Earlier today, the calendar flipped from July to August, and kids everywhere groaned with the realization that they will soon have to be going back to school. But the even louder grousing you’re hearing this morning is from parents envisioning their bank accounts being drained by purchases of backpacks, clothes, pencils (do kids even use those anymore?), and those individual packs of tissues that will never be used but you buy anyway. What some of these parents don’t know is that a number of states have sales tax holidays in August — many of them starting today — to ease the burden of back-to-school spending. [More]

sales tax

In States With Amazon Sales Tax, People Spend Less On Amazon

Many people order things from Amazon because it’s incredibly convenient — no driving to the store; no waiting in line; no shoving into the back of your car… and in many states, no collection of sales tax. A new study tries to figure out the impact of removing that last incentive from the equation. [More]

It’s Florida Customers’ Turn To Pay Sales Tax On Amazon Purchases

There’s good news and bad news for Florida: yes, there is an Amazon distribution warehouse in their fine state now, which means faster delivery of the stuff they impulsively ordered at 3 A.M., and also gives some people jobs. The downside to this sprawling city of stuff is that it means Amazon now has a physical location in their state, and they’ll have to pay sales tax on their purchases. [More]

Online State Sales Tax Solution Remains Elusive After Congress Declares ‘Fundamental Defects’ In Senate Bill

After years of attempts to craft a federal law that would affirm states’ rights to tax online purchases, the issue may still be far from being resolved. The House Judiciary Committee has put the brakes on the Marketplace Fairness Act passed by the Senate in May. [More]

Connecticut Walmarts Charged Sales Tax On Tax-Exempt Gun Safes

Since 1999, shoppers in Connecticut have not had to pay the state’s 6.35% sales tax on gun safes and other firearms-safety items, but someone forgot to tell the Walmarts of Connecticut, which have been improperly charging the tax to customers. [More]

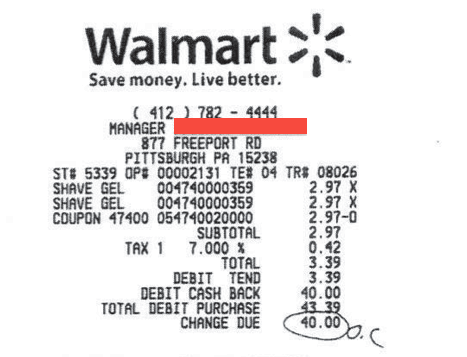

Lawsuit Accuses Walmart Of Overcharging Taxes On Coupon Purchases

A Pennsylvania man’s purchase of two cans of shaving cream at Walmart has ballooned into a lawsuits against the nation’s largest retailer, which stands accused of not taking coupons into account when calculating sales tax. [More]

Senate Signs Off On Marketplace Fairness Act; Online Sales Tax Inches Closer To Reality

If you’re one of the many Amazon customers whose state has yet to reach an agreement about the collection of online sales tax, this will probably be bad news. This afternoon, the Senate voted in favor of the Marketplace Fairness Act, which would give each state the authority to compel online businesses to collect applicable taxes. [More]

Symbolic Senate Vote Demonstrates Support For Marketplace Fairness Act

There have been multiple attempts in recent years to push through some sort of federal law that would allow for state governments to collect sales tax on residents’ online purchases, but none have made it very far. However, a Senate vote this afternoon shows their might be some life in the latest iteration of the Marketplace Fairness Act. [More]

Retailers Love Latest Attempt At Online Sales Tax Law, eBay Not So Much

As we mentioned yesterday, lawmakers in D.C. are going to take another stab at a federal law that would give states the ability to collect taxes from online retailers. Not surprisingly, the retail industry loves it, while eBay says it will only hurt small businesses. [More]

Lawmakers Set For Another Go At Federal Online Tax Law

For several years, there has been a lot of talk — and a handful of legislative efforts — regarding a federal law that would give states the authority to compel online sellers to collect sales tax on purchases. None of these bills have passed, so it’s time to try again. [More]

Amazon E-Mailing Tennessee Residents To Remind Them Of Sales Tax Obligation [UPDATE: South Carolina Too]

Even if your state doesn’t require Amazon to collect sales tax on purchases, you’re still supposed to be paying any applicable tax to the state when you file your annual tax returns. Virtually no one does. That’s why Amazon is e-mailing customers in Tennessee to remind them of their obligation. [More]

Seems Like Amazon Is Disregarding Georgia’s Efforts To Collect Sales Tax

Back on New Year’s Eve, we predicted that a new state law intended to compel Amazon to collect sales tax on purchases made by Georgia residents would probably fail — and that seems to be exactly what is happening. [More]

New Law Will Try (And Probably Fail) To Make Amazon Collect Sales Tax In Georgia

Starting tomorrow, Georgia will begin enforcing a new law intended to compel Amazon and other e-tailers to collect sales tax on purchase in that state. But it looks like Amazon may have a pretty easy work-around. [More]

Add Massachusetts To List Of States That Will Collect Sales Tax From Amazon

Residents of Massachusetts, your days of “tax-free” shopping on Amazon are numbered, as the state’s governor has announced that the e-tail giant will begin collecting sales tax on purchases made by Mass. residents starting next fall. [More]

Court Rules Lap Dances Aren’t Art; Ruin Plans For My MFA Thesis

In a story we’ve been following with great interest for quite some time, the top court of the state of New York has ruled that lap dances are not a form of performance art and are therefore not exempt from sales taxes. [More]

Californians Rush To Buy Before Amazon Starts Collecting Sales Tax

Starting September 15, Amazon.com will start collecting sales tax on purchases made by residents of California. So with the clock counting down, a number of shoppers in the state are buying what they can in the next week and a half. [More]

Amazon To Start Collecting Sales Tax On Goods Shipped To Pennsylvania

To kick off the weekend, Amazon will be collecting a 6% sales tax on orders shipped to Pennsylvania starting on Saturday, because of a state directive that requires it do so. A spokesman said that despite the fact that the company had fought the sales tax, Amazon had to reverse its position to comply with the state. [More]

SEC Investigates Sprint Over Allegations It Failed To Properly Collect Sales Tax

Back in April, the New York Attorney General’s office filed a lawsuit against Sprint, alleging the wireless provider deliberately under-collected sales tax in an effort to remain competitive. Now, Sprint has revealed that it is under investigation by the Securities and Exchange Commission over these same allegations. [More]