Tastykake, manufacturers of numerous kinds of prepackaged snack foods, could be forced to sell or merge after a newly opened factory failed to generate the hoped-for savings. Krimpets, Kandy Kakes, Koffee Kakes, and Kreamies could all be put on the chopping block. And I don’t know if you’re aware, but those kinds of snacks do better in your tummy than on a chopping block. [More]

recession

Jobless Claims Drop To July 2008 Levels

In a potential sign of a mending economy, unemployment claims for the week ending Dec. 25 fell 34,000 to 388,000, the lowest levels since July 2008. However, the good news might be slightly enhanced by it being the week of Christmas, which can throw a wrench into into how the claims are tallied. The last two years have seen the same trend, with claims then jumping upward in January. The news was received by unemployed folks in the same way as when you were a kid you found a cool wrapped present only to discover it was only a decoration. [More]

Scams: Do You Know About Mortgage "Flopping?"

You’ve heard of “flipping” houses, well now there’s “flopping.” While the first was speculative, this one is outright fraud. [More]

U.S. Home Values Set To Plummet By $1.7 Trillion This Year

Property valuation site Zillow says that signs of stability in the housing market are vaporizing, and U.S. home values are poised to drop another $1.7 trillion this year. [More]

What The New Tax Deal Means For You

Besides the Bush tax cuts getting stretched another two years, the proposed new Obama-GOP tax deal has other goodies in the bag for you. [More]

Why Savings Account Rates Suck Right Now

You may have noticed it’s dang hard to get a good rate for saving money right now. Used to be you could get an online savings account with 5%, no problem. Now if you can get in the upper 1% you’re doing pretty good. So what’s the dilly? [More]

Roadside Sign Spinning Outsourced To Pulchritudinous Robot

Rob noticed something uncanny about this sign spinner advertising for a local jewelry store. He was drawn in by her defined features and lifeless gaze, and the expert way in which she moved the sign in the exact same motion every time. Upon closer inspection, he realized that she was no ordinary sign spinner, but an android! [More]

Don't Worry About The Economy, People Are Buying Pickup Trucks

Everything is going to be just cupcakes, at least judging by how pickup trucks are selling. [More]

FDIC Seizes 4 More Banks

The FDIC seized four more banks on Friday. That brings the total number for 2010 to 143, the most in a year since the S&L fiasco back in the 80’s. Here’s who went down: [More]

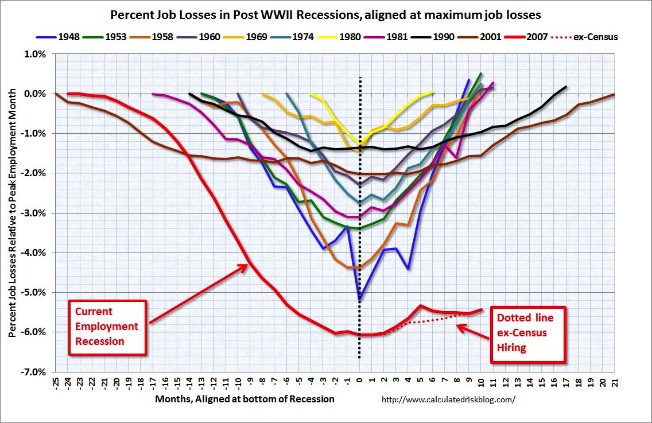

Doomgraph: This Recession's Unemployment vs Other Recessions

Time to crap your pants. [More]

US Added 151,000 Jobs In October, Where's Mine?

Beating expectations, the US added 151,000 jobs in October, for the first time since May. Analysts had projected only a 60,000 gain. It wasn’t enough to nudge the unemployment rate, however, which held at 9.6%. [More]

Walk With A Family Walking Away From Their House

What’s it like to walk away from your house? No, not to go down the street to get some ice cream. Walk away like mailing the keys to your mortgage lender and saying, “Take it. It cost me more than it’s worth.” Immoral? Perilous to future job prospects? Is it “just business?” NPR follows along with one couple grappling with these very questions. [More]

Buyers Unearth Old Real Estate Law To Escape Now-Crappy Home Deals

A law implemented in 1968 to protect would-be swampland purchasers is now the best friend of home buyers who went into contract at the height of the bubble and are now trying to escape paying well-above market value and get back their deposits. [More]

TARP Earned Taxpayers 8.2% Return

For all the Cronenberg-style chest-flesh-yanking the bank bailout generated, gone almost unnoticed is that the damn thing actually made money. [More]

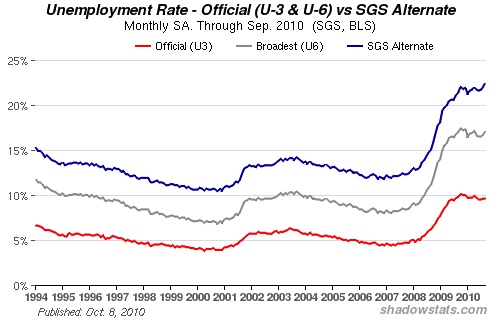

The Real Underemployment Figure Is 22.5%

Ever get the feeling that things are a lot worse than everyone is letting on? [More]

Banks Hired "Burger King Kids" To Process Mortgages

JPMorgan & Chase had a cute name, the “Burger King Kids,” for the workers with little no experience or qualifications it hired to process the reams of mortgages it plowed through at the height of the housing bubble. These walk-in hires “barely knew what a mortgage was,” writes the NYT. The newbies Citigroup and GMAC/Ally Bank outsourced the work to sometimes tossed paperwork into the garbage can. [More]

Fed Might Buy $500B In Treasuries

The Fed sent out signals that it could be making a major new move as soon, which experts think could take the form of buying back up to $500 billion in Treasury Bonds. They could decide as soon as their next meeting on November 2nd, which also happens to be Election Day. [More]

Corps. Gobbling Up Cheap Debt Instead Of Hiring

You can’t get a loan but Microsoft sure can, and it’s taking advantage of uber-low interest rates to raise billions by selling bonds. Why? “Because they can,” writes NYT. They’re not alone, across the board companies are plumping up their cash reserves so they can take advantage when the economy turns around, but it’s unlikely to anytime soon if companies keep saving instead of creating jobs. What came first, the chicken or the nest egg? [More]