Are America’s spending habits becoming more… gasp… sensible?? Time magazine has a list of things we’re spending our money on during this recession, and it might surprise you. We’re not buying tinned soup, we’re buying organic veggies! We’re finally getting that root canal we’ve been putting off! We’ve stopped boozing and whoring! And we’re learning to survive without painting our nails.

recession

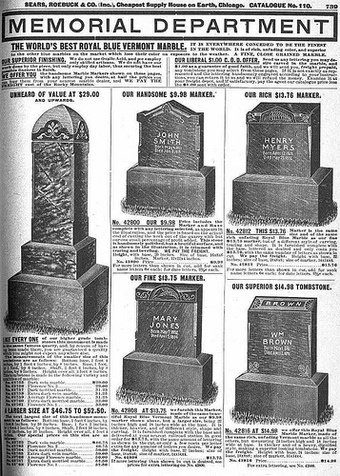

Funerals Another Victim Of The Recession

The Los Angeles County coroner’s office reports that more bodies of deceased residents are going unclaimed than in the past, then cremated at taxpayer expense. Why the increase? Families claim that they simply can’t afford funeral expenses.

Ugly Shoes As Economic Indicator: Crocs In Trouble

Here’s the problem with Crocs. You either love them or you can’t stand them. You make fun of them mercilessly, or you can’t imagine a more comfortable shoe. What’s problematic for the company that makes Crocs is that they don’t really wear out…and who needs multiple pair of glorified garden clogs in a recession?

Who Will Save The Economy? Not Strapped Consumers

Consumer delinquencies hit a record high in the first quarter of the year. Debt-to-disposable income ratios are down only slightly from the beginning of the recession. Who will save the U.S. economy if consumers can’t return to our habits of buying crap we can’t afford and don’t need?

How Much Does That $12 Chain Restaurant Sandwich Really Cost?

Chain restaurants are trying to lure in recession-weary diners with deep discounts, but franchisers worry that if you suddenly start paying half-price for sandwiches, you won’t be willing to pay full price when the economy recovers. We’re all accustomed to chain restaurant sandwiches costing $8 and up, but how much do those sandwiches really cost restaurants to make?

Consumer Confidence Drops Even Lower — But Is The Recession Really To Blame?

Well, after a quick, hi-energy burst of enthusiasm in the spring, we’re back in the doldrums. The consumer confidence index is down to 49.3, below its May level of 54.8. (A level of 90 would indicate a “solid” economy.) And June sales figures due out next week are expected to show a fairly dismal 6% decline since May.

Market Forces And Recession Hurt Nevada's Legal Brothels

Legal brothels in Nevada are in a situation that has seemingly wandered out of an Economics 101 textbook. Scary as it is to reduce In the recession, more women are entering sex work (both legal and illegal) but there are fewer customers to go around.

Sears: Lose Your Job, Keep Your Purchase, Forget The Debt

Acknowledging that skittish consumers are still unwilling to buy big-ticket items, Sears tomorrow plans to unveil a bold new guarantee: if you lose your job after charging a purchase worth $399 or more to your Sears card, the retailer will credit 1/12th of the purchase price to your account for each month you are unemployed. If you stay jobless for one year, the debt is entirely forgiven, and the appliance is yours to keep.

Men Go Mad In Herds

Men…think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.

Farmers Slaughtering Dairy Cows Rather Than Lose Money Producing Milk

It’s so expensive to produce milk right now — due to low demand and high feed costs — that farmers are being paid to slaughter dairy cows in order to “shift the pain to consumers,” says Bloomberg.

Eddie Bauer Jumps In The Bankruptcy Pool

Eddie Bauer is the latest retailer to file for bankruptcy, and it says it hopes to be sold outright rather than try to reorganize, refinance, or liquidate. The AP says the clothing company had “$476.1 million in assets and $426.7 million in debt at the time of the filing Wednesday with the United States Bankruptcy Court of the District of Delaware,” and that by declaring Chapter 11 now it hopes to reassure suppliers and stave off impending cash flow problems.

Direct Sales Grow As Unemployment Increases

Avon, Tupperware, and other direct-sales companies are gaining in popularity, just as they did during the 1990-91 recession. Whether they still have jobs or not, people are looking for ways to earn additional income.

Why Credit History Employment Inquiries Matter

Last week, we covered a story in which a job seeker was denied a job because of his credit report.

Furloughs: Welcome Or Lousy?

Rather than layoffs, a number of employers are turning to furloughs – forced unpaid time off – to meet their budgets. According to a NYT article, employees are handling them in different ways. Some use it as chill time. Others keep working anyway without pay, either out of guilt, routine, or fear of an actual layoff. Has your company been hit with furloughs? How are you dealing? Take our poll inside.

If Gas Prices Fly As Expected, Busineses Need To Ground Themselves To Avoid Crashing

Things that are headed up these days: unemployment, foreclosures, adorable Pixar characters whose houses are attached to helium ballons, Daisuke Matsuzaka’s ERA and, argh, gas prices. A Russian energy group is predicting oil, which is currently just over $70 a barrel, will eventually pierce the stratosphere at $250, meaning it’ll pretty much be Mad Max time for everyone.

What Do You Do When Family Friends Don't Provide The Furniture You Already Paid For?

Ryan is stuck in a bad situation. His father is friends with a the guy who owns a local furniture store, and the store has failed to deliver some custom-made furniture that was fully paid for up front as a goodwill gesture. Now Ryan wants the order canceled, but the owner and his wife are refusing to cooperate.

How The Recession Destroys Friends

Like a tornado, the recession hits unevenly. One house might get turned into splinters, while another is left untouched. Similarily, one friend can still be afford salads and Starbucks for lunch every day while the other has to brown-bag it. The Double-X blog asks its readers, “how do friends in newly different socioeconomic strata adjust?” Answer: most of the time, they don’t.