A panel of wizard-hatted forecasters consulted by The Wall Street Journal has declared the recession officially over. But don’t break out the champagne just yet — unless you’re one of those gilded bankers we mentioned earlier. “We are in a technical recovery, but risks remain abundant,” Diane Swonk of Mesirow Financial told the paper. “It will still take some luck and skill to get Main Street to feel some of the relief Wall Street has felt.”

recession

You Can't Even Afford To Pay For Porn

You cheapskates are really ruining this economy. First, you decided you couldn’t afford to gamble. And now you’re giving up on another industry that could be crucial to pumping up our flaccid economy: porn. According to The Economist, revenues in the $6 billion a year adult entertainment industry have dropped by 30%-50%, with some producers claiming that they’re down by as much as 80%. Film production has dropped from 5,000 to 6,000 a year to about 3,000 to 4,000.

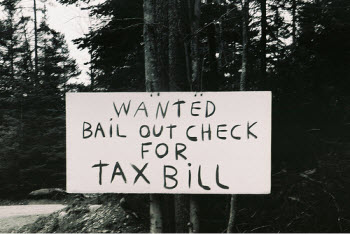

Welcome To The New Gilded Age, Fueled By Your Money

Remember all of those banks that were “too big to fail” and had to be bailed out? Newsweek’s Niall Ferguson is out with a report today pointing out that a year after the collapse of Lehman Brothers signaled the start of the bailout boom, they’re still big, and thanks to the safety net you tossed them, they’re “back to making serious money and paying million-dollar bonuses. Meanwhile, every month, hundreds of thousands of ordinary Americans face foreclosure or unemployment because of a crisis caused by … a few Wall Street giants.”

Recession Hits Casinos, Hurting State Tax Revenues

States that put it all on double zero and let it ride may start wishing they’d listened to Ace Rothstein, and walked out instead of choosing to take the money — and the hammer. The casino industry — once considered recession-proof — is starting to feel the pinch of the current downturn. The New York Times reports that some of the biggest gambling havens, including Nevada, New Jersey and Illinois, have seen massive drops in gambling-related tax revenues. New Jersey’s take was down $62 million, Nevada dropped $122 million, and Illinois spun and lost $166 million in tax revenues.

Consumers Cut Spending, Save Money, Pay Down Debt, Ruin Economy

Good work, consumers of America! You’ve collectively reduced your outstanding debt by $21.5 billion during the month of July. We’re so proud. Except, oops, that’s not so great for the economy.

Six Money Lessons of the Great Recession

Ok, so our collective net worth is down several trillion dollars and personally our fortunes have nose-dived, but at least the recession provides a “learning opportunity.” Or at least that’s MSN Money’s point-of-view. They suggest we’ve learned (the hard way unfortunately) the following money lessons from the recent recession :

Unemployment Claims And Consumer Confidence Down, Whirlpool To Lay Off 1,100

The number of new unemployment claims filed nationwide was down to only 570,000 last week, but consumer confidence is at a four-month low. Maybe that’s because newsworthy layoffs continue, including Whirlpool announcing that they will cut 1,100 full-time positions in the U.S., located in Evansville, Indiana.

FDIC Low On Funds After Record Bank Failures In 2009

Given how many banks have failed and been taken over by the FDIC this year (84, including three yesterday), it’s not one bit surprising that the FDIC isn’t doing too well, funds-wise. It’s down to $22 billion, the lowest the failed bank fund has been since the savings and loan crisis of the early ’90s, when it needed to borrow money from the Treasury Department to keep going.

What Do Sales Data Show About This Recession?

People aren’t buying: Large appliances, furniture, and durable household goods

Laid-Off Workers Keep Up Appearances, Pretend To Be Employed

Earlier this week, the Washington Post shared the story of a man who tried hard to keep up appearances, and to carefully choreograph his routine so his friends and neighbors wouldn’t think of him differently. Finally, he tired of the charade, and outed himself. As an unemployed person.

Sued College Ain't Exactly Harvard

Remember that story about Trina Thompson, the woman who sued her college after she couldn’t get a job? Turns out maybe the institution had it coming.

Lose Your Job? Don't Worry, Our Exorbitant Payday Loan Fees Are On Us

Do you need cash right now, but are worried that you might lose your job in the next two weeks? Guarantees for customers who lose their jobs have worked for Hyundai, Ford, GM, and Sears, so now the practice has expanded to the payday loan industry.

Bad News: Yet Another Record Month For Foreclosures

For the third time in the last five months a new record for foreclosure filings has been reached says foreclosure tracking firm RealtyTrac. July saw an increase of 7% from June of this year and, even more telling, a 35% increase from last year.

Jobless College Grad Sues To Get Tuition Back, Misspells "Tuition"

The job market is tough. No one seems to know it better than our nation’s fresh-faced recent college graduates. They’ve discovered a harsh truth—despite hounding alumni for donations, colleges aren’t able to find jobs for them. One recent college grad in New York City is fighting back, since she graduated three whole months ago and her alma mater hasn’t found her a job yet.

OutOfYourLife.Com: The Man Eater's Cash4Gold?

Here’s a common problem: we have many ex-lovers, who have put ice on our wrists and given us countless pearl necklaces. But these wealthy suitors have left our hearts broken and in this economy, we’re hurting for cash. Thankfully, we discovered Out of Your Life (motto: “It’s time to break up with his jewelry, too”), who will buy our tear-stained jewelry back from us!

New Home Sales Increase! Still Down 21%!

The world is currently overjoyed at the news that new home sales have increased by 11% this month, which is apparently much more than expected, but are still 21% below the levels of a year ago.

Consumers Are Scared To Lose Their Jobs, Still Saving For Their Inevitable Unemployment

The deepest “employment slump of any recession in the last eight decades” has consumers convinced they’re about to lose their jobs — and that’s affecting consumer confidence, says Bloomberg.