If you receive a medical bill dunning you for whatever your insurer didn’t pay, take a closer look before writing your check. The New York Times writes that although balance billing is a common practice, it’s not always legal, and you may be able to ignore it. [More]

payments

Citicorp Deferred Interest Trap Springs Shut On Man Who Underpaid By $11

I suspect some readers will say that Assefa Senbet is to blame for screwing up one of his final payments to Citibank on a deferred interest loan agreement. They’ll be right–it was his responsibility. But he didn’t skip a payment, and he wasn’t late. In fact, he frequently overpaid in order to pay it off early. Near the end of the loan, however, he sent in a check for $70 instead of $81. As a consequence, he’s now paying off $887 in deferred interest fees at a 30% interest rate. [More]

Wachovia Harrasses Me For Phantom Car Loan Payment

Richard bought a vehicle, returned it and bought another from the same dealership. He says Wachovia erroneously paid off the second loan instead of the first. Once he got the finance department to correct the mistake — a process that took a month — Wachovia started hassling him to make a payment for which he was never billed. [More]

Fewer Consumers Write Personal Checks, Fewer Retailers Accept Them

Reader broncobiker sent us the photo at left, wondering whether check acceptance policies might be getting a little out of hand. But checks have so much potential for fraud, and so few shoppers use them, that many merchants have just stopped accepting them entirely.

Wachovia's "Way2Save" Account Triggers Over $5,000 In Penalty Fees

Wachovia has a new financial product called Way2Save that automatically moves $1 from your checking account into a high interest personal savings account every time you make an electronic bill payment. Susan tried to maximize her contributions by making a lot of little bill payments, but Wachovia cut off access to her funds without notice and triggered an avalanche of penalty fees. Now she owes over $5,000 to her credit card companies, far more than she would likely have ever earned through Wachovia’s complicated savings program, and of course Wachovia is denying any responsibility.

Judge Tells ASCAP No Royalties For Ringtones

One of the weirder strategies by the American Society of Composers, Authors and Publishers (ASCAP) recently has been to claim that every time a ringtone played, a royalty should be paid. ASCAP sued AT&T earlier this year over the claim, but a federal judge has ruled that your phone ringing does not constitute a public performance.

Consumers Pay Down Credit Card Debt For 11th Straight Month

The Federal Reserve has released data on consumer debt for August, and for the 11th month in a row we’ve paid down credit card debt and increased savings. Take that, rate-hiking credit card companies!

Pay Restaurant Tabs From The Comfort Of Your Table

If you dislike handing your credit or debit card over to restaurant employees and letting them wander off with it for a while, you’re not alone, and that’s why some restaurants are experimenting with mobile pay-at-the-table technology.

Credit Card Companies Are Warming Up To Reduced Payoff Deals

If you’ve fallen into a debt pit and can’t make your credit card payments, and now you’re watching them steadily mount with penalties, fees, and steep interest rates, consider negotiating a lower payment. The New York Times reports that while most card companies won’t admit it officially, they know when they’ve got a customer who can’t pay, and they’re much more willing to settle for a lower amount than they were a year ago.

HSBC Credit Card's Pay-By-Phone Fee Is Higher Than The Bill

Why does HSBC charge $15 to make a payment over the phone? Other, often smaller, companies charge $3 or less, as MG notes in his email below. In this case, since the alternative is so unwelcome—a possible late payment, and a corresponding hit on MG’s credit score—it seems pretty outrageous to hold him hostage to a $15 fee.

Capital One Charges Woman $29 Late Fee For Paying Too Early

Jason writes, “My wife just sent me an email saying that she paid ‘too early’ (before the new statement was generated) and got charged a ‘Late Fee’ of $29!” He says she called Capital One and got the fee waived, but it’s a good reminder that if you make a payment before the new statement period begins, your card provider will likely apply the payment to the previous statement period, and will still expect a fresh payment from you by the new due date. Just make sure your payments aren’t scheduled so early that they’re applied to the past and you’ll be fine.

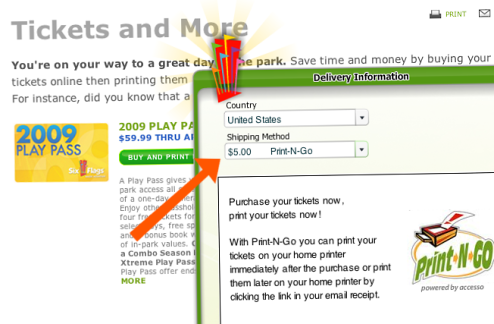

At Six Flags, You Have To Pay A Fee To Print Your Own Tickets

We know Six Flags is desperately trying to avoid bankruptcy, but that’s no reason to go all Ticketmaster on the people who want to have a good time at Magic Mountain in Los Angeles.

Chrysler Financial Accused Of Turning Down Government Loan To Avoid Executive Bonus Restrictions

The Washington Post has just published a story accusing executives at Chrysler Financial of turning down a $750 million government loan because they “didn’t want to abide by new federal limits on pay,” and instead opted for more expensive private sector financing, “adding to the burdens of the already fragile automaker and its financing company.” Chrysler Financial denies the charge.

Virgin Mobile Offers To Pay Your Phone Bill For 3 Months If You Get Laid Off

Starting tomorrow, Virgin Mobile will offer all customers who sign up for $30 or more post-paid plans coverage under their free Pink Slip program, which means if you get laid off and can provide proof, they’ll pay your cellphone bill for three months, and you won’t have to put a Skype number on your resume.

Tennessee Pushes Back Against Late Fees By Credit Card Companies

Although it has yet to pass into law, the Tennessee Senate Commerce Committee has approved a bill that requires creditors to count the postmark date of a payment as the payment date, not the day they say they receive it.