Reader Michael has some questions about how the credit crunch is affecting private student loans. Is anyone still lending?

student loans

Equifax Double-Reports Student Loan, Still Hasn't Corrected It 12 Attempts Later

So what exactly is the problem? After 12 online (and phone) disputes to Equifax and 14 calls (and faxes) to the Direct Loan Servicing Center, each party seems to blame the other.

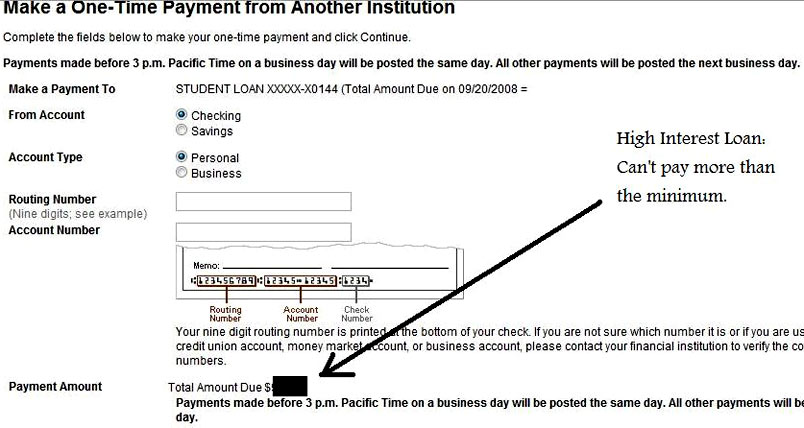

Wells Fargo Forces You To Pay Off Loans Costliest Way Possible

According to reader Caleb, Wells Fargo seems to have recently crippled their loan repayment system in a way that makes it impossible for borrowers to pay off loans the way they want to. That is, unless you prefer to let your highest-interest loans ride for as long as possible while you pay off your lower-interest loans…

Citi Announces One Of Its 'Bold Steps': Stricter Rules On Student Loans

Two readers have forwarded us a second email sent out by Citibank today, but it’s not another vaguely worded PR blast from the CEO. Instead, this one announces that Citibank is adopting the zero-tolerance approach to late payments favored by the credit card industry—miss a payment due date and you’ll lose any interest rate discount(s) you currently enjoy.

Sallie Mae's 100+ Point FICO Drop Error Getting Fixed

Sallie Mae has publicly apologized for a coding error, potentially affecting around 1 million customers, that caused some consumers credit scores to drop over 100 points, and some consumers report that their dinged scores are already back up. If your score is not back to normal and you are in the middle of a transaction where your good credit is at stake, Sallie Mae said it will provide a credit reference letter. You can also call Sallie Mae customer service at 1-888-2-sallie. Sallie has pledged that the fix is in, but consumers can still take matters into their own hands by pulling their free credit report from annualcreditreport.com and disputing the incorrect information with Experian. Note, it’s against Federal law for creditors to report false information to credit bureaus, and consumers can sue violators up to $1,000.

Bank of America To Stop Making Private Student Loans

Bank of America, the nation’s largest bank and one of our largest student lenders, today announced that it would stop making private student loans and instead “do more lending under a federally guaranteed program,” says the Wall Street Journal.

Sallie Mae Has No Idea Where Your $1500 Is

Then I finished my enlistment, was honorably discharged, and waited for the last payment to come in. It was 4 months late and when it got there (mid-December), it looked like it was $1500 MORE than what was left owed on my account. I called the Army and they confirmed that they had payed the correct amount they owed me, taking interest into account. The overpayment belongs to me. Yay, more free money!

Students And Parents, It's Time To Fill Out Your FAFSA

Tax time is also FAFSA (Free Application for Federal Student Aid) time for students and their parents. While the federal due date is June 30th, in some states, the FAFSA is due even before your taxes, so make sure to remember this important piece of paperwork.

Getting Back On Your Feet When You Have Lots Of Bad Student Loan Debt

Reader Jennifer sent the following letter to a few lawyers looking for some help with SallieMae. They told her that there was nothing she could do and to negotiate with the lender and to start making payments:

Launch An ACS EECB

Here are email addresses you can use to launch an EECB (executive email carpet bomb) against ACS, a student lending company that’s a subsidiary of PNC bank.

Don't Forget To Claim Your Student Loan Deduction

If you paid on student loans last year, don’t forget that you can deduct the interest paid up to $2,500 as long as your parents don’t claim you as a dependent, writes Kiplinger. “You can deduct up to $2,500 in student-loan interest paid in 2007 if your income for the year was $55,000 or less if single, or $110,000 or less if married filing jointly.” If you make under $70k single or $140k married, you can still take a partial deduction.

Sallie Mae Will Make Fewer Student Loans In 2008

Student loan lender Sallie Mae said today it plans on making fewer loans in the future “in the wake of federal legislation last year to reduce subsidies for student lenders,” reports Reuters.

Sallie Mae CEO Ends Conference Call With "Let's Get The Fuck Out Of Here"

Dodging tough questions about the student loan company’s fiscal well-being and strategy in the midst of the credit crunch, not to mention his recent sale of 97% of his company stock, Sallie Mae’s CEO ended a conference call yesterday with investors by cursing, reports WSJ:

In an apparent reference to investors’ anger, he said: “I can assure you, you will be going through a metal detector.” He ended the conference call by saying “Let’s go. There’s no questions. Let’s get the [expletive] out of here.”

../../../..//2007/12/13/a-private-student-loan-company/

A private student loan company agreed to change its ways after being sued by the NY AG for deceptive marketing practices. The company licensed school colors, logos, team names, and and designed its materials to look like the University itself was making the loans. [NYT]

The Subprime Meltdown Is The Tip Of The Credit Iceberg

The ongoing subprime meltdown is merely the first destructive wave of credit catastrophe to wash over Wall Street, according to Slate’s resident explainer. Americans drunkenly bandy credit around in several forms: mortgages are the most prevalent loans turning sour, but credit card debt, student loans, and auto loans are silently conspiring to threaten our macroeconomic well-being.

Citibank Charges Student Loans Late Fee From 2005

Sean writes:

When I went to check the statement on my wife’s student loan through CitiBank for November, I noticed a late fee listed. As we signed up to pay via direct debit for the interest rate deduction, we get no paper statements. I checked my records, and our last payment had been processed for the full amount, on the due date. I asked my wife to call and find out why we were being charged a late fee. The representative told her that it was to correct an error from 2005. There is no explanation on the site, and when my wife asked to speak to a supervisor, the supervisor told her that there were no plans to notify people being charged these fees. My wife had to specifically request that a letter be sent detailing these fees.

Verify Extra Payments Are Applied To Your Principal

The Chief Family Officer blog outlined her strategy for paying off student loans faster.

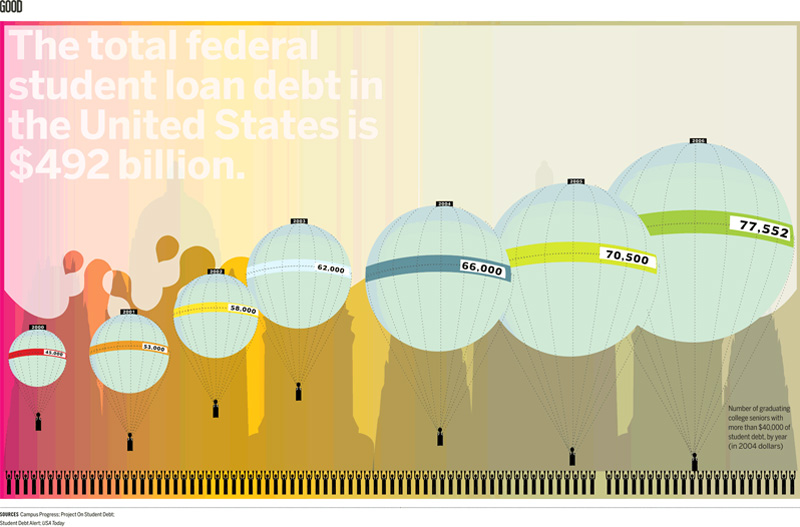

77,552 Of Graduating College Seniors Have $40,000+ In Student Debt

This graph from GOOD and FutureFarmers shows the number of graduating seniors with more than 40,000 in student debt by 2004.