The Better Business Bureau and Senator Charles Schumer are warning the public to be skeptical of any calls promising to lower your credit card interest rate. While nowhere near at the public annoyance level of the recent car warranty robocaller scourge, they’re still out there, automatically dialing people and promising to lower your rate for a hefty up-front fee. The only problem is, they can’t do anything you can’t do on your own, and unless you’re crazy you’re probably not going to charge yourself a thousand bucks for the service.

personal finance

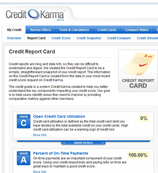

Take Your Score From 650 To 800 With The Credit Karma Report Card

Credit Karma recently launched the free Credit Report Card service that assigns letter grades to each component of your credit score. If you want to improve your credit score, try to bring up your performance in areas where you have low or failing grades. Not every component has the same bearing on your score, so underneath each section Credit Karma tells you how much weight it has. For those who look at their reports and scratch their head, the Credit Karma report card, which is drawn from your TransUnion report, makes understanding why your credit score is the way it is a snap. Full screen shot inside.

Furloughs: Welcome Or Lousy?

Rather than layoffs, a number of employers are turning to furloughs – forced unpaid time off – to meet their budgets. According to a NYT article, employees are handling them in different ways. Some use it as chill time. Others keep working anyway without pay, either out of guilt, routine, or fear of an actual layoff. Has your company been hit with furloughs? How are you dealing? Take our poll inside.

Should I Reduce My 401k And Put The Money Toward Credit Card Debt?

Given the state of the economy today, is it better for me to reduce my 401k to a minimum and use the extra funds to pay off my credit card debt? This is a good time to put money into the markets, based on my admittedly limited understanding, but with interest rates going through the roof (my personal Chase card went from 12.99 to 23.99), I would like to kick down my cc debt (now at around $6,000) faster. I’m currently only putting 6% in my 401k, and I’m fairly young (35). Have you advice for me?

How The Recession Destroys Friends

Like a tornado, the recession hits unevenly. One house might get turned into splinters, while another is left untouched. Similarily, one friend can still be afford salads and Starbucks for lunch every day while the other has to brown-bag it. The Double-X blog asks its readers, “how do friends in newly different socioeconomic strata adjust?” Answer: most of the time, they don’t.

Is It Worth It?

Kiplinger has a fun, albeit relatively easy, quiz that asks if various financial transactions are worth the cost — if you should you pay a little extra upfront in hopes of saving money — or hassle — in the future. In it they offer the following situations:

WaMu Saddles Credit Card Theft Victim With Thousands In Fraudulent Charges

Someone stole reader A’s WaMu credit card number and racked up thousands in fraudulent charges, and now WaMu wants A to pay for it. The fraudsters also made a PIN request for a cash advance over the phone, and WaMu said that phonecall orginated from A’s parents house. Because of this, which A says is impossible, WaMu demands A be responsible for the charges. He’s written letters and called executive customer service and it’s gotten him nowhere. His crappy story, inside…

../../../..//2009/06/10/bond-traders-say-stock-traders/

Bond traders say stock traders are wrong, the Fed will not increase interest rates this year. [Bloomberg]

Dirty Credit Report Scuttles Job Prospects

Dan Denton was about to get a much-needed job. Then the recruiters saw his blemished credit report and took away their offer.

The Maid Is Stealing Your Checkbook

Identity theft is rising in the recession, according to a Brooklyn public defender I talked to at a party this weekend. Most often the crime starts with the perp stealing the victim’s checkbook, he said.

BP Points Out Their Gas Same Price Whether Cash Or Credit

Spotted this sign on a Brooklyn BP gas pump last night, taking pains to point out that they are charging customers the same price whether they use cash or credit. Interesting, because last year around this time we ran a few stories about gas stations who doing the opposite. The thing is, credit card companies charge merchants various transaction fees to process the cards. If retailers can’t assess those fees to the customers who actually incur them, the business has to raise prices on everything for everyone.

The Good, The Bad And The Ugly Of Fixing Credit Report Errors

A great way to improve your credit score is to get rid of errors on your credit report that are dragging you down, but how do you start?

Interest Rates Will Rise Within The Year, Markets Bet

As growing global economic optimism begins to build, the market is betting that the Fed will raise interest rates by the end of this year. This will mean mortgages will get more costly and credit card APRs will rise, but the interest you make off your savings account will go up. [Bloomberg] (Photo: Ben Popken)

Hopelessness Hit 9.4% In May

Hopelessness hit 9.4% in May. Oh wait, we meant joblessness. Actually, with jobless claims about half the average loss of the past six months, could hope poised for a comeback? [NYT] (Photo: joshuahoffmanphoto)

2.5% Online Savings Accounts At Ally Bank (The Rebirth Of Gmac)

Even though GMAC spun off from GM years ago, they recently changed their name to “Ally” in a re-branding, stain-of-association-removing effort. Their whole game seems to be a USAA for civilians, advertising “No minimum deposits. No fees. No min balance. No sneaky discalimers.” Ally Bank is also offering very juicy APYs, like 2.25% for an online savings account, more than double the national average…