Don’t cry over the price of milk spilling upwards. It could actually mean that you pay lower taxes. [More]

personal finance

Bank Of America Exec: It Would Be 'Premature' To Eliminate Debit Card Fee

Bank of America’s infamous $5 monthly debit card fee hasn’t quite caused enough backlash to make the bank Qwikster it away. But customers can cling to hope of the bank one day eliminating the fee, because at least an executive has spoken publicly about the hypothetical notion of getting rid of it. [More]

Credit Card Marketer Uses Clever Way To Circumvent New Regs

Looks like at least one credit card marketer has cooked up a clever way around regulations that forbid unsolicited credit cards from being issued and showing up in your mailbox. [More]

November Fifth Is Bank Transfer Day

Remember, remember, the fifth of November, because that’s when “Bank Transfer Day” is happening. By that date, all participants will have closed their big retail bank accounts and put their money in a local non-profit credit union or local or regional community bank. [More]

Non-Credit Union Alternatives To Banks With Monthly Debit Card Fees

While often the default response online to people looking for something other than a big retail bank to stash their cash is to shout, “Credit union! Credit union!”, they’re not the only game in town. [More]

Negotiate Before You Sign To Get A Better Deal On Your Credit Card

Just like some people don’t kiss on the first date, it can be wise to hold out on a potential credit card company. Don’t give it all up, by which I mean your signature, without playing a little hard to get. Instead of replying to the credit card offer immediately or sending in that online application, call them up and negotiate and get a better deal before you hop into bed with them. [More]

Personal Finance Roundup

That 401(k) loan may cost more than you realize [Market Watch] “About one in four investors borrow money from their 401(k), but, while such loans have some benefits compared to other sources of credit, they also can hit your retirement savings in unexpected ways.”

Where We Spend: 27 Things That Cost Us More [CBS Money Watch] “While overall spending is down 2% from four years ago, we are shelling out more for certain items each month — 27 things, to be exact.”

4 Ways to Beat Debit Card Fees [Wise Bread] “You don’t need to pay those fees. Here are four ways to avoid them.”

Halloween Spending: Be Afraid, Be Very Afraid [Get Rich Slowly] “Who pays $26 for a stegosaurus dog costume?!”

The Only 2 Financial Rules You Need Live By [Money Talks News] “There are two kinds of people: those who think $1,000 is a lot of money, and those who think $10 is a lot of money.”

Don't Mistake Luxuries For Necessities

Those of us who consider ourselves poor are probably overlooking key budget items that sap money away on a monthly basis, keeping us away from important goals that seem unreachable. [More]

How Bank Of America Picked $5 As The Debit Card Monthly Fee

The new $5 monthly fee Bank of America is charging debit card holders wasn’t just picked because the spreadsheet guys really like Subway $5 footlongs. There’s actually a calculation behind it. Here’s the math. [More]

How To Track Your Personal Inflation Rate

National average inflation rates can rise or fall, but the only number that makes a difference in your life is one that’s hidden from you unless you do some legwork to uncover it. Tracking and categorizing your purchases over time allows you to get a handle on how your budget and priorities evolve over time in relation to the fluctuating market. [More]

20 Colleges Costing Over $55,000 A Year Total

In 2007, there was only one college that had a total cost of over $50,000. Now, there are twenty that cost over $55,000. Here they are. [More]

Close Up Loved One's Accounts After They Pass Away

If the responsibility has fallen on your shoulders to close up the accounts and cancel the contracts of a loved one who passed away, it can be a painful, slow, and confusing process. Here are 9 tips to make it go smoother. [More]

Bankers Association Defends Checking Rate Hikes: "We Don't Expect To Pay Nothing To Ride The Train"

Bankers are sure trotting out the appealing straight talk to defend the recent increase in rates on various consumer banking services. First it was Bank of America CEO Brian Moynihan telling folks that adding a $5 monthly fee for debit cards was okay because they “have the right to make a profit.” Now an American Bankers Association has an interesting turn of phrase to defend the jackup in checking account costs, most recently done by Citibank. [More]

Bank Of America CEO Defends $5 Fee Hike: We Have "Right To Make A Profit"

Bank of America has taken a lot of flack over the bank’s decision to levy a $5 monthly fee on debit card holders. Now the CEO is firing right back. [More]

Obama's Debt Reduction Plan Includes Letting Debt Collectors Robo-Call Cellphones To Collect On Federal Student Loans

One part of the debt-reduction bill Obama sent to Congress is a provision that would let debt collectors robo-call cellphones to collect on what’s owed to the government, like federal student loans. [More]

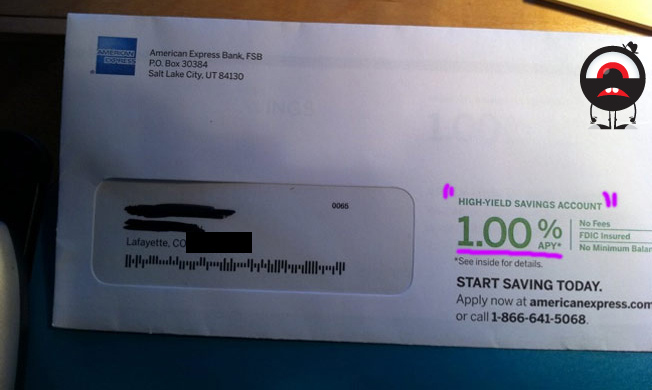

Banks Marketing 1% APR Bank Accounts As "High-Yield"

Considering how “high-yield” savings accounts used to give returns of 4-5%, reader Phil thinks it’s a bit disingenuous for banks to continue marketing them as such when the rates are only 1%. He sent in a picture of a recent piece of junk mail he got from American Express to illustrate. [More]

Personal Finance Roundup

7 times to call your card issuer [MSN Money] “Staying in touch is the best way to prevent inconveniences such as having your account blocked or major problems such as fraud.”

10 Career Lessons from Julia Child [Get Rich Slowly] “The top 10 career lessons you can learn from Julia Child.”

15 Tips for Shopping Consignment Sales [Parenting Squad] “Before you pay top dollar for new clothes, think consignment sales.”

Simply Finishing College Offers the Best Chance to Gain Financial Education [Moneyland] “College graduates pretty much have, or through experience and learning ability soon will acquire, enough personal finance smarts to effectively manage that part of their life.”

Double your salary in the middle of nowhere, North Dakota [CNN Money] “Believe it or not, a place exists where companies are hiring like crazy, and you can make $15 an hour serving tacos, $25 an hour waiting tables and $80,000 a year driving trucks.”

How To Tell Whether A Debt Is "Bad" Or "Good"

While most types of debt will financially hobble you and should be eliminated as soon as possible, other varieties can enrich you. Those who distinguish between the effects of debts and tune their financial plans toward paying down the most destructive types will sit the prettiest. [More]