AllFinancialMatters has a list of the 50 most overlooked deductions from The Ernst & Young Tax Guide 2007. Highlights of particular interest:

taxes

File Taxes For Free If You Make Under $52k

You can e-file your federal taxes for free if your adjusted gross income falls below $52,000 using Free File from the IRS.

Two Free Tax Tools: DeductionPro and OrganizIT

Thanks to H&R Block, today is National Tax Advice day, and they’re offering two free tax prep tools.

I.R.S. Employ Of Private Debt Collectors Criticized

The national taxpayer advocated yesterday asked congress to forbid the IRS from using private debt collectors.

Tax Panic: What to Do If You Can’t Pay

- “The first route is via Form 9465, Installment Agreement Request (PDF). You supply the terms based on your ability to pay over the next few years. If the amount owed is under $10,000, the IRS will accept most reasonable offers to pay within 36 months. Otherwise, larger amounts may require further correspondence and data gathering for the IRS.”

Very interesting stuff. A must read if you’re short on your taxes this year. —MEGHANN MARCO

Should You Itemize Your Deductions?

Married Filing Separately $5,150

There are a few exceptions, conditions, etc that the Tax Man explains in his post, so check it out. Also, keep in mind that itemizing is fun. Yes, really. —MEGHANN MARCO

10 Steps To A Simple Financial Life

One day you woke up and you realized that you were an adult, and, as said adult, you would be mailed something called a “fund prospectus.” What? How did this happen to you? What should you do about it?

Tax Tip: Mileage Calculator

What happens when a web developer has to drive to meetings and then needs to calculate the mileage for tax purposes? You win. Ade Olonoh has created a milage calculator that uses Google Maps and Google Calendar to make mileage calculations easy and quick. Ade says:

New Things To Know For Taxes This Year

Ladies and Gentlemen, Dependants and Deductions, it’s officially tax season! Yay! So, what’s new?

Do I Need To Report This Income?

The IRS wants to eat all your money. They don’t care where you got it, even if its from bribes or selling drugs.

HOW TO: Donate to Charity

It’s the end of the year, so we thought we’d offer some tips on charitable giving. There are only a few days left to donate items before the end of the year. Giving to charity is about more than just saving on your taxes, it’s also about helping a cause that’s important to you. You could save a panda, or cure a disease, or help someone who is hungry. Giving to charity is a way for you to decide where your money goes.

HOW TO Reduce Real Estate Taxes

How can you make sure you’re not paying too much real estate tax?

Charitable Cash Donation Deductions Now Require Proof

Blueprint for Financial Prosperity scrutinized the new IRS rules about charitable donations and found an important change.

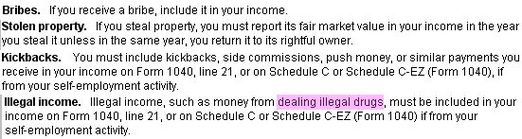

Don’t Forget To Declare Bribes On Your Taxes

When filling out the “other income” section on your taxes this year, there’s a few things you might forget to declare. Like your income from selling drugs. AllFinancialMatters spotted this while cruising the this years IRS FAQ.

Why Are There Taxes On Frequent Flyer Miles?

Why are “free” frequent flyer miles taxed, asks Katie.

H&R Block Leaves Guy With $3100 Bill

guarantee”, so Travis will be responsible for the bill. Whoops. H&R Block’s included “Accurate Calculations Guarantee” covers “penalties and interest caused by such error.”

Get Ready For Tax Time With 3 Folders

AllFinancialMatters has a suggestion for preparing for taxtime year round, something easy and low-energy you can do on a regular basis. Get three folders and label them Income, Expense, and Credits. File records accordingly. Ding!