Con artists use publicly available foreclosure notices to find victims for their equity stripping scams.

subprime meltdown

Another Ohio Judge Halts A Foreclosure

The judge said the foreclosure lawsuit was filed before Wells Fargo owned the mortgage – thus, the suit was premature.

Countrywide Subpoenaed by Illinois Attorney General

Lisa Madigan, the attorney general of Illinois, is investigating subprime mortgage lender Countrywide “as part of the state’s expanding inquiry into dubious lending practices that have trapped borrowers in high-cost mortgages they can no longer afford,” says the New York Times.

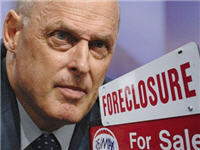

Freddie Mac's Fraud Video Warns Borrowers

Freddie Mac produced this video to educate borrowers who face foreclosure about a fraud scheme where “a con artist will seek out a public notice of foreclosure and approach the potential victim with documents and the promise of sorting out the debt,” thereby tricking the homeowner into signing over the deed to the house.

Bank Of America Plans To Lose An "Unknowable" Amount Of Money

Losses from the subprime meltdown are going to hurt Bank of America, but they won’t say how badly. They just want investors to be prepared when the 4th quarter numbers come in, says the NYT.

Freddie Mac Will Be Losing A Few Billion More, Decides To Stop Buying So Many Bad Loans

“If I were you, I would want in this time period someone running one of these companies (Fannie Mae and Freddie Mac) to err on the side of pessimism rather than optimism,” he said.

Hey, good point.

Fed Cuts Interest Rates By Quarter Point

The Fed cut interest rates again today as they continue in their attempt to swoop in and save the economy from the credit crunch. Much like Superman, but boring and not as effective.

The Subprime Meltdown From The Perspective Of A Housing Counselor

Coppedge saw it coming in slow motion. Around this time last year, she was mostly dealing with renters who were behind on payments. Rarely did she counsel at-risk homeowners. When she did, they were usually suffering a one-time setback such as job loss.

../../../..//2007/12/10/bank-of-america-liquidates-a/

Bank of America liquidates a $12 billion dollar enhanced cash fund. It is the largest investment of its type to close due to losses in the subprime mortgage market, says Bloomberg. [Bloomberg]

The Subprime Meltdown Is The Tip Of The Credit Iceberg

The ongoing subprime meltdown is merely the first destructive wave of credit catastrophe to wash over Wall Street, according to Slate’s resident explainer. Americans drunkenly bandy credit around in several forms: mortgages are the most prevalent loans turning sour, but credit card debt, student loans, and auto loans are silently conspiring to threaten our macroeconomic well-being.

../../../..//2007/12/06/elizabeth-warren-on-the-rumored/

Elizabeth Warren on the rumored teaser rate freeze. [Credit Slips]

From $2 Million To Foreclosure On An Ameriquest Subprime Mortgage

Frances Joy Taylor had had about $2 million in assets, which she intended to leave to her church, before she met a businessman named Tyrone Dash. Dash took over her affairs and “methodically liquidated or leveraged almost everything she owned: her bank accounts and securities, her insurance policies, her credit cards, her two apartment buildings and, ultimately, her home,” says the Seattle Times. Frances suffers from Alzheimer’s.

Bush To Announce 5 Year Rate Freeze For Mortgages

Tomorrow, President Bush will outline a plan to freeze rates for 5 years for subprime mortgage loans that “originated between January 1, 2005, and July 31, 2007, with rates that are due to reset between January 1 of next year and June or July of 2010,” reports Reuters.

Failure: H&R Block Shuts Down Subprime Lending Operation

H&R Block has decided to admit defeat after a plan to sell its troubled subprime lending operation to Cerberus Capital Management LP finally unraveled.

Who Has A Subprime Mortgage? People With Good Credit

The Wall Street Journal analyzed more than $2.5 trillion in subprime loans made since 2000 and found that as the number of subprime loans grew, the loans were being issued to borrowers with better and better credit scores—borrowers who could have qualified for traditional loans with more reasonable terms.

Bush Subprime Mortgage Plan Will Be Finalized Soon

ABC News has an interview with Treasury Secretary Henry Paulson in which he says that the administration’s plan to help subprime borrowers is nearing completion.

The Long Johns Explain The Subprime Meltdown

John Bird and John Fortune are British satirists who, as The Long Johns, explain in eminently practical terms exactly how the subprime meltdown came to be.