Customers of Time Warner Cable may consider themselves the victors in the battle between their cable operator and the Fox network. After all, the two sides came to a last-minute agreement on New Year’s Day guaranteeing that TWC customers will still be able to catch up with Homer Simpson, Walter Bishop and Jack Bauer. But guess who’s gonna pay for that? Here’s a hint: It’s not Rupert. [More]

rate hikes

Report: DirecTV Hiking Prices Soon

High-Def Digest reports DirecTV plans to bump its rates next month. [More]

Chase Raises Interest Rate On Closed Account

David closed his Chase credit card account instead of accepting a rate increase earlier this year. That should have been the end of it, but it turned out Chase later went ahead and increased the interest rate anyway.

Capital One Invents Its Own Christmas Creep, Raises Interest Rate On December 26th

When Wally first got his Capital One credit card, the interest rate was 12 percent. Then they raised it to 22.9 percent. Now they’re going to raise it again—the day after Christmas—to 25.9 percent.

Congress Seeks To Move Up Credit Card Act Implementation To December 1st

Today, Reps. Barney Frank and Carolyn Maloney are going to request that the implementation date for the rest of the Credit Card Act‘s rules be moved to December 1st of this year instead of February 2010, after seeing companies “jacking up their rates and doing other things to their customers in advance of the effective date” all summer, reports Mary Pilon at The Wall Street Journal.

ConEd Hikes Rates, But Consumers Could Still See Lower Bills

ConEd has just what you need in the middle of recession: a rate hike! Monthly bills are set to rise between $6-$8 as the energy monster tries to recoup a half a billion dollars to cover the cost of higher property taxes and the usual infrastructure maintenance that utilities never budget for in advance. The perennial optimists at the New York Post still somehow think you’ll still end up with a lower bill…

Amex Hikes Rate, Drops Balance, Then Tries To Bribe Customer To Pay Off Debt Early

Courey Gouker’s recent experience with American Express encapsulates every trick the company has pulled in the past few months to drive away their customers, including dropping the credit limit, hiking the rate, and even offering him a cash bonus to pay off his balance in full. In addition, the company’s CSRs made promises to him that they didn’t keep, and notes on his account have gone missing. About the only thing they haven’t done is email a photo of the CEO flipping him the bird.

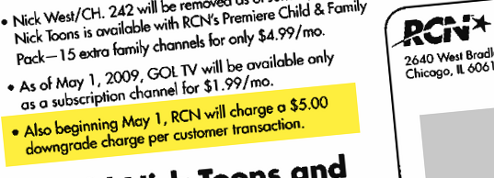

Accept The Rate Increase Or Pay A "Downgrade Fee"; RCN Will Get Money From You Either Way

RCN knows some of you aren’t going to be happy with having your fees increased, especially in such a tight economy. They know that some of you will probably decide enough is enough and call them to request an account downgrade. They’re going to make money off of that, too.

Hit With A Credit Card Rate Hike? Try Freezing The Account

Rosemary writes that Bank of America just increased the interest rates on her two credit cards by 12% and 15% because the balances were too high, after slashing the credit limits on both cards a month before. She’s frustrated, of course, but like everyone else who’s been hit with these increasing fees, she’s sort of stuck with their decision. But Mary Schwager at Examiner.com suggests you try placing your account on hold for six months or so, at which point your creditor may be less terrified of the economy and willing to work with you.

Capital One Does Not Appreciate You Being Responsible, More Than Doubles Your APR

Beverly, who always pays on time and recently started paying off her balance in full every month, just saw the rate on her Capital One card more than double, from 13.9% to 29.4%. That’ll teach you to not help sink the economy, Beverly!

Confirmed: Sirius Radio Raising Rates March 11

Sirius Radio customer service reps are now telling subscribers that the rumored rate hike is indeed going to happen. This means, at the very least:

Tonik Insurance Sneaks 20% Premium Increase On Customer After Approval

Tonik is the rad, x-treme! lifestyle health insurance for young people who can’t afford regular insurance—sort of the Poochie of health insurance, except it’s not going to go away. Aasma wrote to us to let us know that when she signed up for it over the weekend, she got a nasty surprise after she submitted her credit card information.

Advanta Raises Your 8% Credit Card To 20% Because The Economy Is Bad

I have had an Advanta Credit Card for a little over a year now. My interest rate prior to a few days ago was 8%. My credit rating is very good, and I have always made my payments on time. As I was looking over my bill for September I noticed a fee of $75 dollars. A few clicks later I found that my interest rate had been raised to 20%.

Citigroup May Reinstate Universal Default

Last year Citigroup pledged to abandon the customer-screwing policy of universal default, where an unrelated late payment or credit score change can trigger an interest rate increase on your Citibank card. They even used a marketing phrase to promote their promise: “a deal is a deal.” According to the New York Times, Citigroup is “quietly reconsidering its pledge” and may decide to reinstate universal default as early as this week.

Potential Solution To Rogers Wireless SMS Fee Hike

A reader tells us that on March 4, 2008, Rogers Wireless will increase the price of international text messaging to 25 cents per message, which he thinks might be another “get-out-of-contract-free” opportunity similar to what Verizon opened itself up to when it hiked its fees this month. However, according to the portion of the contract Andrew sent us, and based on what a commenter wrote on a previous post, we think what might happen instead is Rogers Wireless will simply let you continue under the terms of your old contract if you call up and insist. It’s worth a shot—post how it turns out if you try it.

New York Regulators Approve Unprecedented ConEd Rate Hike

Staffers at the New York State Public Service Commission have signed off on ConEd’s plan to impose the largest rate hike in the company’s history. ConEd asked for $1.2 billion, but PSC staffers think the utility is entitled to only $618 million. New Yorkers already pay some of the highest electricity bills in the nation.

“This is all part of the sham that goes on with every rate hike request,” said Assemblyman Michael N. Gianaris, a Queens Democrat who sits on the Assembly’s power committee and who has criticized the utility for its response to the 2006 power failure in his borough. “Con Edison asks for more than it expects to get,” he said. “The P.S.C. rides in on its white horse and takes credit for slashing the request. But the end result is still what Con Edison wanted all along.”