Do you have so many credit cards that you could sew a pair of pants from them? Confused as how to get rid of them? Try this handy Excel spreadsheet to generate a custom strategy for becoming debt-free.

personal finance

Meet Leverage Connections, King Of The Robocallers

Last week we reported that some types of unwanted robocall telemarketing will soon be banned. If you’re on the receiving end of Leverage Connections’ prerecorded harassment—they frequently operate under the generic names “Consumer Services” or “Credit Card Services”—you’ll finally have a way to formally complain to the FTC about them. Why would you want to complain? Because they’re the scammiest, most obnoxious robocall telemarketing company we’ve seen so far—even though what they do is apparently legal.

4 Unusual Ways To Save Money

BusinessWeek has put together one of those accursed slideshows of 25 ways to save money, and while a lot of them are things you’ve heard before (use credit cards wisely! buy generic or used!), there are a few less common tips that you might not have considered. Here are four that caught our attention.

Watch Out For These 5 Overdraft Traps

Banks need your money. They’re not doing too well on their own, and you’re not screwing up enough to generate the fees they need to make their shareholders happy. That’s why they’ve set up sneaky ways to maximize your every mistake—or in some cases, ways to change the rules so that you make new mistakes where you didn’t before—in order to penalize you. Here are five things SmartMoney says to watch out for.

6 Unpleasant Truths About Personal Finance

Ready for some tough love about how to improve your financial situation? Jeffrey Strain, the man behind SavingAdvice.com, has put together a list of six “awful truths” about personal finance for TheStreet.com. The reason they’re “awful,” he writes, is that “these truths mean that the each person must take more responsibility and make hard decisions that they would rather leave to others.”

Sadness Makes You Spend More

Is [it] a biologically driven disease of the brain, a learned habit run amok, an addiction in its own right or a symptom of the other dysfunctions—most notably depression—that so often accompany it?

Personal Finance Roundup

Using Your Health Savings Account as a “Super Roth” Investment Vehicle [Free Money Finance] “If you can afford to delay using your HSA funds and instead leave them invested, your payoff in retirement will be substantial.”

../../../..//2008/08/15/this-week-personal-finance-website/

This week, personal finance website The Simple Dollar ran a series of “Big Debates” that discussed some common either/or finance choices, including the merits of using or eschewing credit cards, whether to pay off debt or save for retirement, and the advantages of 401(k)s versus Roth IRAs.

What To Do When Citibank Charges You Interest On A Zero Balance

A Consumerist reader was surprised to find that Citibank had applied a finance charge on a zero balance account. She did what every good Consumerist should do: prepared her evidence, jumped quickly ahead to a live person on the Customer Service side, and resolved the issue. Here’s what happened:

Personal Finance Roundup

When should you spend to save? [MSN Money] “Are warehouse store memberships a good deal? How about extended warranties? It all depends on the products — and on you, the shopper.”

Your Best Investment: Your Health

It’s been suggested that your career is your biggest financial asset because it fuels all of your financial progress — it grows your net worth, pays for your living expenses, sends your kids to college,funds your retirement, and the like. That’s why we protect our careers with products like disability, medical, and life insurance, because without the ability to work — even for a limited amount of time — most of us would experience severe financial hardship.

../../../..//2008/08/08/good-housekeeping-has-an-extensive/

Good Housekeeping has an extensive article detailing the 5 most common money mistakes that people make, from spending too much on “bargains” to letting their children blow their budget by not standing up to whining and teaching their children the value of things. [Good Housekeeping via Digg]

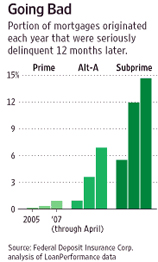

The Only Thing Worse Than '06 Mortgages: '07 Ones

Man, remember those mortgages made in 2006? That was some bad juju. Whooee. But if you thought those were bad, wait till you get a load of the mortgages made in 2007. As the graph shows, people are defaulting on them at an even higher rate than the ’06 ones. How could this be? By 2007 the bubble was popping and lenders could all see that they needed to stop giving making loans to underqualified borrowers, right? That was exactly the problem: “Mortgage originators who profited handsomely from the housing boom “realized the game was completely over” and pushed mortgages out the door,” reports WSJ.

Etrade: Hire That Baby To Do Customer Service, He'd Do A Better Job

“Maybe I should call the E*Trade Baby. He might give me better customer service.” Matt’s mother died last year and he has been trying since last year to liquidate her E*Trade CD and put it in the family trust. Every other financial institution has been able to liquidate the assets with no problem, but it seems after blowing their wad on funny Superbowl ads, E*Trade has nothing left over for customer service. Here’s Matt’s story, and our advice on how can get his problem fixed:

Personal Finance Roundup

The Promotion That Got Away: 5 Ways to Bounce Back [Yahoo HotJobs] “Nearly everyone has been passed over for a job they ‘deserved.’ If and when that happens there are five important steps to take.”

Save On Weddings By Finding Out Who Your Real Friends Are

Though the average cost of a wedding is up for debate — “experts” report different numbers, though most agree it’s between $25,000 to $30,000 — the fact is that an average wedding in America can be pretty darned expensive. And while you can take steps to save a bit here and there, there is one area that you’ll need to focus on if you want to save big bucks: the reception.

Don't Let Your Credit Card Rate Get Spiked

Credit card companies are raising interest rates and canceling cards left and right. Bankrate has seven ways to avoid getting caught up in the “risk repricing” spree. It all comes down to keeping everything looking normal.