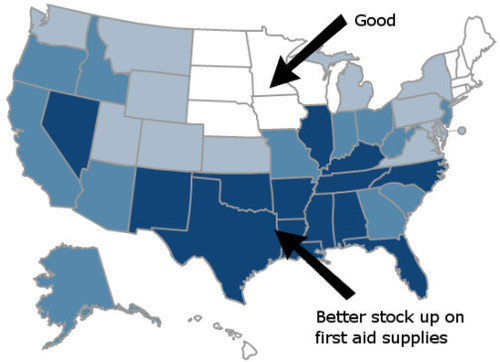

While expensive medical emergencies can hit anyone, anywhere in the U.S., a new report finds that one region of the country has a higher level of medical debt than the rest of the states. [More]

states

Cancer Charities That Scammed $75M From Donors Must Shut Down, Issue Refunds

Last May, an investigation involving federal regulators and prosecutors from all 50 states led to four national cancer charities being charged with swindling consumers out of $187 million in charitable donations. Today, two of those bogus charities — responsible for $75 million in bilked donations — have agreed to close up shop and provide refunds to donors.

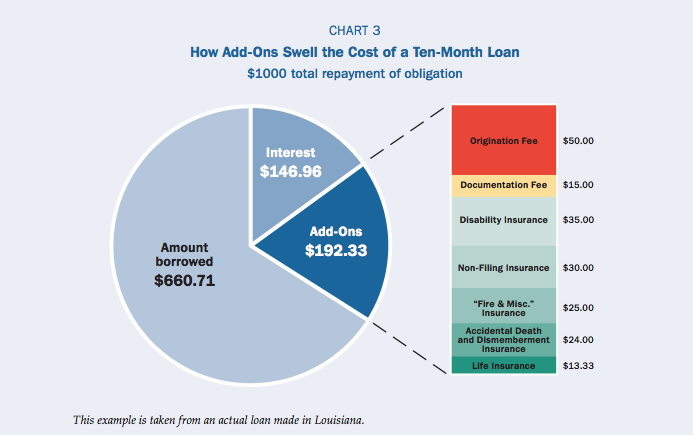

Most State Laws Can’t Protect Borrowers From Predatory Installment Loans, Open-End Lines Of Credit

As regulators continue to craft rules meant to crackdown on costly and harmful short-term payday lending, companies are offering alternative products like installment loans and open lines of credit to consumers. But, as it turns out, these cash infusions can be just as devastating to those in need, and few states offer sufficient protections for borrowers. [More]

Credit Bureaus Must Pay $6M, Fix Errors More Quickly Under 31-State Agreement

The three largest companies to collect and disseminate credit information for millions of Americans – Experian, Equifax and TransUnion – must significantly change the way they treat disputed information on credit reports as part of a massive multi-state settlement announced this week. [More]

4 Cancer Charities Accused Of Swindling Donors Out Of $187 Million

Federal regulators, state officials and prosecutors and law enforcement officers from all 50 states and the District of Columbia partnered today to charge four cancer charities and their operators for running a scheme that swindle consumers out of $187 million in charitable donations. Two of the charities have agreed to settle the charges and dissolve their businesses, while two other plan to fight the charges in court. [More]

Internet Sales Tax Bill Introduced Again

Last week, Massachusetts Rep. Bill Delahunt introduced a bill called the “Main Street Fairness Act,” which is a stupid name for a bill. The text of the bill hasn’t been released yet, but if passed, it would presumably set up a process where sales tax could be collected on purchases made over the Internet. As anyone who has shopped online over the past decade is probably aware, this has been an ongoing and thorny issue, since billions in online sales tax would provide a welcome revenue stream for struggling states. [More]

Asphalt Has Become So Expensive That Some States Are Going Back To Gravel

Kiplinger says that in the near future, if you’re driving down a rural or less-traveled road, you might find yourself driving on gravel. Road asphalt has doubled in price over the past three years and shows no signs of coming back down, so some states–Michigan, Minnesota, Indiana, Vermont, and Pennsylvania to begin with–are looking for ways to cut corners. Gravel costs $20 a ton compared to asphalt’s current $400/ton price. [More]

Connecticut Bathroom Access Law Now In Effect

Connecticut shoppers with bowel disorders, rejoice! Now, there’s a sentence we never expected to write. In order to prevent humiliating and undignified restroom access debacles for people with verified medical conditions, Connecticut has passed a law guaranteeing their access to otherwise off-limits restrooms in public places. The law went into effect on October 1st.

What Happens When Your Life Insurer Kicks The Bucket?

Life insurance polices are backed by state guarantee associations, but the coverage offered varies drastically from state to state. Some products, like variable annuities, can be recovered in full because of the way they’re structured, but if you have term life insurance or a universal policy, you should know the limitations of your state’s coverage…

Thirteen More Weeks Of Unemployment Benefits In New York State

Governor David Paterson of New York signed into law a bill extending unemployment benefits for thirteen more weeks. Around 56,000 people are on their last week of benefits right now, and the extension takes effect immediately.

Study: The Poorer You Feel, The More Lottery Tickets You Buy

Very Short List notes that “America’s lotto kiosks are currently reporting heretofore unheard-of earnings,” despite the average rate of return—53%—being less than slot machines. Researchers at Carnegie Mellon recently completed a study in which they primed people to feel relatively poor, then offered them a chance to buy lottery tickets, and the results suggest that the poorer you feel, the more likely you’ll waste your money on a lottery.

Use Your Bank Accounts Every Three Years Or They Will Go To The State

Each year banks give states $4.7 billion belonging to people who failed to “initiate a transaction or communicate with the financial institution” in the past three years. The money isn’t lost forever, but getting it back can be a bureaucratic hassle full of forms and headaches.

CSO Maps State-By-State Data Breach Disclosure Laws

CSO has produced an interactive U.S. map that shows what’s required of companies that suffer a data breach in the 38 states that care enough about consumer rights to have passed disclosure laws. Most are modeled after California’s strict SB1386 anti-ID theft law, but now you can tell at a glance what your state is doing about the issue—and in most cases you can click on the icon in the pop-up info box to see a copy of the actual law.

New Hampshire Gives Payday Lenders The Boot

New Hampshire will become the latest state to keep payday lenders from gouging their patrons. A measure passed by the legislature will cap interest rates on payday loans at 36%, a drastic change for an industry used to bludgeoning underbanked consumers with interest rates exceeding 500%. Payday borrowers spend an average of $793 trying to repay a $325 loan. Let’s see how the economic leeches spin this as a loss for consumers.

NY Governor On The Mortgage Meltdown: "The Bush Administration Will Not Be Judged Favorably"

What did the Bush administration do in response? Did it reverse course and decide to take action to halt this burgeoning scourge? As Americans are now painfully aware, with hundreds of thousands of homeowners facing foreclosure and our markets reeling, the answer is a resounding no.