Another chapter in Bob Sullivan’s excellent book Gotcha Capitalism explores how Wall Street quietly devours your retirement plan through an array of hidden fees. Bob quotes a Wall Street money manager as saying, “If we had to disclose fees, half the people in this room wouldn’t have jobs.” [More]

money

How To Recession-Proof Your Career

With the economy on the brink of recession, many folks are concerned about their jobs. Will the company downsize or have temporary layoffs? Will employees be asked to forego raises or (gasp!) take pay cuts? The Wall Street Journal addresses this issue head-on and lists eight tips for recession-proofing your career. They offer some good suggestions, but here are two we especially like:

2007 Federal Tax Law Changes

Every year, as way to make itself feel important and useful, the federal government makes modifications to the tax code. Here’s a detailed breakdown of all the changes for 2007 and how they affect your wallet, from AMT exemption amounts, to deductions for business-related mileage.

Exciting New Service Helps You Walk Away From Your Mortgage!

You will immediately know the exact amount of days you have to live in your house payment free. We stay on top of your walk away plan and keep you up to date with weekly progress emails. We also will notify you if the lender is taking longer than expected subsequently giving you more time in your home payment free.

It’s like a spoof, except real!

../../../..//2008/01/30/how-to-use-the-drop/

How to use the drop in interest rates to refinance your home mortgage and get a better deal. [Kiplinger]

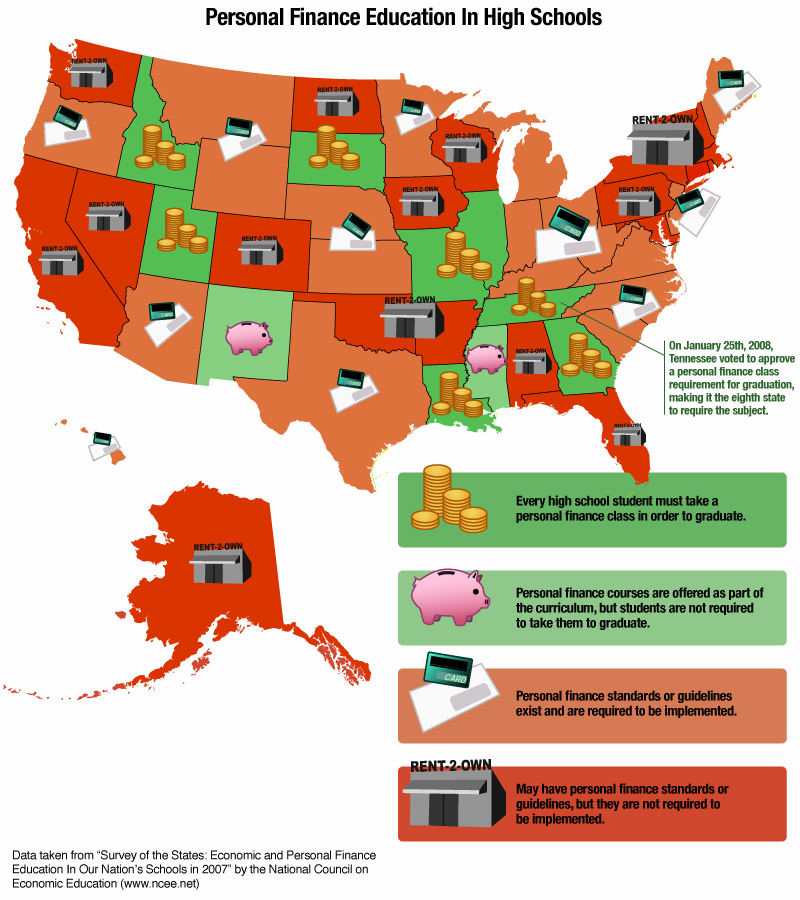

Report Card On Personal Finance Education Nationwide

Less than a week ago, Tennessee voted to require a personal finance class of all graduating high school students, starting with this year’s seventh graders. Unfortunately, less than 20% of states have similar requirements. We’ve made a fancy-schmancy graphic to show which states are teaching tomorrow’s citizens how to manage money, and which states are likely to be great places to set up payday loan shops. Inside, see the chart nice and big.

Low Income? You May Qualify For Tax Saver's Credit

If you’re single and earned less than 26,000 last year, or married and together made less than $52,000, then you can qualify for a tax credit of up to $1000 if you contributed to a retirement savings account during the year. To get the maximum credit, you’ll need to have socked away $2,000 and earned less than $15,500 as a single tax filer ($31,000 if married). And yes, this is a credit, not a deduction (something this writer has confused in the past), so it can make a significant difference on your final tax bill.

../../../..//2008/01/29/hsbc-direct-lowered-its-online/

HSBC Direct lowered its online savings account rate to 3.8%. Now my bet in moving all my money to E*TRADE, currently running at 4.4%, has paid off.

Tyson Foods To Raise Prices "Substantially"

Eat that chicken and your wallet takes a lickin. The CEO of Tyson Foods, makers of fine chicken, beef, and pork products, said in a conference call yesterday, “We have no other choice but to raise prices substantially…We are raising prices because we can’t absorb these costs. Despite concerns about the economy, people have to eat, and they will continue to eat protein.” 2008, the year of tightening wallets… and belts?

How States And Companies Make Money Off Of Unspent Gift Cards

In the last three years, New York has collected $19 million in unused gift card balances under the state’s unclaimed-property laws. Best Buy added $135 million in unspent gift cash to its total operating income over the past two years. “For individual retailers, unspent balances can range anywhere from 2% to more than 10% of all gift-card sales,” notes BusinessWeek.

How Companies Make Money Pissing You Off

A story in Bob Sullivan’s new book Gotcha Capitalism shows one of the first points when companies realized they could make more money by getting rid of their customers. The year was 1995, and First National Bank of Chicago decided to charge customers a $3 fee for talking to a teller. The move was lambasted in the press and by comedians, and analysts predicted a severe decline in profits as customers fled in protest. Instead, First National Bank’s percentage of customers producing an “adequate return” went from 33% to 45%, and profit went up 28%. How does this work? Bob writes:

…satisfying the right customers is the goal, but pissing off the wrong customers is equally important…[D]epositors with large accounts were exempt from such fees…Only irritating customers with tiny bank accounts who asked a lot of questions went elsewhere….Chasing away undesirable customers with outrageous fees has been an important element of the banking business ever since.

And every other service industry as well.

Poll Results: How Will You Spend Your Tax Rebates?

Last Thursday we polled our readers for what they plan on doing with their money when they get their tax rebate checks. The result is that Consumerist readers mainly plan on using their money in precisely the opposite way that the politicians want them to, paying off debt (46.3%) and saving it in the bank (30%). All the other options combined, which would have a supposedly more directly stimulating effect on the economy, add up to only 23.8%. Food came in at 1.5%, depreciating assets 8.2%, discretionary spending 4.5% and stimulating the critical beer and cigarette industries 9.6%. It seems our readers are more concerned about their personal finances than the national economy. Good. Maybe if more people were like them we wouldn’t be in this mess in the first place.

30 Free Ebooks On Personal Finance

Mint has gathered 30 of what they consider the best free personal finance ebooks around, grouped into categories like “Basics,” “Saving & Investing,” and “Security & Privacy.”

Get Out Of AT&T Without ETF Thanks To Text Message Rate Increase

AT&T is raising the rates for sending text and picture/video messages to 20 and 30 cents, respectively, giving customers a chance to break free of their contract without early termination fee if they use the now-classic “materially adverse changes to contract” argument. Inside, how to deploy that tactic, as well as the text of the rate change notice.

Senate To Scuttle Timely Economic Stimulus Plan

Smarting from its continued failure to check the expansive growth of the unitary executive, the Senate has decided to assert itself by derailing an agreed upon economic stimulus plan. Senate leaders are now insisting that the stimulus plan contain an extra $25 billion to fund road work, tax cuts, and extend unemployment insurance.

../../../..//2008/01/26/bill-clinton-and-arnold-schwarzenegger/

Bill Clinton and Arnold Schwarzenegger are teaming up to help poor Californians open starter bank and checking accounts so they don’t have to turn to cash checking and payday loan places with usurious fees. [WSJ]

../../../..//2008/01/24/the-first-tax-rebate-checks/

The first tax rebate checks will be sent out in May and just about everyone should have them by July. [AP]

Credit Card APR Magically Raises From 7.99% To 21.99%

I keep reading and it says that I can “reject this amendment” by doing so in writing by 2/29/2008.