The halcyon days of not paying sales tax (even though you’re obliged to) on your Amazon purchases may be coming to an end once and for all, as members of Congress are doing more than just talking about the issue. Next Tuesday, the House Judiciary Committee will hold a hearing on the merits of creating a law allowing states to compel online retailers to collect sales taxes. [More]

sales tax

Amazon’s Same-Day Delivery Could Make Bricks-And-Mortar Retailers Even More Irrelevant

One of the few knocks against online retailers is the difficulty in getting your purchase immediately, meaning people continue to go to bricks-and-mortar stores when they need to get their hands on an item right away. But it looks like Amazon could take away that advantage from its competitors by expanding the number of warehouses it has around the country. [More]

Since We’re Bad At Paying Online Sales Taxes On Our Own, States Want Retailers To Take Charge

If the ongoing battle between online retail giant Amazon and individual states has taught us anything, it’s that there’s a lot of money to be made from e-sales taxes. And since we as customers aren’t so great when it comes to paying those on our own, states across the country are ramping up efforts to have those taxes levied by the retailers themselves. [More]

Why Am I Being Charged Sales Tax On A XBOX Live Subscription?

Victor found a great deal on an XBOX Live 12-month subscription card from Buy.com, but was surprised to see that the company charged him sales tax. No other online vendors that he tried charge sales tax on the cards––which are, after all, more of an intangible item, akin to a gift card. [More]

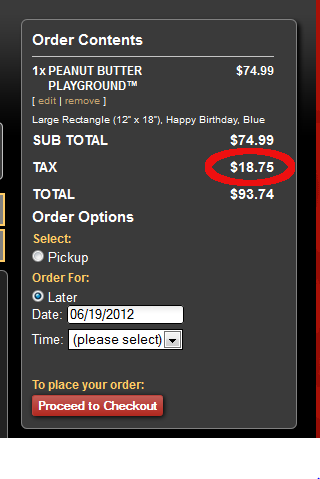

Here Is Why You Should Always Check The Sales Tax On Your Online Order

When you place an order online — especially through a large national chain — you might expect that your sales tax would be calculated accurately. But, as demonstrated by the Cold Stone Creamery store that charges 25% tax, that isn’t always the case. [More]

Amazon To Collect Sales Tax, Build Distribution Center In New Jersey

One by one, the number of states where Amazon does not collect sales tax continues to shrink. New Jersey Governer Chris Christie has announced that the e-tail giant will not only begin collecting sales tax in the Garden State, but will also open a distribution center there. [More]

Amazon To Start Collecting Sales Tax In Texas

Starting in July, shoppers in Texas will no longer have to go through the hassle of calculating and paying all that sales tax that Amazon hasn’t been collecting on their purchases. On Friday, the Lone Star State joined a growing group of states reaching accords with the online giant about making sure those taxes get collected at the time of purchase. [More]

Illinois Judge: Law Requiring Amazon To Collect Sales Tax Is Unconstitutional

Last year, Illinois joined the ranks of states passing laws requiring Amazon and other online-only retailers to collect sales tax on purchases by that state’s residents. Yesterday afternoon, a judge in Cook County, IL, surprised a lot of people by ruling this law violates the U.S. Constitution. [More]

Amazon Agrees To Collect Sales Tax In Nevada

The number of states where Amazon shoppers aren’t charged sales tax continues to shrink, as the massive online retailer has agreed to begin collecting the tax on sales to Nevada customers starting in 2014. [More]

Arizona Tries To Shake Amazon Down For $53 Million In Sales Tax

The burden of state sales tax continues to plague Amazon. Groups of states hold Amazon to different standards when it comes to collecting the tax. While some disagreements end amicably — such as the company’s January deal with Indiana that it will have to start collecting state sales tax in 2014 — other states are a bit more confrontational. [More]

Indiana, Enjoy Your Final Two Years Of "Tax-Free" Amazon Purchases

Add Indiana to the list of states in which Amazon customers will pay sales tax when they buy something, as state officials have reached a deal that will require the online retailer to start collecting the state’s 7% tax on purchases. [More]

Senators Introduce Bill To Compel Amazon & Others To Collect Sales Tax

As has been discussed here on numerous occasions, even though Amazon.com didn’t charge you sales tax on that laptop you purchased, you still may owe it (though very few people ever pay). Thus, once again, a bipartisan group of Senators in D.C. have introduced legislation that would require online retailers to collect sales tax. [More]

Amazon Tries To Dodge California Sales Tax By Dropping Associates Program In State

Responding to a new law that would affix a sales tax to Amazon purchases made in California, Amazon announced it will drop its Affiliates program in the state. Affiliates members help sell Amazon products and get a cut of the proceeds. Dropping the program’s California users would presumably spare Amazon from having to collect sales tax on its California transactions. [More]

Big Box Stores Pushing To Tax Amazon Sales Nationwide

In recent years, retailers have been successful in getting a handful of states, including Illinois and New York, to pass laws requiring Amazon.com and similar e-tailers to collect sales tax on products shipped to those states. Now, with the backing of super-sized chains, there is a full-on push to get these laws on the books in every state that collects sales tax. [More]

Amazon Tries To Make Itself Exempt From Tenn. Sales Tax

Everything is negotiable when you’re a company that’s as big as powerful as Amazon. After landing a sweet incentive deal to build a distribution hub in Tennessee, the online sales giant is trying to get the state to excuse its customers from paying state sales tax on their purchases. [More]

Ohio Supreme Court: State Sales Tax OK For Satellite, But Not Cable

Giving an odd boost to cable providers, the Ohio Supreme Court ruled the state could slap a sales tax on satellite TV services even though cable companies don’t need to tack the tax on to their packages. [More]

5 Downright Silly Sales Taxes

Several months ago, we wrote about New York State’s decision to crack down on bagel vendors who weren’t charging an 8.875% sales tax on sliced bagels. Believe it or not, that’s not the silliest sales tax story of the year. [More]