If it’s truly going to be a surprise, there’s not much you can do on the day it happens, other than roll with the punches and maybe meet up with some friends after work for a beer. However, you can take some important steps to insure that you’re well-protected if you ever find yourself in this situation, so that you can improve your odds of landing another job quickly, before that creepy desperation sets in and you start to make recruiters and HR specialists uncomfortable. Consumerism Commentary describes 5 ways to prepare yourself for unexpected “career mobility.”

savings

NBC Teaches Personal Finance Lessons On "30 Rock"

NBC is taking the “workplace comedy” concept to new levels of realism, by including a couple of scenes about a major character’s lack of a savings plan in this week’s “30 Rock” episode. After being awarded a $10,000 “GE Followship Award” for being such a great follower, Tina Fey’s character stuns her boss by revealing she doesn’t have a 401(k)—or, apparently, even a savings account.

Put Impulse Spending To Work As A Savings Builder

If you’re the type of person who thinks “discretionary spending” means “I can buy what I want, when I want,” read this person’s idea for how to create an Impulse Buy Savings Plan. It gives you a methodology where you can effectively trap your impulse purchases in a cooling-off period, while also seeing how that money would look if it were saved instead.

Where To Stash Your Rainy Day Fund

Everybody needs emergency cash reserves for the unpleasant day when your expenses unexpectedly exceed your income. By stashing your reserves in the right place, you should ideally be able to fund your life – rent, food, transportation, utilities, and any other fixed expenses – for at least three months. The Washington Post has a few tips to keep inflation from eroding the value of your pot of emergency cash.

../../../..//2007/10/17/not-freezing-to-death/

Not freezing to death is expensive! SmartMoney offers up its own advice on how to cut heating costs this winter—mostly the usual stuff about shopping around for a supplier, upgrading old equipment, and winter-proofing your house. Also: new insulation may qualify you for a one-time tax credit of $500 if you do it before the end of the year. [SmartMoney]

13 Retirement Myths Debunked By Money Magazine

According to Money, there are 13 big myths about retirement that you need to be aware of—and the sooner you know about them, the sooner you can make any necessary adjustments to improve your preparations for those twilight years.Myth 1: You need a big income to have a big nest eggMyth 2: You…

Budgeting Tip: Use What You Buy

A columnist at Get Rich Slowly describes how her family learned to focus on getting the most use out of the things they purchase, rather than using them once or twice and then moving on to the next new thing. While it sounds like an obvious tip, it can be a little harder to practice in real life—but, she writes, the results can be eye-opening.

Find Out Your Nest Egg Score

A.G. Edwards has a short online quiz that determines your “nest egg score” based on criteria like how long before you plan to retire, how aggressively you invest, and where you live. It’s not meant to provide an in-depth portfolio review, just a quick sketch of where you stand—you’ll get a score very similar to a credit score, along with a comparative national average and a list of tips on how to improve your score.

10 Things You Can Do To Save Energy This Winter

Anyone who followed our IDT-Energy debacle will understand why number 10 has a special place in our heart.

10. Avoid Energy Scams. Beware of pitches from door-to-door salespeople, unsolicited letters, and phone callers that promise to save consumers big bucks on their heating bill. Alternative power suppliers are unlikely to save consumers much money unless they are using lots of energy.

They also talk about programming your thermostat, sealing cracks, and replacing old windows.

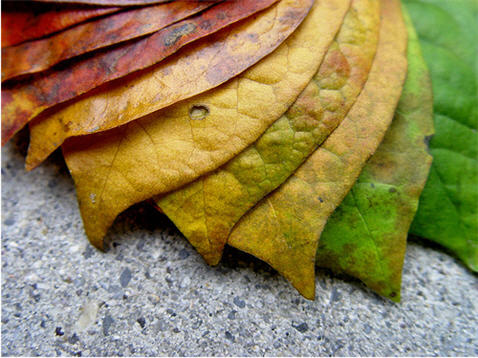

../../../..//2007/09/30/its-already-fall-time/

It’s already fall – time to start saving for the holidays! The holiday shopping season may not kick off for 52 days, but it’s never to soon to start saving. By socking $5 away every day between now and Christmas, you can build up a cache of over $400.

Banks Requiring Higher Balances To Avoid Fees

Since last year’s survey, the average balance requirement to avoid fees on an interest account jumped almost 25 percent, from $2,660.49 to $3,316.60. Imagine keeping more than $3,300 in a low-yielding account, just to avoid fees!

Ew! The good news is that you can still get a free checking account, but it won’t pay interest. There are good options out there, it’ll just take a bit of shopping around. Don’t leave your money in a low-interest account just to avoid fees unless you have a darn good reason for doing so.

HSBC Direct Cuts Rates To 4.5%

We checked HSBC Direct’s front page daily after the Fed interest rate cut, in fear that our fave online saving account would also cut its high 5.05% interest rate. We chuckled as complaints rolled in about people’s various money market accounts getting their rates trimmed. After we were lulled into a false sense of security and stopped checking, a reader pointed out that HSBC has slashing the rate to 4.5%. Noooooooooooo…

12 Ways For You To Beat Inflation

The Digerati Life has a lengthy article that offers 12 tips on how to help beat the eroding power of inflation. Broadly speaking, you should first recognize that inflation erodes purchasing power in the long run and take steps to insure yourself from it, while also being “mindful of when inflation rates rise” and taking additional measures during those periods.

Utilities With Successful Conservation Campaigns To Collect Government Cash

California utilities may soon unveil new conservation campaigns thanks to an innovative plan unveiled last week by regulators. Under the plan, the Public Utilities Commission will set three-year efficiency targets. Utilities that meet at least 85% of the targets stand to collect rewards of up to $323 million. Utilities that fail to meet 65% of the targets could face penalties worth $500 million.

The PUC forecasts that the program would result in $2.4 billion in energy savings before 2008 and would cut about 3.4 million tons of carbon dioxide from California’s air.

Walmart Launches House Brand CFLs

“The introduction of our Great Value bulbs make CFLs a more accessible option for our shoppers as we strive to sell 100 million CFLs by the end of 2007,” said Wal-Mart General Merchandise Manager Andy Barron in a statement.

How To Find Lower Priced Generic Drugs

Here’s two sites which will help you find cheaper generic alternatives to brand-name prescriptions:

The Copper In Your House Is Worth Lots Of Money

I recently hired a plumber to do a rebuild on an existing small bathroom. During the demolition phase, the plumber remarked that he would be reclaiming the old copper pipe and that it was worth around $25.

Tips For A "Greener" Autumn

LighterFootprint has compiled a list of things you can do during the fall to help lower your impact during the winter. Lowering your impact usually means lowering your energy costs, so it’s a good idea to pay attention to these tips even if you hate the planet and want it to melt.