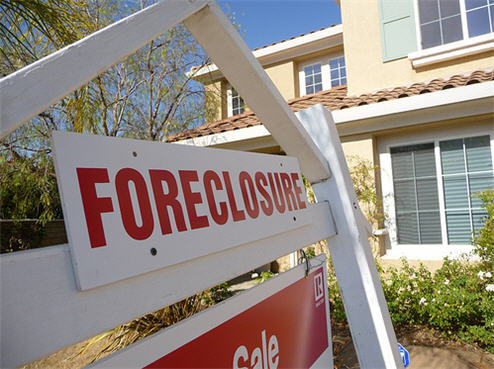

Hmm, wasn’t this housing bubble crap supposed to be slowing down? Guess not. The foreclosure numbers for last quarter are twice as bad as last year according to the new numbers from RealtyTrac (a firm that tracks foreclosure filings.) 1 in every 171 households nationwide was foreclosed on, received a default notice or was warned of a pending auction in the second quarter of 2008. Bloomberg says this is an increase of 14% from last quarter and an increase of 121% from this time last year.

real estate

Will The New Homeowner Rescue Bill Help Rescue You?

A new bill that will help 1-2 million homeowners escape their unaffordable mortgages by refinancing into new low-cost fixed-rate loans insured by the Federal Housing Administration (FHA) has passed the House and will now move on to the Senate. If it is eventually passed by the Senate and signed by the President (who is no longer threatening to veto it), will it help you?

Personal Finance Roundup

The smartest advice I ever got [CNN Money] “40 great minds share the best money lessons they ever learned.”

Wachovia: We Just Lost $8.9 Billion!

Wachovia just lost $8.9 billion dollars, and will cut 6,350 workers as the credit crisis keeps on truckin’, says the Associated Press. This is um, a lot more than Wall Street had been expecting. Earlier this month, Wachovia had projected a $2.6 billion loss.

What It Takes To Qualify For A Mortgage In A World With Standards

The party is over. If you want a mortgage you’re going to have to be able to afford it. Oh no! Now what are you going to do? Kiplinger’s has an article that explains how mortgage lending works when there are “standards” involved. How quickly we all forget…

Moving With Movearoo's Help? Hope You Like AT&T, Verizon, And Qwest

Movearoo.com is a new website that appears to offer free assistance with your move, helping you set up things like phone service, gas, and electricity at your new address. The site calls itself “Your Total Moving Resource.” It’s a helpful site, sure, but you should be aware that it’s funded by AT&T, Verizon, and Qwest, and exists primarily to promote their services. In other words, you won’t find a comprehensive list of competing phone service providers through Movearoo, only those offered by the three sponsor companies. A consumer advocate points out the drawback of making Movearoo your sole relocation resource:

Don't Get Ripped Off By A Shingle Warranty

If you’re not careful, a shingle warranty can leave you soaked. Shingle warranties usually only pay out when the shingles themselves are defective, and most shingle failures are due to improper installation. The shingles themselves are only 10-20% of a roofing job. Most of the costs are from labor. If your shingle warranty covers only the shingles themselves and not the warranty, the shingle warranty will only be worth a few hundred dollars. And watch out for prorated shingle warranties – their value may decline precipitously after the first few years. Learn more about shingle warranties and what to watch out at The Roofery.

Cattleprod Loan Servicers To Answer Your Loan Modification Requests

If you’re trying to get your mortgage modified or just a question answered but find yourself stymied by your loan servicer’s slow or lack or response, you can write what is termed a qualified written request (QWR) under section 6 of Respa, The Real Estate Settlement Procedures Act. Under federal law, they have to acknowledge the letter within 20 working days and respond in 60. Inside, a template to follow for drafting a QWR…

Ex Countrywide Manager Exposes Its Lies

A former regional manager for Countrywide Home Loans, the mega mortgage company whose shady mortgage mill came to epitomize the subprime meltdown, went on The Today Show camera to detail some of the company’s questionable practices. Here’s some of the tricks he warned upper management about during his 6-month stint before he was fired for refusing to give loans to unqualified buyers:

../../../..//2008/06/19/over-400-people-have-been/

Over 400 people have been charged in the government’s national mortgage fraud probe, called “Operation Malicious Mortage,” which dealt with individual rather than corporate fraud. [Reuters]

"We Used To Sell Homes In A Day, Now 50% Of Our Sales Are Foreclosures"

Bank repossessions (that’s when not even the bank can sell your house) are up 48% from a year ago, as falling house prices trapped borrowers in mortgages they couldn’t afford, says Bloomberg.

More Than 1 Million Homes Are Now In Foreclosure

Grim numbers today from the Mortgage Bankers Association. 2.5% of all mortgages serviced by the association’s members are now in foreclosure — 1.1 million homes. The rest of the numbers aren’t any more cheerful. Both the rate of new foreclosures and late payments were the highest on record going back to 1979, says the AP.

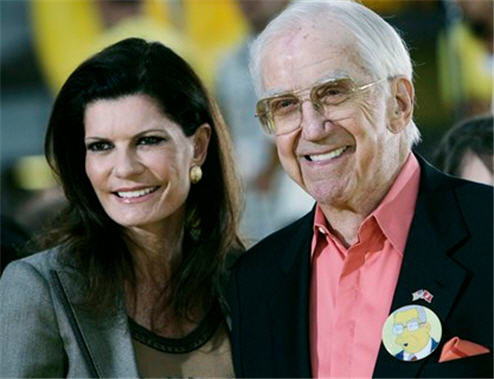

Countrywide Is About To Foreclose On Ed McMahon

Ed McMahon, former sweepstakes pitchman and Johnny Carson sidekick, has defaulted on his multimillion-dollar Beverly Hills home, says the AP. Mr. McMahon’s house has been on the market for two years, but is located so close to Britney Spears’ house that he’s having trouble selling it.

New Houses Are Now "Buy One Get One Free" In San Diego

Michael Crews Development has a proposition for you. If you buy one of his $1.6 million-and-up, 2-acre estate homes in the San Pasqual Valley, he’ll toss in a four-bedroom row home for free!

../../../..//2008/05/27/sales-of-newly-constructed-single/

Sales of newly constructed single family homes are down 42% from last year, the largest single year-to-year drop in nearly 27 years. [Reuters]

Is This Woman The Smoking Gun Of The Mortgage Meltdown?

Meet Tracy Warren. NPR says she’s not surprised by the mortgage meltdown because she was supposed to be in charge of preventing it. Tracy worked for a quality control contractor that reviewed subprime loans for investment banks before they were sold on Wall Street, and her company’s biggest client was none other than Bear Stearns. Tracy says she found plenty of loans to reject. The trouble is, according to Tracy, after she rejected them… her bosses unrejected them.

Subprime Meltdown Driven By Nouveau Riche Countries With Too Much Money And Nowhere To Put It

The fuel and engine for the sub-prime mortgage meltdown and the credit crunch was Allen Greenspan and the doubling of the global monetary supply, according to the This American Life episode “The Giant Pool of Money” I just got around to listening to. Basically, a bunch of poor countries got rich all of a sudden selling TVs and the like, and in 6 years, doubled the worldwide supply of money. The giant pool of money was hungry for places to invest itself.