One of the major sticking points of the inevitable Wall Street bailout was executive pay — but the New York Times says that Treasury Secretary and former CEO of Goldman Sachs, Henry M. Paulson Jr., has agreed to compensation caps for the executives of firms that benefit from the bailout.

real estate

WaMu Lent $24.5 Million To One Shady Family Of ID Thieving House Flippers

If you’re expecting this story to be about the worst bunch of shady house flippers from the height of the credit boom, you’ll be disappointed. This story is about a family that took WaMu for huge amounts of money by buying homes and selling them to their friends and other family members for grossly inflated prices — and pocketing the profit while the homes fell into foreclosure. They did this as the California real estate market was imploding, and after WaMu had announced that it had tightened its lending standards.

Live Underground For Cheap

Forget the sub-prime meltdown and get with the subterranean housing craze. This book – linked in one of Chris’s posts but I just had to bring it to the front page – has everything you need to know about building a house underground. The most amazing thing is that there’s ways to do it to get light from all four sides. The penultimate amazing thing is not being buried alive while you sleep.

Escape The Rat Race With A Tiny House

It’s not just supermarkets that are shrinking—you can also build yourself a 90-square-foot house to shack up in with your hunched-over spouse and children. You’ll save money! You’ll save the environment! Relatives will never expect to be given free room and board when they come to visit!

Facing Foreclosure? Buy A Second Home! Wait, What?

ABCNews says that more and more people who are facing foreclosure are just buying cheaper homes and then just walking away from their original mortgage. It only works for people who can afford the down payment on a new home and carry both mortgages until they’re in the new home, but for some people whose payments are about to balloon, it’s the most attractive option out there right now.

Homeowners Sue Countrywide!

Who isn’t suing Countrywide lately? Phuong Cat Le from the Seattle Post-Intelligencer says that a group of homeowners are now suing Countrywide, alleging that the lender steered them toward high-risk loans without disclosing the inherent risks.

Expect Fewer Deals At Home Depot, Lowe's

Home Depot and Lowe’s are starting to realize that the surging housing market — which had fueled their own sales for the last few years — is really and truly over and it may not be coming back for a good long while. What does this mean for their customers? An emphasis on lower prices every day — and fewer promotions.

Would You Judge A Real Estate Broker By His Blog?

The Washington Post reports that consumers are starting to judge real estate agents by their blogs. Almost 10% of real estate brokers are apparently blogging, a number that is likely to rise faster than that sketchy “up and coming” neighborhood you’ve heard about for years.

Donald Trump Saves Ed McMahon From Foreclosure!

Donald Trump doesn’t know Ed McMahon, but he “grew up watching him on tv,” so he’d like to be his new landlord. McMahon is currently facing foreclosure from Countrywide, and had 2 weeks to sell his house before the bank repossessed it. Mr. Trump has agreed to buy the house and lease it to McMahon, says the LA Times.

Houses For $1: "My 14-Year-Old Son Could Buy a Block of Detroit Property"

Things are looking pretty bleak in parts of Detroit these days. In fact, you can get a house for $1. Yes, that’s right. A house.

Not Good: Fannie Mae Loses $2.3 Billion

Fannie Mae is the nation’s largest mortgage finance company and it’s just not doing too well, says the AP. Increasing losses from foreclosures are wiping out Fannie’s revenue.

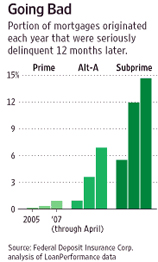

The Only Thing Worse Than '06 Mortgages: '07 Ones

Man, remember those mortgages made in 2006? That was some bad juju. Whooee. But if you thought those were bad, wait till you get a load of the mortgages made in 2007. As the graph shows, people are defaulting on them at an even higher rate than the ’06 ones. How could this be? By 2007 the bubble was popping and lenders could all see that they needed to stop giving making loans to underqualified borrowers, right? That was exactly the problem: “Mortgage originators who profited handsomely from the housing boom “realized the game was completely over” and pushed mortgages out the door,” reports WSJ.

Homeowners In Denial: Everyone's House Is Worth Less Except Yours

According to a new survey from Zillow.com, Americans are totally out of touch with reality when it comes to their homes. 62% of homeowners surveyed said they thought their homes had appreciated in value over the past year. In fact, only 19% of homes in the US increased in value, and 77% actually decreased in value. (5% stayed the same.)

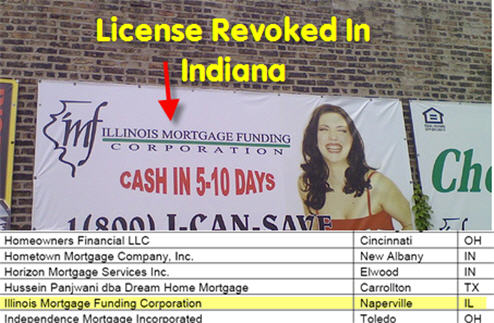

Oh Sh*t! 40% Of Indiana's Mortgage Brokers Lose Their Licenses

40% of Indiana’s mortgage brokers have lost their licenses because they did not comply with a new law aimed at “raising the standards” of the mortgage lending industry. The law requires mortgage brokerages to “name a principal broker with at least three years experience who has passed a state exam and will oversee his company’s business affairs,” says BusinessWeek. Sounds reasonable, doesn’t it?

Beware The "Fannie Mae" Prize Draw Scam

Scammers love to tap into national trends to put a new face on an old scam, and the “Fannie Mae, Freddie Mac Equity Prize Draw” scam spotted by the Louisville, KY BBB is no exception.