ATTENTION: Bank of America is currently in the process of purchasing Countrywide, but the transaction is not yet complete. For the purposes of this contest we ask that you evaluate their track record with consumers separately. Thank you.

mortgages

Illinois And California Are Suing Countrywide For Deceptive Lending And Fraud

The Attorneys General of Illinois and California announced today that they are suing Countrywide Financial for its role in the subprime mortgage meltdown.

../../../..//2008/06/19/over-400-people-have-been/

Over 400 people have been charged in the government’s national mortgage fraud probe, called “Operation Malicious Mortage,” which dealt with individual rather than corporate fraud. [Reuters]

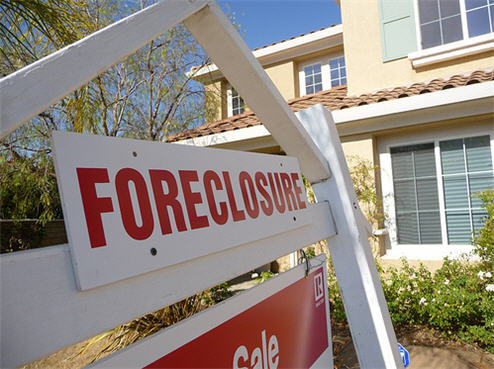

"We Used To Sell Homes In A Day, Now 50% Of Our Sales Are Foreclosures"

Bank repossessions (that’s when not even the bank can sell your house) are up 48% from a year ago, as falling house prices trapped borrowers in mortgages they couldn’t afford, says Bloomberg.

Countrywide CEO Gave Below Market Rate Loans To Senators From A Special "VIP Desk"

Does Angelo Mozilo spend all of his time thinking of ways to be shady? Now ABC News says that Countrywide had a special “VIP desk” that gave out below market rate loans to Senators and other politically connected people.

Bank of America Receives The OK To Buy Countrywide

It is done! The Federal Reserve has given the OK for Bank of America to buy subprime poster child Countrywide Financial Corp.. Bank of America CEO, Ken Lewis, says that even though the mortgage market has deteriorated significantly since the bank offered to buy the mortgage lender, buying Countrywide is still a good deal because the housing market is going to improve “by early next year.”

More Than 1 Million Homes Are Now In Foreclosure

Grim numbers today from the Mortgage Bankers Association. 2.5% of all mortgages serviced by the association’s members are now in foreclosure — 1.1 million homes. The rest of the numbers aren’t any more cheerful. Both the rate of new foreclosures and late payments were the highest on record going back to 1979, says the AP.

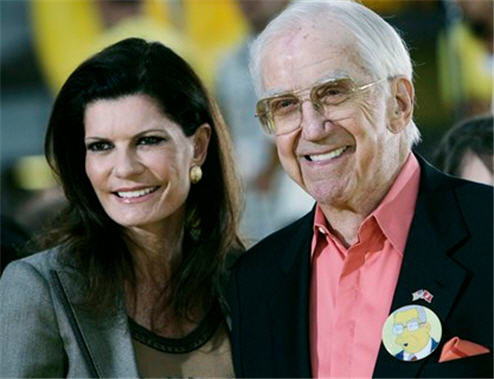

Countrywide Is About To Foreclose On Ed McMahon

Ed McMahon, former sweepstakes pitchman and Johnny Carson sidekick, has defaulted on his multimillion-dollar Beverly Hills home, says the AP. Mr. McMahon’s house has been on the market for two years, but is located so close to Britney Spears’ house that he’s having trouble selling it.

Credit Crunch CEO Bloodletting Claimes Latest Victim: Wachovia's Ken Thompson

Just when you thought it was safe to go back in the water… Wachovia CEO Ken Thompson has been gobbled up in a subprime shark attack after 32 years with the company.

Subprime Meltdown Driven By Nouveau Riche Countries With Too Much Money And Nowhere To Put It

The fuel and engine for the sub-prime mortgage meltdown and the credit crunch was Allen Greenspan and the doubling of the global monetary supply, according to the This American Life episode “The Giant Pool of Money” I just got around to listening to. Basically, a bunch of poor countries got rich all of a sudden selling TVs and the like, and in 6 years, doubled the worldwide supply of money. The giant pool of money was hungry for places to invest itself.

Woman Loses Home Over $68 Dental Bill

Maybe there are no more debtors’ prisons, but that doesn’t mean your life can’t be screwed up by unscrupulous collection agencies.

Countrywide CEO Accidentally Emails Homeowner, Calls His Plea For Help "Disgusting"

Apparently Angelo Mozilo, the CEO of Countrywide, has never made a mistake and needed help (from, say, Bank of America,) because he thinks that homeowners who are desperately trying to refinance out of their disastrous home loans and avoid foreclosure are “disgusting” if they look to the internet for help writing letters.

../../../..//2008/05/13/last-week-the-best-radio/

Last week the best radio show ever, This American Life, tackled the housing and credit crisis by talking to some of the real people involved with packaging junk no-proof loans into “sensible” investments. In the words of host Ira Glass and friends, it all comes back to “The Giant Pool Of Money.” [This American Life]

../../../..//2008/05/12/people-lose-their-houses-and/

People lose their houses and move all their stuff into self-storage, where the first month is often free. Then it turns out they can’t pay their self-storage bills any better than their mortgage. However, the number of defaults are down from a year ago, suggesting that the worst is over. [NYT]

../../../..//2008/05/12/mortgage-meltdown-isnt-just-for/

Mortgage meltdown isn’t just for people with bad credit, 2.3% of prime loans were 60 days past due in February, up from 1.4% a year ago and the highest in a decade. [USATODAY]

Countrywide Still Asking Consumers To Lie About Their Income

Countrywide would like you to believe that it put all that messy “predatory subprime lending” business behind it and is no longer coaching consumers to lie on their loan applications in order to qualify them for loans they can’t afford… but are they telling the truth about telling the truth? One woman who recently contacted Countrywide about refinancing her home told NPR that sketchy mortgage lending is alive and well at Countrywide.

Consumer Bankruptcies Up Nearly 50% From A Year Ago

The number of people filing for bankruptcy continues to increase, as bad mortgages and the rising price of [insert noun here] squeezes every last penny out of debt-laden consumers. The American Bankruptcy Institute says the number of filings was up 47.7% in April from a year ago, and up 7.1% from March ’08.