Two years after the Federal Trade Commission sued the marketers of the “Pure Green Coffee” for using fake news sites and fictional reporters to push the weight-loss supplement, the man behind those companies has been ordered to repay $30 million to customers tricked into buying the product. [More]

refunds

GoPro Recalls Recently Launched Drones After Some Stop Working

GoPro only released its new $800 (no camera included) Karma drone two weeks ago, but the flying photo-taking device has already been recalled because some of them simply stopped working.

[More]

Galaxy Note 7 Owners Sue Samsung After Being Left Without Phones For Weeks

Before any official recall was announced, Samsung offered replacement devices or refunds to owners of potentially explosive Galaxy Note 7 phones, but some customers maintain that the company still left them hanging without a smartphone for too long. [More]

Alaska Airlines Passengers Get $500 After Fish, Formaldehyde Spill On Luggage

We all know that there are risks to checking luggage on a flight — lost bags, damaged or stolen items, mix-ups with other passengers’ luggage — but what you probably don’t assume is that your checked bag will end up covered in formaldehyde and dead fish. [More]

Southwest Passengers Recall Three-Day Nightmare Travel Experience

There are travel hiccups that keep passengers from getting to their destination by a few hours. And then there are ordeals that keep people in limbo for days. Case in point: a Southwest Airlines flight from the Dominican Republic to Atlanta that turned into a three-day real life nightmare. [More]

If You Bought Egyptian Cotton Sheets From Target, You Might Be Getting A Refund

Target is breaking up with one of the world’s biggest textile manufacturers, claiming that the company was sending it sheets labeled as “Egyptian cotton” that were actually made with cotton of the non-Egyptian sort. That means refunds for customers who bought the bedding in question. [More]

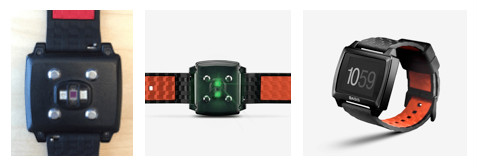

Intel Recalls Basis Peak Smartwatches For Overheating

Smartwatches can do a lot of things: tell the time, show text messages, read your heart rate. But one thing they aren’t supposed to do is overheat, burning wearers. For that reason, Intel says it is recalling all of its Basis Peak watches. [More]

Hoverboard Owners Report Issues Getting Refunds After Recall

Nearly a month after the Consumer Product Safety Commission recalled half a million (non-hovering) hoverboards over safety concerns, urging owners to stop using the self-balancing scooters and seek refunds, some customers say they’re having a difficult time doing so. [More]

New Law Will Make Airlines Refund Baggage Fees When Bags Are Delayed

You’ve been there. You’re sitting at an airport in one state, while your luggage is stranded at an airport in another after it failed to make its connecting flight. You desperately need a fresh change of clothes and yet, it’s unclear when you’ll be reunited with your belongings. This, after you paid the airline to check that bag and have it arrive when you arrive. [More]

eBates Expanding Cash Back To Stores In Real Life

You may be familiar with eBates, a company that sends shoppers a fixed percentage rebate from their online shopping as long as they click on the site from the eBates site. Now the rebates are invading real life, too, and will be available at physical stores too. [More]

Apple To Begin Issuing Refunds In E-Book Settlement Case June 22

Three months after the Supreme Court left Apple on the hook for $450 million in the settlement of a 2012 antitrust case against the company and five major book publishers, the tech giant is poised to begin handing out payments to customers starting tomorrow. [More]

Amazon Stops Price-Matching Everything But TVs, So Here’s Your Guide To Other Retailers’ Policies

No one likes to pay more for something than they have to. For that reason, several retailers offer pricing guarantees that allow customers to receive refunds if the cost of an item changes within a certain amount of time. Amazon is no longer one of the companies offering this protection. [More]

PayPal Won’t Protect Your Payments To Crowdfunding Projects

If you’re using PayPal to help fund yet some friend’s hot sauce Kickstarter project, listen up. Starting next month, PayPal’s Purchase Protection won’t cover the transactions made on crowdfunding platforms. [More]

Don’t Throw Away Prepaid Debit Cards After You Use Them To Make A Purchase

If you exhaust all the money on a prepaid debit card and have no intention of refilling it, your tendency is probably to simply discard the piece of plastic and move on with your life. But you may want to hold on to that card for a while, lest you have to jump through hoops if you return the purchase. [More]