re no economist, but that doesn’t seem to keep pace with inflation.

usury

Payday Lenders Target Poor New Mexicans

NPR’s got a nice little story on payday loans in New Mexico.

Almost As Many PayDay Loan Centers As There Are McDonalds

There’s almost as many PayDay Loan Centers in America as there are McDonald’s.

Do PayDay Loan Centers Target Minorities?

Do payday loan centers target minorities? If there’s any doubt in your mind, consider an instructional course offered by the Community Financial Services Association of America (CFSA,) a payday loan trade group. The couse is titled, “Building Community Support: Strategies for Business Survival.”

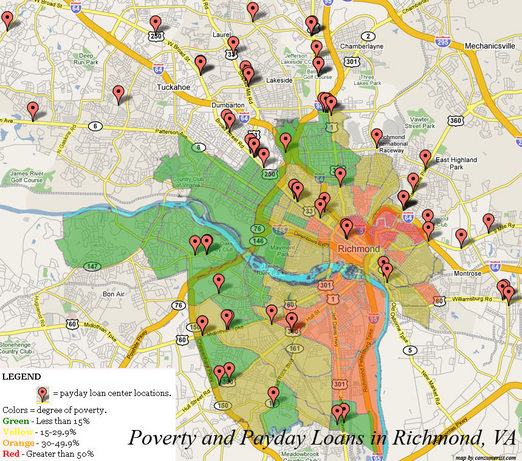

Do PayDay Loan Centers Target The Poor?

According to Virginia Delegate Jennifer L. McClellan, “There are over two payday lending stores for every McDonalds in Virginia and three for every Starbucks.”

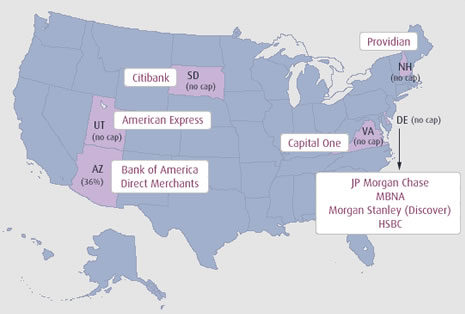

The Geography of Usury

If you’ve ever wondered why your credit card bills are postmarked in Utah, Delaware, Virginia, or South Dakota, and why your interest rates are higher than you think should be legal, the map above might help.

UPDATE: Getting Out of Credit Card Debt

T’is a pity for the flower of youth to be wrinkled by the radioactive belch of credit card debt. Yesterday, we asked the readers about how college boy L.S. should get out of his $2150 in credit card debt set at exorbitant rates and here’s what we think he should do.

Maxed Out Movie Details America’s Pit of Debt

- “…back in the ’60s and ’70s … a lot of bankers objected to credit cards and said they were not going to give consumers the noose from which to hang themselves–that was immoral, that was unethical … They understood that people would abuse credit if given too much of it, and the banker had to fill this role of regulator. That philosophy doesn’t exist any more.”