Hank at Own the Dollar lists 50 financial moves to make in your 50s. [More]

personal finance

Sued By Chase For $7k, In Debt For $40k+, I Think I'll Declare Bankruptcy

Justin’s friend who was being sued by Chase Bank for $7,500 has an update for us after he and his friend read our advice and your comments on his situation. Turns out he’s not just in debt for $7,500, but for over $40,000: [More]

Know The Differences Between House And Senate CFPA Bills

Quick, what’s the differences between the House and the Senate bills for creating the Consumer Financial Protection Agency? 4,3,2,1, okay, you can stop sweating, NYT has got you covered. Left column shows House, right column shows Senate. Choose the key areas to focus in on, like consumer protection, risk and executive pay on the left. Then dazzle your friends at the bar tonight!

Bank Of America Has The Crappiest Credit Card Customers

Bank of America is tops when it comes to having the most deadbeat customers. They are leading the pack in delinquent customers and charged off accounts. That ravenous acquisition strategy’s not looking so hot now, eh? You can gorge, but eventually you have to pay the check. Here’s how the major credit card companies stacked up Jan-Feb. [More]

Reader Pays Off $14,330 In 20 Months

Stuck in a $14,300 debt hole, reader Trixare4kids was dug herself out using tips she learned about on Consumerist. Let’s learn how she went on a personal finance rampage, learned to live frugally, did it all in 20 months, and how you can do it too! [More]

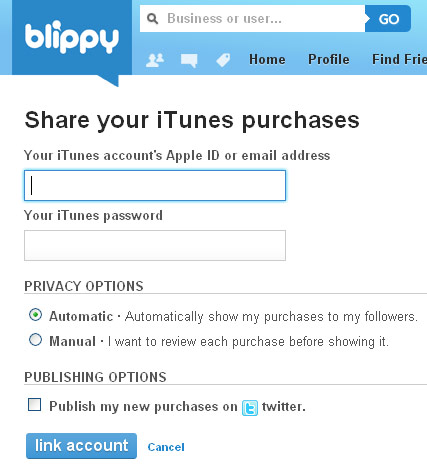

Young, Dumb, Full Of Risk For ID Theft

A new study finds that the young and the feckless are the most at risk for identity theft. 18-24 year olds are more likely to be victimized because they don’t check their accounts frequently or thoroughly enough. You can beat the statistics, though, if 1 in 20 times you’re tempted to check your friend’s Facebook updates you instead scrutinize your account statements. [WashingtonPost] (Thanks to Timothy!) [More]

Personal Finance Roundup

Nailing the Interview [Wall Street Journal] “Here are some tips on how to nail a job interview — whether it’s in person, via the Web or even on the phone.”

Secret tips for buying a new car [CNN Money] “A new service called TrueCar…informs the customer where the best deals are.”

How to win the March Madness pool [Smart Spending] “The experts offer some suggestions for increasing your chances of winning the pot.”

IRS offers help paying taxes [Washington Post] “The agency will hold 1,000 open houses on Saturdays where taxpayers can work out payment problems with IRS officials.”

US sales tax rates hit record high [MSN Money] “In jurisdictions large and small, sales taxes have continued a steady climb. States and cities see them as a way to make up for budget shortfalls.”

Credit Unions Ask Customers To Leave

Credit unions might be attractive alternatives to big commercial banks, but they’re not crisis-proof. OregonLive says about a fifth of the nation’s credit unions are having financial troubles right now. To get in better financial health, they’re introducing fees for services that have long been free, and even asking members to move their deposits to other institutions. [More]

TD Bank Will Pay Off Your Mortgage

Free house! TD Bank is running a new contest: apply for a new mortgage, get a chance to have them pay it off in full for you. [More]

Faux-Hawked Wells Fargo Manager Allegedly Embezzled $900,000+ From Elderly

An ex-Wells Fargo bank manager is accused of embezzling more than $900,000 from customers, most of whom were frail and elderly. [More]

Reach Chase Executive Offices For Mortgage Modifications

Here is a fun-pack of executive escalation contact info you can use if you’re trying to get Chase to modify your mortgage. With the bureaucracy and indifference staring you down, you’ll need every vector you can get your hands on. [More]

Stay On Top Of New And Overlooked Deductions

Are you up-to-date with all the tax code changes this year? The TurboTax blog rounds up some of the newest tax credits and highlights deductions that people sometimes sleep on, like the long-term resident credit and unemployment and job search deductions. More coin in your coinpurse means you can buy all the churros you want this year! Update: Looks like we broke their blog. Here’s a cached copy of the post in question. [More]

Use This Calculator To Set Your Paycheck Withholdings

Tax refunds are fool’s gold, because they’re interest free loans you’ve been floating to the government all year long. The ideal move is to have just the right amount deducted from your paycheck each week so you’ll pay a small amount come tax time. [More]

Making The Most Of Medical Expense Tax Deductions

Kiplinger has advice on on how to maximize your medical expense deductions at tax time. You can only deduct out-of-pocket expenses that exceed 7.5% of your adjusted gross income, so you should try to bundle medical procedures in the same year if possible. [More]

Personal Finance Roundup

Making the Most of Your Most Valuable Financial Asset [Free Money Finance] “Consider this post a reminder that what we do with our careers can make a tremendous amount of difference to our net worths.”

Hard Times Turn Coupon Clipping Into the Newest Extreme Sport [Wall Street Journal] “Penny pinchers deal for discounts.”

Ten Tips for Maximizing Your Savings at a Warehouse Club [The Simple Dollar] “You really can do much better on some items by utilizing a warehouse store, but you’ve got to follow a good plan. Here’s how.”

Is your retirement fund leaking? [MSN Money] “Frequent trading by fund managers can inflate costs that aren’t reflected in the numbers most investors watch. That’s money from your retirement kitty.”

5 Smart Uses for Your Tax Refund [Kiplinger] “Use the influx of cash to improve your financial situation.”