President Bush signed a massive mortgage relief bill that will help hundreds of thousands of homeowners refinance their unaffordable mortgages into fixed rate government backed loans rather than lose their homes to foreclosure. The bill also put tighter reigns on Freddie and Fannie, says the Associated Press.

mortgage meltdown

U.S. Foreclosures Double: 1 in Every 171 Households Affected

Hmm, wasn’t this housing bubble crap supposed to be slowing down? Guess not. The foreclosure numbers for last quarter are twice as bad as last year according to the new numbers from RealtyTrac (a firm that tracks foreclosure filings.) 1 in every 171 households nationwide was foreclosed on, received a default notice or was warned of a pending auction in the second quarter of 2008. Bloomberg says this is an increase of 14% from last quarter and an increase of 121% from this time last year.

../../../..//2008/07/24/bad-news-sales-of-existing/

Bad News: Sales of existing homes slide to a 10-year low, despite a drop in prices and a glut of available homes. [Reuters]

Will The New Homeowner Rescue Bill Help Rescue You?

A new bill that will help 1-2 million homeowners escape their unaffordable mortgages by refinancing into new low-cost fixed-rate loans insured by the Federal Housing Administration (FHA) has passed the House and will now move on to the Senate. If it is eventually passed by the Senate and signed by the President (who is no longer threatening to veto it), will it help you?

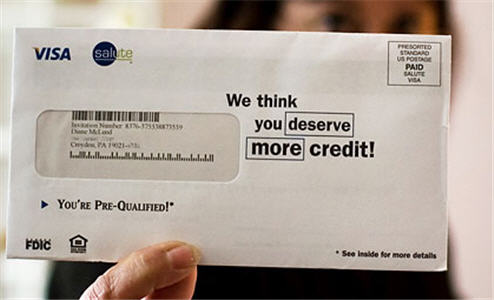

Debt Slavery: Why Are Americans So Willing To Dig Themselves Deep Into Debt?

The New York Times has an article that tells the unfortunate tale of Diane McLeod and her love affair with debt. She started out “debt free” when she got married, but after a divorce she’d managed to accrue $25,000 in credit card debt. Despite not having a down payment or any assets, Diane was given a $135,000 mortgage. Over the next few years, illness, underemployment, and shockingly irresponsible spending combined disastrously with the bank’s willingness to refinance her loan as her home appreciated (for a fee, of course). 5 years later, Diane owes $237,000 on her mortgage. She’s in foreclosure now, and a recent sheriff’s auction of the home did not draw a single bidder. A similar house down the street recently sold for $84,000 less than she owes on her home.

Wachovia: We Just Lost $8.9 Billion!

Wachovia just lost $8.9 billion dollars, and will cut 6,350 workers as the credit crisis keeps on truckin’, says the Associated Press. This is um, a lot more than Wall Street had been expecting. Earlier this month, Wachovia had projected a $2.6 billion loss.

What It Takes To Qualify For A Mortgage In A World With Standards

The party is over. If you want a mortgage you’re going to have to be able to afford it. Oh no! Now what are you going to do? Kiplinger’s has an article that explains how mortgage lending works when there are “standards” involved. How quickly we all forget…

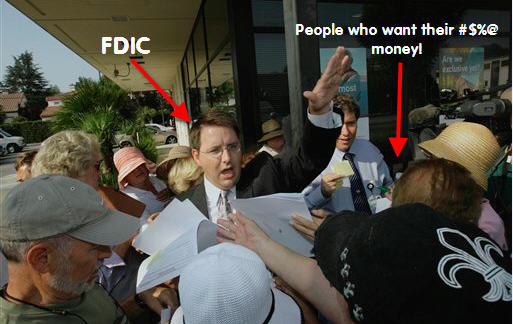

IndyMac Failure Demonstrates That The FDIC's Customer Service Skills Could Use Some Work

We’re always told not to worry about our bank failing because our deposits are insured up to $100,000 by the FDIC. Well, in case you were wondering what happens when a bank actually does fail, look no further than the great state of California, where IndyMac has been taken over by federal regulators and its customers are getting a taste of all the FDIC has to offer.

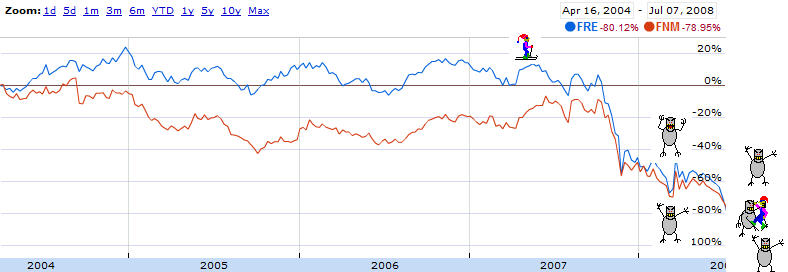

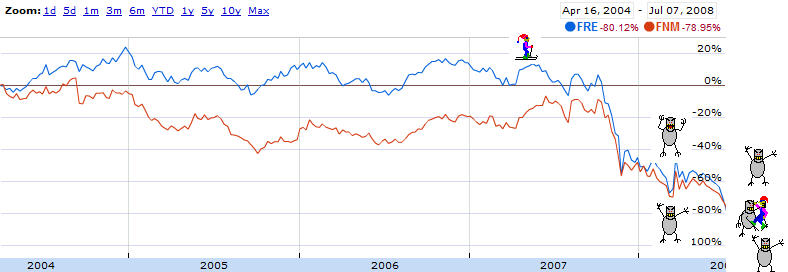

U.S. Treasury Attempts To Save Freddie, Fannie, Avert Apocalypse

This Sunday the Bush administration asked Congress to approve a “rescue package” that would give officials the ability to inject “billions of federal dollars” into Freddie Mac and Fannie Mae. The Federal Reserve also announced that it would make its short-term lending programs available to Freddie and Fannie, said the NYT.

Bush Administration Considering A Takeover Of Freddie And Fanny

Freddie and Fanny lost about half of their value overnight as investors became more certain that the government was going to have to bail out the two GSEs (Government Sponsored Enterprises.) The New York Times says that senior members of the Bush administration are considering a takeover of Freddie and Fannie that would leave their shares “worth little or nothing,” and where taxpayers would pay “any losses on mortgages they own or guarantee.”

Mortgages Of The Apocalypse: Are Freddie And Fannie Going To Collapse?

Freddie Mac and Fannie Mae, the “government sponsored” enterprises that are supposed to bail us out of the current mortgage crisis, may be in danger of collapsing, according to William Poole, the former president of the St. Louis Federal Reserve, who told Bloomberg the companies are already “insolvent.”

Illinois And California Are Suing Countrywide For Deceptive Lending And Fraud

The Attorneys General of Illinois and California announced today that they are suing Countrywide Financial for its role in the subprime mortgage meltdown.

"We Used To Sell Homes In A Day, Now 50% Of Our Sales Are Foreclosures"

Bank repossessions (that’s when not even the bank can sell your house) are up 48% from a year ago, as falling house prices trapped borrowers in mortgages they couldn’t afford, says Bloomberg.

Countrywide CEO Gave Below Market Rate Loans To Senators From A Special "VIP Desk"

Does Angelo Mozilo spend all of his time thinking of ways to be shady? Now ABC News says that Countrywide had a special “VIP desk” that gave out below market rate loans to Senators and other politically connected people.

../../../..//2008/06/06/more-bad-news-the-new/

More bad news! The New York Times says that about 1 in 11 American mortgages were past due or in foreclosure at the end of March. [NYT]

Bank of America Receives The OK To Buy Countrywide

It is done! The Federal Reserve has given the OK for Bank of America to buy subprime poster child Countrywide Financial Corp.. Bank of America CEO, Ken Lewis, says that even though the mortgage market has deteriorated significantly since the bank offered to buy the mortgage lender, buying Countrywide is still a good deal because the housing market is going to improve “by early next year.”

More Than 1 Million Homes Are Now In Foreclosure

Grim numbers today from the Mortgage Bankers Association. 2.5% of all mortgages serviced by the association’s members are now in foreclosure — 1.1 million homes. The rest of the numbers aren’t any more cheerful. Both the rate of new foreclosures and late payments were the highest on record going back to 1979, says the AP.

Credit Crunch CEO Bloodletting Claimes Latest Victim: Wachovia's Ken Thompson

Just when you thought it was safe to go back in the water… Wachovia CEO Ken Thompson has been gobbled up in a subprime shark attack after 32 years with the company.