Lawmakers are hashing out the details of a huge taxpayer-funded bailout of Wall Street in an attempt to keep afloat the system of banks whose willingness to lend drives this economy’s growth. Constituents have flooded their representatives phone lines and inboxes with with their heated reactions. What do you think?(Photo: Getty)

sub prime meltdown

Wall Street Is Dead

Wall Street is dead. According to its Journal, it died last night when the Federal Reserve agreed to convert Goldman Sachs and Morgan Stanley, the last remaining mega brokerages on Wall Street, into bank-holding companies. The Wall Street that was, “a coterie of independent brokerage firms that buy and sell securities, advise clients and are less regulated than old-fashioned banks,” is no more. In exchange for access to more Federal loan money, and not having have to mark its assets at market value, the two companies will be subject to tighter capital requirements and more government regulation and oversight about how they do their business. This will blunt profits, but that seems in order considering the run racked by so much reckless profiteering, for so long.

What To Do In These Uncertain Financial Times

The housing crisis. The stock market plunge. The banking industry in shambles. What’s a person to do in the midst of all this financial turmoil? We thought we’d offer our suggestions for making it through the rough waters many of us are facing:

Favorite Comment Of The Day

laserjobs: The way things are going the FDIC will probably end up with WaMu. So as long as you are under the FDIC limits you will probably be with the safest bank around soon: WaMu Federal.

WaMu Begins To Sell Itself

WaMu has begun to try to sell itself. So far, no takers. If no one buys it, one of two things will happen. Either it will be placed into a conservatorship, like IndyMac, or form a bridge bank, a kind of temporary bank. So the question for depositors is: wait to find out who your new masters are, or pull out now and decide for yourself?

Feds Loan AIG $85 Billion

The Federal Reserve Bank of New York will lend AIG $85 billion. Explaining the breathtaking move the Fed said, “a disorderly failure of A.I.G. could add to already significant levels of financial market fragility and lead to substantially higher borrowing costs, reduced household wealth and materially weaker economic performance.” They’re not just dumping out the public purse on the counter, though. FBNY will take a 79.9% stake in the company, the collateralized loan is for two years, and is expected to be paid off by selling off assets. NYT writes, “the bailout is likely to prove controversial, because it effectively puts taxpayer money at risk while protecting bad investments made by A.I.G. and other institutions does business with.” You can say that again.

Lehman Brothers Did Business With Mortgage Fraudsters Back In 2000

The Lehman Brothers collapse is shocking! Unless you remember a little story from 8 years ago…

Live Underground For Cheap

Forget the sub-prime meltdown and get with the subterranean housing craze. This book – linked in one of Chris’s posts but I just had to bring it to the front page – has everything you need to know about building a house underground. The most amazing thing is that there’s ways to do it to get light from all four sides. The penultimate amazing thing is not being buried alive while you sleep.

Home Mortgage Collector Confessor Responds To Your Comments

In response to some of the comments posted on 12 Confessions Of A Home Mortgage Collector, the confessor has sent in a followup letter to answer your questions, and clarify some of his statements.

12 Confessions Of A Home Mortgage Collector

A former Wells Fargo Home Mortgage home collector has stepped forth from the shadows to tell you what’s really going on. Here’s his confession:

../../../..//2008/09/10/now-that-the-magic-accounting/

Now that the magic accounting party is over, Fannie Mae and Freddie Mac are to be removed from the S&P 500 starting Wednesday. The minimum market cap a company needs to be allowed in the index is 5 billion. Freddie’s market cap is $614 million and Fannie’s $1.04 billion. [AP]

../../../..//2008/08/27/fdic-chairs-assessment-of-the/

FDIC chair’s assessment of the banking situation: worse and getting worser. [NYT]

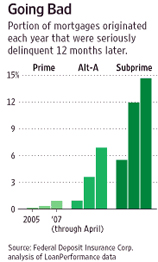

The Only Thing Worse Than '06 Mortgages: '07 Ones

Man, remember those mortgages made in 2006? That was some bad juju. Whooee. But if you thought those were bad, wait till you get a load of the mortgages made in 2007. As the graph shows, people are defaulting on them at an even higher rate than the ’06 ones. How could this be? By 2007 the bubble was popping and lenders could all see that they needed to stop giving making loans to underqualified borrowers, right? That was exactly the problem: “Mortgage originators who profited handsomely from the housing boom “realized the game was completely over” and pushed mortgages out the door,” reports WSJ.

Ex Countrywide Manager Exposes Its Lies

A former regional manager for Countrywide Home Loans, the mega mortgage company whose shady mortgage mill came to epitomize the subprime meltdown, went on The Today Show camera to detail some of the company’s questionable practices. Here’s some of the tricks he warned upper management about during his 6-month stint before he was fired for refusing to give loans to unqualified buyers:

Blame The Subprime Meltdown On The Repeal Of Glass-Steagall

A lot of blame has sloshed around for the sub-prime meltdown, from greedy borrowers to greedy mortgage brokers to Alan Greenspan, but if you want the real culprit, it was the repeal of the Glass-Stegall Act. On November 12, 1999, the champagne must have been shooting from the walls at Citigroup, which had worked behind the scenes for over 30 years to get the act overturned. After recovering from their hangover, they and their banking buddies went on a sub-prime lending orgy. But what was Glass-Steagall and how did it use to protect us?

../../../..//2008/03/28/new-trend-organized-bus-tours/

New trend: organized bus tours of foreclosed properties for potential buyers. [AP]