../../../..//2007/07/29/interested-in-personal-finance-but/

Interested in personal finance, but don’t know where to start? MyMint has 70 tips spanning credit, investing, finance in relationship, housing, retirement, and more.

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2007/07/29/interested-in-personal-finance-but/

Interested in personal finance, but don’t know where to start? MyMint has 70 tips spanning credit, investing, finance in relationship, housing, retirement, and more.

../../../..//2007/07/27/debt-isnt-just-for-the/

Debt isn’t just for the poor: This guy’s household makes $163,200, but they’re over $536,000 in debt. [Saving Advice via Mighty Bargain Hunter via Blogging Away Debt]

../../../..//2007/07/26/all-encompassing-directory-of-retirement-planning/

All-encompassing directory of retirement planning tools and calculators. [All Financial Matters]

../../../..//2007/07/25/spending-diary-is-a-free/

Spending Diary is a free and simple online way to track your expenses. [Spending Diary]

../../../..//2007/07/25/wesabe-the-personal-finance-social-networking/

Wesabe, the personal-finance social networking site, introduced a Firefox extension to ease member’s upload and access to banking data. [Wheaties For Your Wallet]

People just starting to get out of debt often struggle to decide where to allocate their money. Each person needs to make their own list based on their own priorities and circumstances, but Debtor’s Anonymous member Wittygal’s payment priority list may serve as a decision guide:

This chart, via OnMyOwnTwoFeet, shows the incredible costs if you incur $5,000 in credit card debt and only make the monthly minimum payments. By the time the debt is paid off, you’ll have effectively paid double the original debt.

Try putting money in front of any noun. All of a sudden, it sounds much better. Try it. Money couch! Money shoes! Money cat!

../../../..//2007/07/24/list-of-debtors-anonymous-meetings/

List of Debtor’s Anonymous meetings by state. [Debtor’s Anonymous]

A CreditCards.com survey found that 90% of respondents thought their household had “average” or “less than average” amount of debt.

../../../..//2007/07/20/warren-buffet-likes-index-funds/

Warren Buffet likes index funds. [Bankrate]

Money has a new column written by an anonymous financial planner (and you know how much we love that sort of sh*t), who says that if your financial planner is honest, he or she will tell you how you’re making them money.

If you’ve received a notice from a debt collector, but have reason to believe you don’t actually owe that debt (or owe a lot less than they say you owe), federal law gives you a brief opportunity to force the collector to demonstrate that you do indeed owe this debt, and to stop trying to collect on it until they have verified you are the one responsible, and that the money is still owed. [More]

Here’s an idea for people trying to get a lock on their spending but find writing down everything too fascist. What about taking a picture of everything you buy with your cameraphone and uploading it to Flickr?

The 401(k) is one of the best ways to maximize your retirement savings. After all, if the company matches your contribution, you start off with a 50% to 100% gain right off the bat. That said, many employees are not making the most of the potential locked in their 401(k)s. Here are some of the most common mistakes, according to Vanguard:

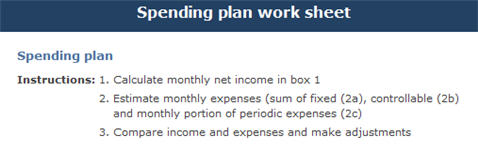

If you’re not one to budget, you probably spend whatever you think you can afford. This might be more (or less!) than it really should be.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.