Washington, D.C., might as well be called Acronym City. It feels like there are a zillion different, discrete agencies, organizations, bureaus, boards, and commissions within the federal government, each with its own graceless three-, four-, or five-initial moniker, forming the tangled web of a bureaucracy that regulates… well, almost everything. So what are the key regulatory agencies, anyway? Who oversees what, and who do they report to, and how does it all work? [More]

treasury

Bank Of America & Chase Continue To Be Penalized For Sucking At Loan Modifications

For the third quarter in a row, the Treasury Dept. has released its report card detailing how the country’s largest mortgage servicers are doing with processing loan modifications. And for the third consecutive quarter, both Bank of America and JPMorgan Chase will not receive incentive payments from the Treasury because the banks are doing such a craptastic job at complying. [More]

GAO To Feds: Replace Dollar Bills With Coins

While many other global economies — including the European Union — have ditched their low-value paper banknotes in favor of coins, the U.S. continues to churn out dollar notes while $1 coins take a backseat. But a new report by the Government Accountability Office urges the Treasury and the Federal Reserve to give renewed thought to the idea of making dollar bills extinct. [More]

Treasury Impotent To Penalize Wrongfully Denied Loan Mods

For all its tough talk, the Treasury can’t do jack to reign in lenders who are wrongfully denying home owners loan modifications. After seeing reports that some banks were basically modifying no loans at all, Treasury staffers huddled up to talk about withholding payments and levying fines on the baddest of the bunch. Unfortunately, they were told by their own lawyers that they don’t have that power. ProPublica reports, “staffers were walked back by Treasury lawyers, who said the government was only party to a commercial contract with servicers and not acting as their regulator.” [More]

Treasury Dept. To Offer Tax Refunds On Pre-Paid Debit Cards

We’ve been warning readers for years against “refund anticipation loans,” where tax preparers like H&R Block and Jackson Hewitt give you a pre-paid debit card now loaded with your expected return (minus fees and interest). And yet, these cards have continued to appeal to some lower-income taxpayers who don’t have bank accounts for direct-deposit of their returns. Now the federal government is providing these people with an alternative — a debit card that will accept the direct deposit. [More]

US Bailout Money Wound Up In Foreign Banks

Because of there being no data on where the money was going and a general attitude of pumping as much money into the banks as quickly as possible, billions of US bailout money wound up in the coffers of foreign financial firms, a watchdog panel chaired by Elizabeth Warren – Warren for CFPA head! – found. 43 of the 87 banks that benefited as a result of the of the AIG bailout were foreign. [More]

Stock Market Typo/Robot Apocalypse Still Being Investigated

Treasury Secretary Tim Geithner will meet with federal regulators and top officials from the NYSE and other exchanges to dicuss whatever the hell happened last Thursday that caused the stock market to completely freak out. [More]

$100 Bill Redesigned, Now Has Hidden Images

Today the Treasury Department will reveal a redesigned $100 bill. The new design brings the bill in line with the smaller denominations that are already in circulation, and it adds a fancy new anti-counterfeiting measure called Motion that uses special threads to “create an optical illusion of images sliding in directions perpendicular to the light that catches them.” [More]

Bank Of America Posts $1 Billion Loss In Third Quarter

Do you hate Bank of America? Well take today’s earnings report and wallow around in it like Ann-Margret in beans, becuse the bank has posted a loss of $1 billion before dividends to preferred shareholders—”When those dividend payments are included, the loss was $2.24 billion,” reports the New York Times.

This Is Timothy Geithner's Beautiful House – Not Selling

It’s a common enough story. A family puts their house up for sale after one of the parents gets a great job offer in another city. Sure, they bought the house at the peak of the housing bubble, but they refuse to sell for less than they paid. The house stays on the market for months on end.

Here Comes The Consumer Financial Protection Agency!

Shhh, everyone, gather near and listen to Treasury Secretary Timothy Geithner deliver the most beautiful, wonderful mandate we could give to a new federal agency: “The agency will have only one mission—to protect consumers.” And with that, the Treasury Department sent to Congress legislation that will create the brand new Consumer Financial Protection Agency.

How To Redeem Government Bonds

Earlier this week, Consumerist published a story about how you can check for unredeemed, matured government bonds by checking with TreasuryDirect. Here’s how to redeem a bond.

Check For Unredeemed, Matured Government Bonds

A PR person just contacted us on behalf of the U.S. Treasury Department to point out that there are $16 billion in unredeemed bonds that are no longer earning interest. “Specifically, there are 40 million Series E savings bonds purchased between 1941 and 1978 that are over 30 years old and therefore have fully matured. They can be cashed out today for at least four times their face value.”

Hank Paulson Admits He Never Really Understood How Mortgage-Backed Securities Worked

Here’s more proof that the people who probably should have known how they were making all that housing bubble money never did—even those who personally made tens of millions off of it. The Business blog at The Atlantic notes a quote Hank Paulson, former Goldman Sachs CEO and Treasury Secretary, gave Newsweek: “I didn’t understand the retail market; I just wasn’t close to it.”

About 10 Banks May Need More $ After Gov Stress Test

The number of banks that will need more capital has grown. Now it looks more like 10 banks that underwent the government stress-tests are undercapitalized, possibly among them Wells Fargo, Bank of America, Citigroup and some regional banks, reports WSJ. The good news seems to be that the problems the stress tests are revealing aren’t as bad as analysts had been saying. Clearing out some of that fear contributed to Monday market gains and the S&P 500 entered positive territory for the year for the first time in months.

6 Major Banks Fail Initial Stress Tests

6 of the major 19 banks failed the Treasury’s “stress tests” and need more cash as a buffer against losses, according to leaked preliminary results.

Would You Use A Government-Issued Credit Card?

With President Obama and Congress threatening to tag-spank credit card issuers, Slate is left wondering why the government doesn’t just issue its own credit card. Before you scream “SOCIALISM!,” consider the government’s heavy involvement in the banking sector, not just through the recent bailouts, but through long-standing institutions like Fannie and Sallie Mae, and Freddie Mac. Credit-worthy borrowers in Germany, France, and India all have access to low-interest, no-fee credit cards issued by their central banks. Would you ever be interested in an Obama-backed credit card?

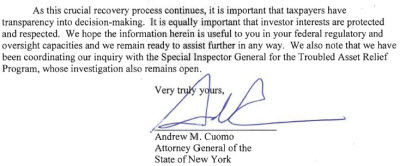

Bank Of America CEO: The Bush Administration Made Me Do It!

New York Attorney General Andrew Cuomo’s office is at it again. They’ve been investigating the circumstances that led to the merger of Bank of America and Merrill Lynch and the subsequent bonus payments to executives. In a letter to Senator Chris Dodd (D-CT), chairman of the Senate Banking Committee, Cuomo quotes Bank of America CEO Ken Lewis as saying that former Treasury Secretary Hank Paulson threatened him with removal from his position and mass firing of the board and senior management if he didn’t allow the merger to go through.