If there’s one group of Americans who don’t carry their weight and need to pay more money to the healthcare industry, it’s those layabout senior citizens! That’s why their Medicare drug premiums are increasing by an average of 31% for the 10 most popular plans beginning in 2009. If you were with Humana, formerly the cheapest Medicare drug plan you could get (its premium was $9.51 in 2006), you can expect to pay $40.83 per month in 2009, an increase of 60% over this year’s rate. As you would expect, Humana is no longer the cheapest option—so it may be time to shop around for a new plan.

rates

Congress Asks Wireless Carriers To Justify Text Message Rate Increases

The similar price increases, coming at similar times, Kohl said, “is hardly consistent with the vigorous price competition we hope to see in a competitive marketplace.”

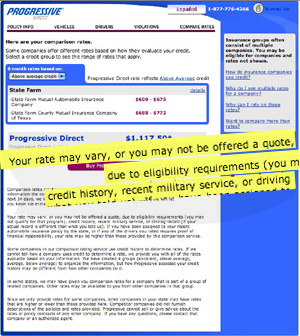

Progressive Responds To Question About Using Recent Military Service To Determine Rates And Eligibility

The Progressive auto insurance company saw our post “Why Is Progressive Using “Recent Military Service” To Determine Rates And Eligibility?” and responded to let us know that it’s just to make sure that service members aren’t penalized for having a lapse in their coverage due to the fact that they’ve been deployed overseas. They’ve apologized for the confusing wording on the website and have pledged to rewrite it for clarity. Full official statement, inside…

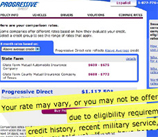

Why Is Progressive Using "Recent Military Service" To Determine Rates And Eligibility?

[Update: Progressive responded and clarified that the fine print does NOT mean they will use military service to give you a higher rate.] We got this email tonight from Ceaser, who wants to know why his military service would negatively affect his car insurance:

While searching for new car insurance on progressive and sadly other insurance carriers, figuring what the rate check would be I answered a few questions. Some questions asked were if I was currently in the military and in college, I am both. As an Iraq war Army vet I am currently going to school with the GI bill, and tuition assistance from the Air national guard, so I put that I am both a student and national guard.

Over Your Credit Limit? Get Ready For Higher Interest Rates!

Next time you brush past your credit limit you may get hit with more than a hefty over-the-limit fee. The Red Tape Chronicles reports that credit card companies are starting to slap exuberant spenders with penalty interest rates. Compounding the danger to consumers, creditors are simultaneously rushing to slash credit limits.

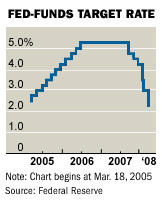

Another Deep Rate Cut From The Fed

The Federal Reserve Open Market Committee today announced a rate cut of 75 basis points to 2-1/4 percent.

EU Pushes For Per-Second Wireless Billing

Viviane Reding, the European Union’s Telecommunications Commissioner, is our new wireless hero. She’s demanding that wireless carriers in Europe begin billing on a per-second basis rather than per-minute, because “at the retail level, the difference between billed and actual minutes appears to be typically around 20 percent.”

U.S. Markets Down Sharply Despite Emergency Rate Cut

Despite the fact that the Fed cut the federal funds rate on overnight loans between banks to 3.5 percent from 4.25 percent in an attempt to prevent a sell-off in U.S. markets, the Dow Jones Industrial average opened down by more than 460 points.

You Really, Really, Hate Blockbuster For Raising Prices

I responded by immediately canceling my account – I gave them the benefit of a doubt the first time, but this is too much.

Liveblogging The Senate Permanent Subcommittee On Investigations Hearing On Arbitrary Credit Card Rate Increases

Today at 9:30 a.m., Senator Carl Levin (D-MI) will continue his investigation into the unfair and deceptive practices of the credit card industry. Today’s topic: arbitrary rate increases for cardholders in good standing. The hearing picks up where Senator Levin left off in March, when he questioned the use of excessive fees, interest charges, and the abuse of grace periods.

Get Those Credit Card Rate increases Canceled

A Kiplinger reader shares his strategy for getting ridiculous rate increases on his three credit cards rolled back to their original rates. It’s a technique that’s probably familiar to a lot of Consumerist readers when negotiating for lower rates in general: be polite but unyielding, know where you stand as far as leverage (it helps to have a perfect history with the company), start with basic customer service, and then escalate as needed.

../../../..//2007/11/30/the-feb-will-likely/

The Feb will likely cut rates again in December “providing three conditions are met: financial markets remain distressed, the risks to inflation do not increase and the remaining economic data do not come in stronger than expected.” [MSNMoney]

Mortgage Rates Are At 2 Year Lows

The Wall Street Journal is reporting that the national average interest rate on the benchmark 30-year, fixed-rate loan averaged 6.1% last week, the lowest rate since Oct 13, 2005.

Comcast Apologizes For Calling You A Liar

George, who was called a liar by an ill-tempered Comcast CSR (who didn’t believe that George had been quoted a lower price than the one that was noted on his account) has written in to let us know that Comcast apologized:

"Comcast Flat-Out Calls Me A Liar"

Reader George is unhappy with Comcast and he doesn’t even have it yet.

What The Fed's Rate Cut Means For You

The Fed’s recent quarter-point rate cut could either mean more or less cash in your pocket, depending on what you accounts you own. Here is the breakdown:

FDIC Chair Suggests Fixing Rates To Solve Mortgage Crisis

Sheila C. Bair, the chair of the FDIC, suggests that lenders “restructure all 2/28 and 3/27 subprime hybrid loans for owner-occupied homes in cases where the borrower has been making timely payments but can’t afford the reset payments. Convert these to fixed-rate loans at the starter rate.”

Should Car Insurance Rates Be Based On Your Credit Score?

For a decade now, all the major auto insurers have used a customer’s credit rating to some degree in determining premiums. They claim that it results in lower rates for “most” customers, and that the data prove that people with lower credit scores make more claims and for higher amounts. The FTC released a report this summer that validated the practice—but also confirmed an unpleasant truth critics have been saying for years: because a higher percentage of Hispanics and African-Americans have low credit scores, there’s a good chance they’re disproportionately affected.