Anyone had enough bad news lately about the economy? Layoffs, the stock market diving, bailouts, government debt, the housing crisis — all of it can add up to some pretty somber feelings. And the fact that it’s been going on for awhile now can drag anyone down. We’re not going totally Pollyanna on you, but we do share the sentiments of the Wall Street Journal that maybe we should stop complaining and be a bit thankful. Turns out that doing so could put you in the middle of a growing trend:

personal finance

Citibank Reinstates Credit Limits If You Ask

Like many credit cards, Citibank is cutting people’s credit limits left and right but apparently if you call up and ask to get your credit limit back to where it was, they’ll do it for you. Classic tactic: Conduct adverse action, easily fix it for the small amount of people who complain, profit from the difference. As ever, squeaky wheel gets the grease.

Certificates Of Deposit Aren't Risk-Free

With the stock market gyrating wilder than a dashboard hula doll, you probably want an investment that won’t depress you when you open the paper. Certificates of Deposit or “CDs,” an insured savings account with a guaranteed interest rate may sound like the antidote, but even they are not without risk.

Your Piggy Bank Is Happy: Savings Rate At 14-Year High

Americans took their cost of living raises and stuck them in their piggy banks, says the Commerce Department, pushing the savings rate to a 14-year high. Not long ago we had a savings rate of 0.1% — now it has skyrocketed to 5%.

../../../..//2009/02/27/great-idea-from-reader-cumaeansybil/

Great idea from reader CumaeanSybil: “One thing I’ve been doing lately: every time I buy something on sale, I take the difference from regular price and put it in savings. It keeps me motivated to seek out sale prices and coupons, because I like seeing that account grow.”

Personal Finance Roundup

Certified used car worth more money [Bankrate] “A factory-certified preowned plan can add as much as 5 percent to the selling price of a used vehicle. You have to decide how much money more peace of mind is worth to you.”

Split A Sitter, Save A Bundle

Here’s a good way to save a bundle on your bundle of joy – share a sitter with a neighbor. By dropping off her 15-month-old at a neighbor’s place 4 days a week, Real Simple reader Maureen Dempsey says she saves ~$400 a month. The article doesn’t specify it but I imagine babysitter watches both kids at the same time for a little bit more but not as much as hiring two separate sitters. Plus Maureen’s kid also gets to interact with another kid at the same time. Surviving the recession is all about working together and splitting up costs. [via Real Simple] (Photo: Ordinary Guy)

Internal AmEx Doc On $300 Bribe To Zero Account And Leave Program

Here’s an internal AmEx doc with what customer service reps should say when people call up asking about the $300 to pay off and close your account program, or, as they term it, the “Balance Down Initiative.” The sheet was obtained exclusively by creditcarforum.com. My favorite part is the answer for if people who weren’t chosen to participate ask if they can join. The correct response is, “We apologize, but we can only honor this offer for selected cardmembers. However, if you’re interested in paying down your balance, I can help you with that.” Full doc inside…

AmEx Pays Some $300 To Zero Their Balance And Leave

American Express is so desperate to clean liabilities off its balance sheet that it’s paying some customer $300 if they will pay off their balance in full and close their credit card. The offer is only good if you get a card in the mail from them about it with a 14-digit RSVP code. Thanks for playing, don’t let the door hit your ass on the way out.

CNN Explains: "Living Within Your Means"

In case anyone forgot how the global economy came to teeter on the brink of collapse, CNN recently needed to help a reader figure out the difference between “living within your means” and “living below your means.” Let’s see if we can’t constructively add to the conversation…

Save Money by Spending Money

With the economy in the dumper, saving money is back in style. Simply comparing the number of “how to save money on (fill in the blank)” articles this year versus a couple years ago, our informal research shows the relationship at 234,000 to 1. Ok, so we made that up. But it does seem like savings tips are all the rage these days. Unfortunately, the key is finding new money saving ideas…

Hot Cartoon Makes Understanding Credit Crisis Simple And Fun

This a freakin’ awesome cartoon that explains how the credit crisis began, played out, and exploded in our face. I know you’ve seen and heard a million of these by now, but this one is highly visually engaging and entertaining, enough so I could see it being used in the classroom and kids not getting (too) bored. Graphic designer Jonathan Jarvis. Especially good is how it explains leverage.

Exploding The Myth Of The Bad Credit Card Customer

Too often, when we post about undeserved credit card rate hikes, a few readers will justify the credit card company’s actions by pointing out that the OP is, in pure business terms, a bad customer. If you’re a consumer, this is the worst way to visualize your business relationship with your credit card company. Here’s why.

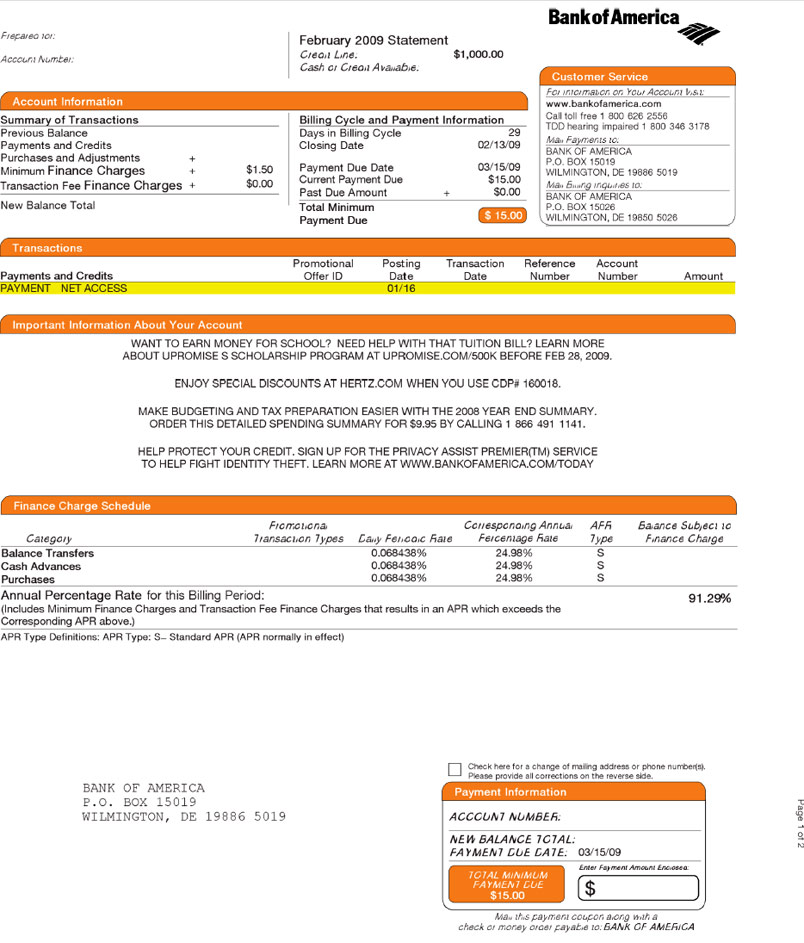

Your APR Is Now 91.29% – Yours Truly, Bank Of America

David’s effective APR on his Bank of America credit card is now 91.29%. It’s not a typo or a scam, it’s math.

Capital One Does Not Appreciate You Being Responsible, More Than Doubles Your APR

Beverly, who always pays on time and recently started paying off her balance in full every month, just saw the rate on her Capital One card more than double, from 13.9% to 29.4%. That’ll teach you to not help sink the economy, Beverly!