../../../..//2008/03/18/some-of-the-same-strategies/

Some of the same strategies that landed sub-prime borrowers in trouble are becoming increasingly popular among the rich as wealth-management tools. [NYT]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/03/18/some-of-the-same-strategies/

Some of the same strategies that landed sub-prime borrowers in trouble are becoming increasingly popular among the rich as wealth-management tools. [NYT]

../../../..//2008/02/15/smaller-cities-that-missed-the/

Smaller cities that missed the housing bubble have also missed its burst, and people are actually making money off the sale of their homes. [NYT]

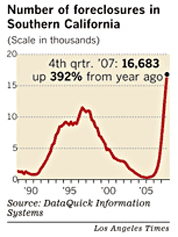

The number of homeowners losing their house to foreclosure shot to a new record of 31,676 in the last quarter of 2007, Los Angeles Times reports. Research firm DataQuick says that 41% of homeowners currently in default can keep their homes if they bring their payments current, refinance, or sell their home, down from 71% the year prior. Hey, at least it’s sunny.

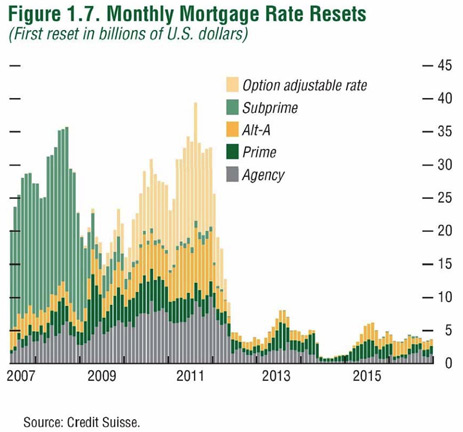

Credit Slips’ Adam Levitin takes a look into the possibly even grimmer future of the housing market. We’ll let him explain it because he’s smart:

…this graph from Credit Suisse is the most sobering thing I’ve seen in a while. Mortgage_rate_resets It shows that most of the interest rate resets ahead aren’t subprime, but are instead Alt-A and option-ARMs…

../../../..//2007/12/21/ftc-takes-heat-for-giving/

FTC takes heat for giving credit bureaus a special exception that allowed them to make lists of people who just filled out a loan application and sell them as leads to subprime lenders. [USA Today via U.S. PIRG Consumer Blog]

The Fed proposed new sub-prime lending rules designed to protect consumers from predatory lending practices, in the future. You know, because the most important thing is to prepare for the next sub-prime meltdown. Critics were quick to lambaste the plans:

../../../..//2007/12/14/what-if-instead-of-bailing/

What if instead of bailing out SIV owners, we were bailing SUV owners? A satirical look at the subprime-meltdown. [Patrick.net via My Money Blog]

../../../..//2007/12/12/if-youre-facing-foreclosure-you/

If you’re facing foreclosure, you can call 888-995-HOPE and get free advice from non-profit counselors about how to save your house or at least minimize the damage.

../../../..//2007/12/10/washington-mutual-will-lay-off/

Washington Mutual will lay off over 3,000 people. Sub-prime meltdown continues at brisk pace. [Seattle Post-Intelligencer]

Here’s another mortgage that should have never been made: A single mother earning $34,000 a year buys a ranch house for $385,000 by taking out two mortgages. Her then boyfriend was helping with payments, but then there wasn’t more more construction work. Blogger JLP figures she was probably putting 86% of her income towards the mortgage.

../../../..//2007/11/27/the-fed-infuses-money-supply/

The Fed infuses money supply to banks with $8 billion. Come on boys, we know you can avoid a recession, put your nose to the grindstone and win one for the Gipper! [NYT]

In Ohio, judges have dismissed 32 more foreclosures due to insufficient documentation. This is no white-knight that’s going to save homeowners at risk for foreclosure. One law prof told us that whenever we go through a glut of foreclosures, judges start clamping down and begin requiring the plaintiffs to have all their papers in order. It’s all just a matter of getting the note from the loan originators, who usually hold on to all the proper paperwork.

2 weeks ago both my wife and I got a summons, that let us know that our landlord was being sued by the bank he financed the house through, for not paying his mortgage since July of this year…

../../../..//2007/11/14/deutsche-bank-tried-to-foreclose/

Deutsche Bank tried to foreclose on 14 properties in Ohio, but the federal court judge determined that the bank couldn’t sufficiently prove that it actually owned the mortgage notes, and dismissed the case. [IamFacingForeclosure]

../../../..//2007/10/24/merril-lynch-a-79-billion/

Merril Lynch a $7.9 BILLION write-down from sub-prime mortgage losses. [CNN Money]

../../../..//2007/10/11/risky-mortgages-werent-just-for/

Risky mortgages weren’t just for the poor and financially unsophisticated, spikes in high-rate loans were seen across the income spectrum. [WSJ via Consumer World Blog]

../../../..//2007/10/10/us-strip-malls-vacancies-are/

U.S. strip malls vacancies are up to a 5 1/2 year high of 7.4%, ripples of the sub-prime meltdown. [WSJ]

../../../..//2007/10/10/a-increase-in-spammers-trying/

A increase in spammers trying to capitalize on the housing crisis can mean only one thing: spammers can read newspapers. [Symantec]

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.