1-in-5 Auto Title Loans Lead To Vehicle Seizure Image courtesy of Stephan De Witte

When seeking an infusion of cash to make ends meet, consumers may turn to payday loans, cash advance loans, or auto title loans. While each of these short-term, high-interest loans pose a financial risk to borrowers, only one has the ability to take away what is often a person’s largest asset: their vehicle. And, according to a new report, one-in-five consumers who take out a single-payment auto title loan have their car seized by lenders.

The figure is the result of a Consumer Financial Protection Bureau analysis of nearly 3.5 million single-payment auto title loans issued between 2010 and 2013.

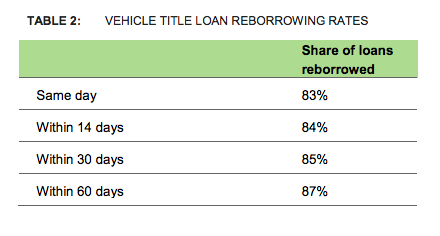

According to the report [PDF], four-in-five of the loans — about 80% — that eventually led to the seizure of a vehicles were renewed the day they are due because borrowers cannot afford to repay them with a single payment.

The CFPB found that just 12% of borrowers manage to be take out a loan and repay it with one payment.

Nearly half of the remaining borrowers end up taking out four or more consecutive loans, creating a long borrowing sequence.

The CFPB found that nearly two-thirds of auto title loans are renewed the same day they are due. [click to enlarge]

Rolling over loans tacks on additional fees and interest to the original loan, increasing the debt burden for borrowers.

“What starts out as a short-term, emergency loan turns into an unaffordable, long-term debt load for an already struggling consumer,” the CFPB found.

Additionally, the CFPB found that another two-thirds of these loans were issued to borrowers who would eventually take out seven or more consecutive loans, leaving the consumer stuck in debt for more than year.

“Our study delivers clear evidence of the dangers auto title loans pose for consumers,” CFPB Director Richard Cordray said in a statement. “Instead of repaying their loan with a single payment when it is due, most borrowers wind up mired in debt for most of the year. The collateral damage can be especially severe for borrowers who have their car or truck seized, costing them ready access to their job or the doctor’s office.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.