Last week a clutch of protesters sang parodic carols outside the Goldman Sachs Christmas party at the hoity-toity BLVD club to protest the companies involvement with subprime mortgages.

subprime meltdown

Protesters Taunt Goldman Sachs Employees By Singing "Frosty The Goldman" Outside Company Christmas Party

Countrywide Invents Evidence In Foreclosure Hearing

One of the nation’s biggest mortgage lenders, Countrywide, admitted to a Pennsylvania judge that it had fabricated some of the evidence supplied in a homeowner’s bankruptcy case. The evidence in questions were a series of letters the lender said it sent to the homeowner notifying her that she owed $4,700 because of problems with escrow deductions. The homeowner had filed for Chapter 13 bankruptcy and the mortgage debt was discharged after she met the terms of her 60-month bankruptcy plan. But then later Countrywide told her they were foreclosing on her house because she still owed them money. They said they had sent her three letters notifying her of the debt. The homeowner, her lawyer, and the Chapter 13 trustees say they never got them. When Countrywide produced the letters it supposedly sent, the homeowner’s lawyer noticed that the ones addressed to him didn’t have the address of his office at the time; they had the address of the office he had moved to AFTER the dates on which the letters were said to have been sent. What a bunch of crooks.

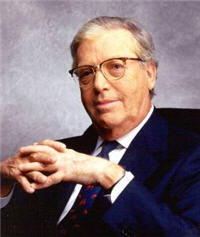

Bear Stearns CEO Forced Out By Angry Shareholders, Common Sense

Bear Stearns CEO James Cayne is expected to step down as CEO due to pressure by pissed off shareholders , reports the Wall Street Journal.

Credit Card Delinquencies Skyrocket

../../../..//2008/01/02/the-disgraced-former-hr-block/

The disgraced former H&R Block CEO responsible for the company’s disastrous foray into subprime mortgage lending, Mark Ernst, will receive a $2.5 million dollar cash bonus, stock options, and free health care until 2010. [Reuters]

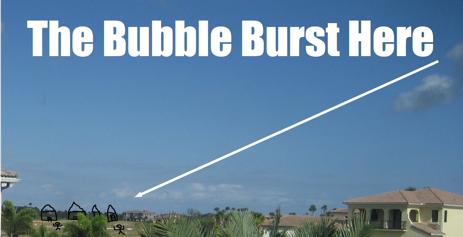

Stockton, California Shows Us How Bad The Mortgage Meltdown Can Get

Steve Carrigan is in charge of economic development for Stockton. He says bank loans made it a party every day.

../../../..//2008/01/02/home-prices-hit-record-rates/

Home prices hit record rates of decline and are heading lower. [CNN Money]

Housing Market Meltdown Making Sellers Extremely Creative

It’s not new news that the housing market is in the dumper. That’s generally good news for buyers, but shall we say less than optimal if you’re looking to sell your home any time soon. So what’s a seller to do? Looks like creativity is the name of the game. Sellers are dipping into their handbag of tricks to try and unload properties worth more yesterday than they are today (and worth even less tomorrow) Here’s a sampling of what sellers are doing:

../../../..//2007/12/31/sales-of-existing-homes-rose/

Sales of existing homes rose slightly for the first time in 9 months, but prices fell. Analysts do not think the bottom has yet been reached: “Given stress in the mortgage market and depressed buyer sentiment, we judge this to be a brief respite and look for sales to fall further,” Lehman Brothers economist Michelle Meyer said. [Wall Street Journal]

Higher Taxes, Fewer Services In Subprime Meltdown's Wake

Municipal ledger hounds are worried that local governments will slash services as the imploding housing market chokes off access to lucrative property tax revenue. The New York Times visited the future retirement destination of its readers, South Florida, to see firsthand the devastating affect the subprime meltdown can have on communities. For anyone who says “What housing crash, my community is fine,” hop across the jump for a look at your potential future.

../../../..//2007/12/20/ouch-bear-stearns-loses-money/

Ouch. Bear Stearns loses money for the first time in 80 years. [NYT]

Foreclosures Up 68% From Last Year

Foreclosure tracking firm RealtyTrac has announced November’s foreclosure numbers and, while foreclosure activity is down 10% from last month’s number, the news isn’t happy. Foreclosures are up 68% from November 2006, with 201,950 foreclosure filings—up from 120,334 this time last year. Also worth mentioning, last year’s numbers weren’t exactly low—they were up 68% from 2005.

Fed Approves Plan To Curb Irresponsible Lending

The Fed has unanimously approved a new plan to tighten provisions designed to prevent predatory mortgage lending, as well as help to decrease the number of consumers who irresponsibly take on debt that they cannot afford to repay.

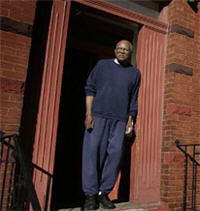

As Foreclosures Increase, Renters Suffer

Stephen O’Brien wants to buy a foreclosed apartment building on Warwick Street in Roxbury. He wants to keep the ground-floor tenant, James Evans, 77, who is partially blind and living on Social Security.

../../../..//2007/12/17/stagflation-is-coming-stagflation-is/

Stagflation is coming, stagflation is coming! [Bloomberg]

../../../..//2007/12/17/fewer-borrowers-will-qualify-for/

Fewer borrowers will qualify for mortgage insurance, due to tightened restrictions following the subprime…