No matter your spiritual disposition, those guys who wrote the Bible knew a thing or two about holding on to your shekels.

personal finance

Personal Finance Roundup

A Look At The Consumer Action Handbook [The Simple Dollar] “I thought I’d give this free document a walk-through similar to one of my book reviews.”

../../../..//2007/07/13/20-must-know-credit-scoring-terms/

20 must-know credit scoring terms so you will know how to understand your credit report [Bankrate] (don’t forget you can get your free credit report at annualcreditreport.com)

12 Signs Of A Debt Addict

Do you have a problem with compulsive spending? Debtor’s Anonymous, yes, there is such a group, has 12 warning signs to watch out for.

../../../..//2007/07/10/the-7-myths-of-college/

The 7 myths of college financial aid (p.s. WSJ is free online today) [WSJ via AllFinancialMatters] (Photo: elle_rigby)

Shape Your Portfolio Balance For Investment Success

Want to know the one tip that will make you a successful investor? No, this isn’t a sales pitch for some get-rich-quick stock trading program. It’s a bit of good investing advice from Business Week on the factor that most separates excellent investors from average Joes.

../../../..//2007/07/06/this-is-pretty-much-the/

This is pretty much the quintessence of how many people get stuck in debt (it was certainly true for us): “…we were spending more than we made because we thought we would make more money later to pay it off.”

../../../..//2007/07/06/how-much-should-i-put/

How much should I put in my 401(k) vs my RothI RA vs straight-up savings?

../../../..//2007/07/06/you-can-apply-the-principles/

You can apply the principles of the Getting Things Done book to all aspects of your Consumerist lifestyle, from following through on a resolution to draft a budget, to remembering to call customer service, to funding your IRA.

What Are "12b-1 Fees?"

Another factor to consider when choosing a mutual fund are its 12b-1 fees, which are basically money the fund managers take out to pay for running and marketing the fund.

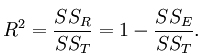

What Is R-Squared?

We’re trying to learn more about mutual funds, which we find quite frightening, so let’s start by breaking down some terms, like R-squared, a measure of volatility. Here’s what Vanguard says:

../../../..//2007/07/06/networthiq-is-a-kinda-neat/

NetworthIQ is a kinda neat online service where you enter all your assets and debits by category and it gives you an aggregate personal finance “IQ” number to track over time. [via Poorer Than You]

Personal Finance Roundup

The Cheapest Days to Buy Certain Items [Smart Money] “We talked to the experts, and narrowed down the best days of the week to buy certain items.”

../../../..//2007/07/05/inflation-eats-up-most-of/

Inflation eats up most of the appeal of zero-coupon bonds.

Earn A Lot More Interest By Opening A High-Yield Online Savings Account

Your savings can earn upwards of 4 more percentage points of interest, if you put it one of these high-yield online savings accounts. Here’s seven to check out.

../../../..//2007/07/04/the-richest-man-in-babylon/

The Richest Man In Babylon is an excellent personal finance primer told through a series of easy-to-understand parables.

Pending Home Resales Drop To Lowest Level Since September 2001

Pending sales of existing homes dropped for the third straight month as troubles in the mortgage industry continue to disrupt the housing market. Figures released today show a 3.5% drop in May, following April’s drop of 3.2% and March’s drop of 4.5%.

Which Credit Card Best For A Beginner, Best For An Intermediate Seriously Thinking About His Options?

“I had this thought a few days ago, I have 2 credit cards (that I keep paid off, woo!) and my woman who just graduated college is thinking about getting one. Now the question I had was, I got my cards without too much thought involved as to what would be the best option for me, they are OK cards, maybe the best, but i don’t know this. When I read your “10 commandments of credit“, I realized that consumerist would be the perfect place to ask the question: what credit card is best for a first time CC? Are there other cards that are more fitting for someone with more established credit history? What is the consumerist card of choice?!”