There’s not much amusing in the subprime meltdown and housing bubble burst, which is why we were gladdened to see a site called Burbed. Basically, they make fun of San Francisco Bay Area housing listings.

subprime meltdown

Consumer Confidence, Home Prices Take A Nosedive

It was only a few short weeks ago that the media was reporting a new 6 year high in consumer confidence. We wanted to buy tacos. And jetskis. And footballs.

Inside The Countrywide Subprime Lending Frenzy

The New York Times has a very interesting article about the business practices that resulted in Countrywide’s dramatic spiral into the dirt. Recently, the nation’s largest mortgage lender had to tap $11.5 billion in emergency credit and was the beneficiary of a $2 billion investment bailout from Bank of America.

As The Fed Snoozes, States Step Into The Subprime Breach

States are beginning to enact protections for subprime borrowers, reacting to the absence of a national solution from Washington. North Carolina last week became one of one of several states to clamp down on the adjustable-rate mortgages that have fueled the subprime meltdown.

Mortgages Are Disappearing But The Advertising Isn't

Even as lenders face bankruptcy and banks are closing down their mortgage divisions and cutting jobs, the advertising for subprime and non-conforming loans is still going strong. What’s the deal?

../../../..//2007/08/23/the-federal-reserve-board-has/

The Federal Reserve Board has put together a big old list of links for consumers facing foreclosure. [via CL&P]

../../../..//2007/08/22/npr-says-problems-with-us/

NPR says, “Problems with U.S. subprime mortgages are reverberating worldwide. Traders are trying to decide whether recent cash injections by the Federal Reserve and other central banks are enough to ease worries about the economy.” Great, we probably broke Europe. [NPR]

Capital One To Close Mortgage Unit

“Current conditions in the secondary mortgage markets create significant near-term profitability challenges,” Capital One said in a statement. “Further, recent and continuing developments in the mortgage markets reduce the long-term outlook for profitability in the business, as the company expects markets for prime, non-conforming mortgage products are likely to remain challenged.”

Later, gator.

Getting Foreclosed? We Want To Hear About It

Have you or someone you know experienced or are experiencing foreclosure? The Consumerist is interested in interviewing people who are losing their house. Please send an email, subject line “foreclosure” with your contact information and the best time to reach you at tips@consumerist.com.

Brokers Lured Naive Homebuyers Into Mortgages They Couldn't Afford

The core of the subprime meltdown are homeowners not paying their mortgages. A contributing factor to the default rate are people who signed up for loans with low teaser rates that ratcheted up afterwards, and now it’s time to give the devil his due. Why would people do such a foolish thing?

Countrywide Borrows $11.5B from 40 banks

Countrywide has secured $11.5B in financing from 40 banks in an effort to remain afloat as the mortgage market crashes.

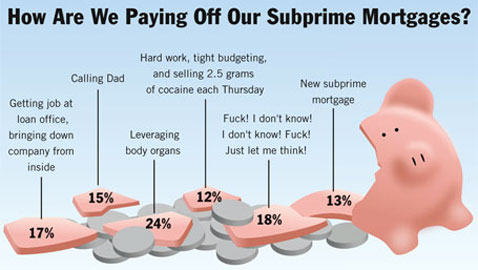

How Are We Paying Off Our Subprime Mortgages?

But with liquidity drying up, the last, and most hilarious, option is probably shrinking…

Global Market "Correction" Just Like Pork Chops And Sausages

It’s easier to understand the subprime mortgage meltdown and how it’s erasing gains in the global markets with the humorous little metaphor we heard offered on the BBC world service this morning from the editor of Britain’s MoneyWeek magazine. She likened the “eventuality” (seeing as we’re not quite ready to call it a crisis yet) to a butcher shop. It used to be that retail banks kept mortgages on their books for the life of the loan, but within the past five years, they realized that you instead of just eating the porkchop among your family, you can chop it into “tiny bits” and make them into “loads and loads of sausages” and sell them to everyone.

Whoops, Where'd My Mortgage Go?

NPR interviewed a would-be Brooklynite named Claudia who is trying to buy an apartment for herself and her teenaged sons. Everything seemed settled, when all of a sudden the lender that was going to be offering Claudio her HELOC loan decided they didn’t really want to anymore.

Countrywide, America's Largest Mortgage Lender, May Have To File For Bankruptcy

“If enough financial pressure is placed on Countrywide or if the market loses confidence in its ability to function properly then the model can break, leading to an effective insolvency,” Bruce wrote. “If liquidations occur in a weak market, then it is possible for Countrywide to go bankrupt.”

Foreclosure Filed On 1 In 29 Households In Detroit In 2007

The foreclosure numbers for the first half of 2007 are in and Stockton, California leads the pack with 1 out of every 27 homes foreclosed on in 2007. Second is Detroit, with 1 in 29 and coming in third, Las Vegas with 1 in 31.

What To Do If Your Mortgage Lender Goes Bankrupt

Panic! Burn down your house! Ha ha, just kidding. Actually, you shouldn’t let your mortgage lender’s death pangs interfere with your payments, says Gerri Willis of CNNMoney, because your loan will just be sold to another lender. However, make sure you review the details of your mortgage agreement; the terms should remain the same no matter who buys your loan, and you have a 60 day grace period to get your payments to your new mortgage lender.