You might remember a little incident on a United Airlines flight back in April in which a ticketed passenger was forcefully removed from a flight after he refused to give up his seat. That incident resulted in several airlines changing their policies related to overbooking flights, and the results of those changes are starting to show: The number of passengers bumped from U.S. airlines is at its lowest level in more than a decade. [More]

rates

Data Shows Borrowers With Less Student Loan Debt More Likely To Default

When you hear about someone defaulting on their student loans, you might assume this borrower took out several tens of thousands of dollars to pay for their education. But a look at the data shows that those borrowers who are most likely to default are often the ones who owe the least.

[More]

Sprint Raising Data Rates By $10 Per Month For New Activations

Starting January 30, Sprint is raising data rates by $10 a month for new phone activations. The rate increase will not apply to existing customer unless they upgrade or activate another smartphone. [More]

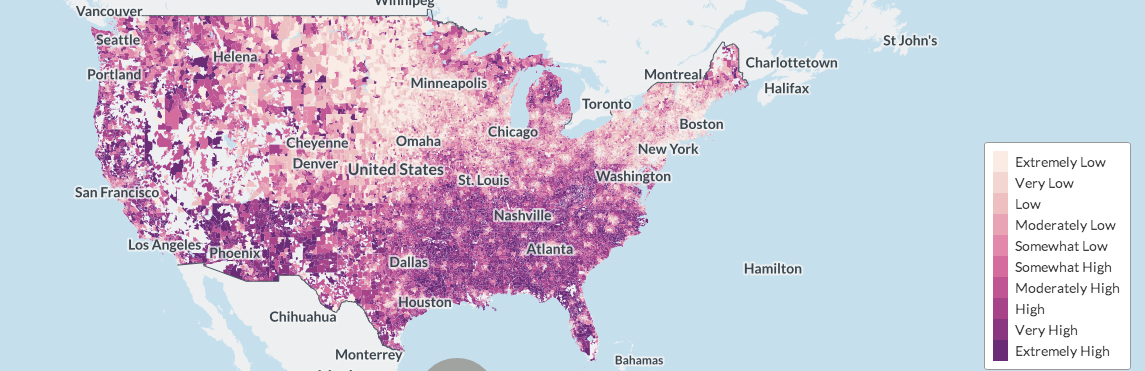

We're Actually Using Less Electricity This Summer

Despite the record-breaking heat in some parts of the country, total U.S. energy consumption this summer has actually fallen compared to 2009, and peak demand levels–when electricity consumption is at its highest–have dropped as well. [More]

USPS Suggests Cutting Saturday Delivery And Increasing Rates

The United States Postal Service is continuing its long slide into suckage according to a new report delivered by Postmaster General John E. Potter this morning. People sent far less mail last year (“more than double any previous decline,” says the Washington Post) and labor costs continue to rise, which helped the USPS lose $3.8 billion in 2009. [More]

State Investigators Find All Sorts Of Dirty Tricks At Mercury Insurance

This summer Californians will be able to vote on Proposition 17, which if passed will allow insurers to bypass some legal restrictions on how much they can charge for auto insurance. Mercury Insurance Group is a big proponent of the proposition, but maybe that’s because it’s been possibly sidestepping the law in recent years anyway. Hey, making it legal will just prevent another state report like the one Carla Marinucci at the San Francisco Chronicle obtained, which contains findings that Mercury “has engaged in practices that may be illegal, including deceptive pricing and discrimination against consumers such as active members of the military and drivers of emergency vehicles.” [More]

Michigan Utility Company Must Refund $39 Million To Overcharged Customers

In Michigan, utilities can increase rates without first getting approval, but that means the Michigan Public Service Commission can later reduce them. That’s what happened on Monday, when the Commission ordered Consumers Energy to refund about $39.6 million to customers it overcharged since last May.

"Chase Hiked My Minimum Payment To 5 Percent!"

Chase just notified Greg that they’re more than doubling his minimum payment requirement. Because he and his wife are carrying such a large balance due to a promotional balance transfer offer a few years ago, this pushes their monthly payment to nearly $1,000.

Amex Hikes Rate, Drops Balance, Then Tries To Bribe Customer To Pay Off Debt Early

Courey Gouker’s recent experience with American Express encapsulates every trick the company has pulled in the past few months to drive away their customers, including dropping the credit limit, hiking the rate, and even offering him a cash bonus to pay off his balance in full. In addition, the company’s CSRs made promises to him that they didn’t keep, and notes on his account have gone missing. About the only thing they haven’t done is email a photo of the CEO flipping him the bird.

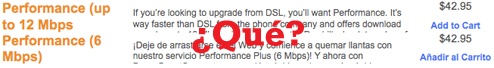

Why Is Comcast Charging Spanish-Speaking Customers The Same Price For Slower Service?

UPDATE: We’re bad at Spanish. See below. We came across a Twitter user who, while browsing Comcast’s internet prices, discovered that the Spanish-language version of the site offers reduced speeds at the same prices as the higher speeds seen on the English version of the site. What the hell?

69 Cent Tracks Are Hard To Find On iTunes Music Store

MP3newswire.net browsed through not-quite-hits from past decades on the iTunes Music Store to see where these fabled 69 cent music tracks are hiding. He tried the Katydids, Camper Van Beethoven, the Lyres, Rock and Roll Trio, but found nothing below 99 cents. Then he went back to be-bop and blues recordings of the ’40s—nope. Finally, he looked at songs from Ada Jones, a recording artist from 1893 to 1922. Everything was still 99 cents.

iTunes Raises Prices To $1.29 For Popular Music Tracks

Say what you will about Apple’s dominion over the music industry, but for a while now they’ve maintained an artificially low market for music tracks by forcing labels to sell songs for 99 cents each. That era is over: in exchange for moving to a higher bitrate and going 100% DRM free (hooray) iTunes has officially introduced “variable pricing” (boo), which means each track may cost 69 cents, 99 cents, or $1.29—it all depends on the song and the label. It looks like Amazon has introduced variable pricing as well, although it’s mostly holding to the 99 cents threshold for now. Amazon’s tracks, by the way, have always been free of DRM.

../..//2009/04/02/mortgage-rates-are-at-a/

Mortgage rates are at a record low of 4.78%, according to Freddie Mac. [Bloomberg]

../..//2009/01/25/rumor-confirmed-att-has-indeed/

Rumor confirmed: AT&T has indeed dropped the price of its unlimited data and messaging plan by $5—the new cost is $30/mo, and $10/mo to add a second phone under their shared family plan. Unless you plan on texting more than 200 messages a month, however, it’s not worth it (you can get unlimited data + 200 messages for $20). [Engadget Mobile]

Confirmed: Sirius Radio Raising Rates March 11

Sirius Radio customer service reps are now telling subscribers that the rumored rate hike is indeed going to happen. This means, at the very least:

Is Sirius XM About To Raise Rates On Its Customers?

Ryan pointed us to an article on Orbitcast about a rumored fee hike by Sirius XM. The increases appear to be for services that aren’t strictly protected by the FCC agreement, which is why they would legally be able to do this despite promises that they wouldn’t raise rates for 36 months after the merger.

Chase Invents $120 Annual Fee For Balance Transfer Customers

Some customers who transferred their balances to Chase were hit with a new fee this month: a $10 monthly surcharge just for having the account in the first place. This $120 annual fee is pure profit for Chase and doesn’t get applied to the balance. Oh, and they’re doubling the minimum payment as well, although the sooner you pay off your Chase credit card and close it, the happier you’ll be.