While health officials continue looking for a cure for the Zika virus, scientists are considering the possibility that the mosquito-borne illness could also be sexually transmitted from human to human. [More]

report

Graduation Rates: The Telltale Sign Of Success Or Indicator Of Failure?

For millions of students, attending college is a means to a better life: more job prospects, and higher earnings over a lifetime. While students who enroll and graduate from an institution of higher learning often reach those goals — despite graduating with thousands of dollars in loan debt – millions of others never graduate and face mounting financial obstacles. [More]

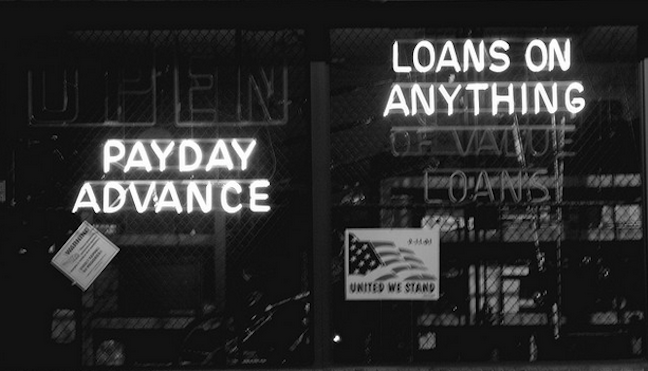

1-in-5 Auto Title Loans Lead To Vehicle Seizure

When seeking an infusion of cash to make ends meet, consumers may turn to payday loans, cash advance loans, or auto title loans. While each of these short-term, high-interest loans pose a financial risk to borrowers, only one has the ability to take away what is often a person’s largest asset: their vehicle. And, according to a new report, one-in-five consumers who take out a single-payment auto title loan have their car seized by lenders. [More]

4 Things We Learned About Working In A Poultry Plant

For years, reports have surface related to the mistreatment of chickens — and other animals — that are destined for our dinner tables. What we hear about less frequently are the working conditions for those employed by the nation’s biggest poultry producers. [More]

Investigation Into Honda’s Inaccurate Death And Injury Reports Closed

Eighteen months and $70 million later, the National Highway Traffic Safety Administration has closed a probe into Honda’s failure to report over 1700 injuries and deaths over a period of 11 years without further penalties against the carmaker. [More]

Survey: 9-in-10 Christian Consumers Think Payday Loans Hurt Borrowers

Expensive. Harmful. Predatory. Those are just a few of the words that members of faith-based groups used to describe payday and auto-title loans in a recent report that asked congregants in 30 states to detail their experience with the short-term, high-cost loans and similar financial products. [More]

Banks Are The Key To Stopping Scammers That Target One In Five Older Americans

If we’ve said it once, we’ve said it a million time: those who attempt – and often succeed – at scamming senior citizens of their savings are the worst of the worst when it comes to already unsavory, immoral fraudsters. Despite regulators’ attempts to take these operations out of commission, one in five older Americans report being the victims of financial exploitations either by ne’er-do-wells or family members. [More]

Senate Report Claims Takata Falsified Data On Airbag Inflators

Less than a month after an independent review panel hired by Takata — the company behind the ongoing recall of millions of defective, potentially dangerous, airbags — found that the Japanese auto parts maker lacks quality control processes and policies to address defects, a Senate panel report backed up the findings and found the company falsified some test data about certain airbag components. [More]

Report: Regulators Ask VW To Produce More Electric Vehicles To Make Up For That Emissions-Cheating Stuff

While hundreds of thousands of consumers in the U.S. continue to wait for Volkswagen to create a plan to fix vehicles that cheat emission standards, federal regulators are apparently looking to the future, asking the carmaker to produce more electric vehicles in the country as a sort of penance for its use of “defeat devices” in diesel cars. [More]

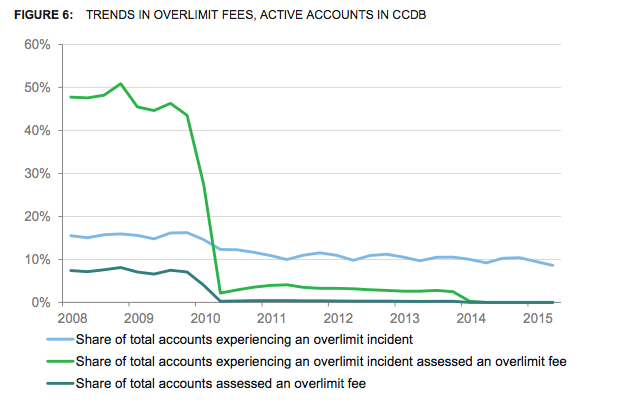

Report: Credit Card Reforms Saved Consumers $16B In Six Years

In 2009, lawmakers passed a massive set of reforms for the credit card industry – known as the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) — aimed at protecting consumers though transparency, fairness, accountability and better access to an array of financial products. A new report from the agency tasked with enforcing these rules, finds that nearly six years after implementation, consumers have saved nearly $16 billion in fees. [More]

System For Recalling Defective Tires Is “Broken,” Says Federal Safety Agency

When a manufacturer recalls a vehicle for a safety defect, they’re required to contact owners of the affected models and provide a remedy for the issue free of charge. But federal investigators say this sort of smooth recall just isn’t possible for tires because the current tire recall system is “completely broken.” [More]

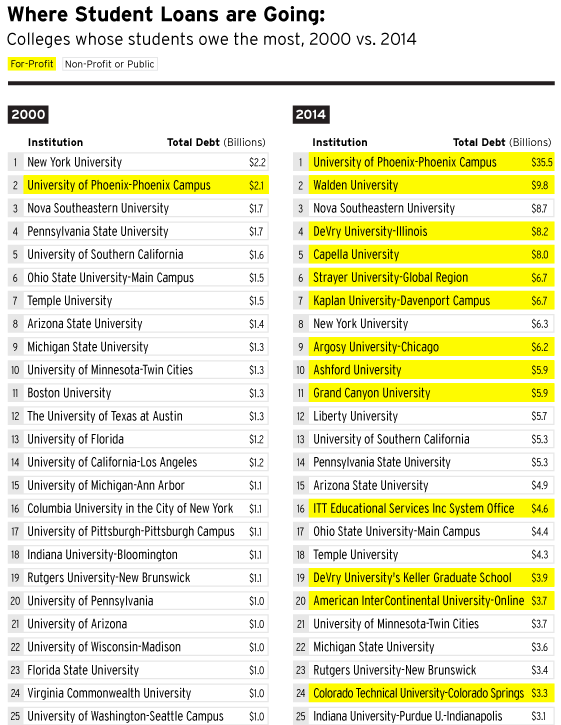

For-Profit Colleges Lead The Way On Loan Defaults: Report

During the Great Recession, the growing industry of for-profit colleges promised millions of Americans a path to a higher education. But the high tuitions charged by many schools sent U.S. student loan debt soaring to more than $1.2 trillion. A new report claims that while for-profit schools charged top-dollar, many students were getting a cut-rate education, making it difficult to obtain jobs that will allow them to pay down this debt.

[More]

Military Personnel Face Student Loan Issues Despite Required Protections

The Servicemembers Civil Relief Act (SCRA) provides a number of protections for military personnel and their families when it comes to private and federal student loans. While these benefits aim to alleviate the burden servicemembers face when paying back their educational debts, a new report from the Consumer Financial Protection Bureau shows that many student loan servicers continuously fail to uphold their end of the SCRA requirements. [More]