Jeff Yeager, Wise Bread blogger and author, has just published a new book titled The Cheapskate Next Door, where he interviews over 300 self-described cheapskates to find out what makes them tick. In an interview over at Daily Finance, he says that for most of his subjects, the choice to live frugal lifestyles wasn’t primarily about money. [More]

personal finance

Personal Finance Roundup

A Frugal Fact: The 6 Most Valuable Grocery Store Products Known to Man [Len Penzo] “Here is my official list of the six most valuable grocery store products – along with a partial list of their many uses.”

How to Save Money While Traveling [Get Rich Slowly] “Here are some easy ways to save while traveling.”

Shopper’s guide to used-car bargains [MSN Money] “Good deals are harder to find now, but the right strategies can help you get the most for your money.”

Secrets of extreme savers [CNN Money] “You can put away a lot more than the average American without living a deprived life.”

To retire comfortably, under-40 workers need to seriously bulk up savings [Washington Post] “I am going to try to scare some sense into you with three words about life in retirement: The paychecks stop.”

Wedsafe.Com Insures You Against Wedding Disasters

Putting on a wedding is a lot like putting on a show. A very expensive stressful show that’s for one night only. [More]

Personal Finance Roundup

5 things to know about energy rebates [CNN Money] “In many locales the money is already gone.”

4 Strategies to Make ETFs Work for You [Kiplinger] “We show you how to use exchange-traded funds to boost your returns and hedge your bets.”

7 stupid retirement myths exposed [MSN Money] “Subscribing to unfounded beliefs can make your retirement harder — if not impossible — to reach.”

What Exactly Are 12b-1 Fees, Anyway? [Wall Street Journal] “Here’s where your dollars are going.”

Organic Groceries on a Budget [Wise Bread] “Here are some strategies for affording organic groceries.”

Wiring Money Is A Ripoff Red Flag

One good way to get ripped off in a transaction is to agree to wire the other person money. Whether it’s through your bank, money order, or Western Union, wiring money has zero protections against loss. Which is why con artists love it dearly. [More]

Debt Collectors Discover New Levels Of Relentlessness

It makes sense that as the economy has soured that the rapacity of debt collectors would rise, but this much? [More]

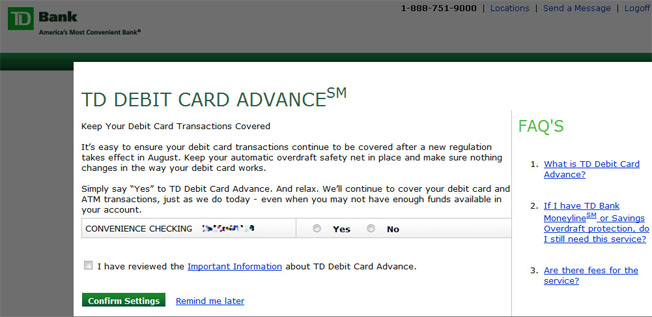

TD Ratchets Up Overdraft Opt-In Push With Pop-Up Scare Tactics

TD Bank is really stepping up its efforts to try to get customers to sign back up for “overdraft protection,” which really just protects their right to charge you $35 if you want to buy a $2.00 candy bar and only have a $1 in your account. Now they’re greeting customers accessing their accounts online with pop-up ads trying to scare them into agreeing to signing up for the service. [More]

Is "Consideration" The Magic Word For Getting A Refund?

Is using the word “consideration” in customer service interactions a magic incantation that opens up doors to a world of refunds, rebates, and discounts? [More]

Letting Mortgage Go Delinquent To Qualify For Short Sale Damages Credit

In order to qualify for a “short sale,” in which the lender agrees for the house to be sold for less than the remaining amount owed and takes a loss, the lender sometimes requires the homeowner to be several months delinquent on their mortgage payments. But while getting out of a house you can’t afford can be a good idea, bear in mind that the delinquency will stain your credit report. [More]

30-Year Mortgage Rates Drop To Record Low 4.57%

Rates on 30-year mortgages fell to 4.57% this week amid falling new home sales and increasing joblessness. It’s the third straight week that mortgage rates have dropped, and they’re the lowest since Freddie Mac started keeping track in the 70’s. [More]

Last $10 On Visa Gift Card Proves Seemingly Inextractable

Kate has a $50 Visa gift card. She used $40 on it and then tried to buy some DVDs for $7, but the card was rejected. What gives? [More]

Personal Finance Roundup

10 thrifty ingredients to improve your meals [Smart Spending] “Affordable, healthy meals need not be boring and bland.”

21 Web Sites for Finding Deals Online [Kiplinger] “We’ve tested and picked 21 Web sites we think are easy to use and will help you save money all year.”

4 More Ways to Save on Maternity Clothes [Wise Bread] “Here are four clever tips you may not have known about!”

I Love You, You’re Perfect, Now Sign Here [Wall Street Journal] “Move over, heirs and heiresses: Baby boomers are flocking to sign prenuptial agreements, too.”

Nine Tactics That Work for Starting Food Preparation at Home [The Simple Dollar] “Making food at home isn’t the hard chore that many people make it out to be.”

Study: American Express Has Most Obtuse Penalty APR Polices

If you’re gonna get kicked in the pants, wouldn’t you at least like to know why? Well, American Express is the least clear in how they communicate their penalty interest rate policies, a new Card Hub survey finds. [More]

Hackers Love Stealing Your Credit Card From Hotels

Make sure you check your credit card for suspicious charges after you use it at a hotel. A new study finds that 38% of credit card hacking cases involved hotels, way ahead of any other industry. [More]

TD Bank Pushes Totally Flat Debit Cards

Run your fingers over one of TD Bank’s new debit cards and you’ll notice something missing. There’s no embossed numbers. It’s not a fake, it’s the future: a completely flat debit card that can be issued right on the spot when you open an account at a local bank, with no waiting for it to arrive in the mail. [More]

27 Of The Sickest Things You've Done To Save Money

We asked Consumerist readers to share the sickest, grossest, and sketchiest things they’ve ever done to save money. Over 250 comments poured in and most of them had to do with things that people have reduced themselves to eating at one point in the past.

This was one of the most entertaining comments threads I’ve read here in a while and it was hard but I have whittled them down to the 27 sickest: [More]

Filibuster Scuttles Jobless Benefits Restoration For Third Time

Happy Fourth of July weekend! To help you celebrate Independence Day, which includes independence from the government dole, a Senate filibuster has successfully prevented unemployment benefits from being extended for 1.3 million out of work citizens. [More]

HOA Board Member Says They're Not All Money Grubbing Scumbags

Yesterday we wrote about how in Texas, there’s been a bit of a spree of homeowner’s associations (HOAs) foreclosing on people’s houses over just a few hundred in late dues, then selling the house to themselves and turning it around for a juicy profit. And now, the other side of the story. Robert is an HOA board member in Texas and while his association does sometimes foreclose in order to collect, there’s more to the situation than meets the eye. Here’s his take: [More]