Web Extra: Rumor Control! [On The Money]

money

Understanding The Money Meltdown In 10 Easy Links

After reading these 10 links, the I Will Teach You To Be Rich blog believes they will make you smarter than 99% of other people about the financial crisis, what it means, and what to do about it. [I Will Teach You To Be Rich]

How Not To Panic About The Stock Market

Seeing the greatest single-day point drop in the Dow is probably not the kind of history anyone wants to be living through right now. The failure of the bailout bill to pass caused a big freakout in the market, which thought we were going to get a bailout today. But before you click the button to transfer all your investments to 0% return T-bonds (aka I give up on investing), first ask yourself if that’s really in line with your long-term investment goals. Secondly, realize that point-wise it might the greatest drop, but it’s not the greatest drop percentage-wise. In other words, we’ve been here, and bounced back, before. If you’re decades away from retirement, today’s plunge is a buying opportunity. Here are some thoughts about fighting the urge to panic.

What Wachovia Customers Need To Do Post-Citigroup Takeover (Hint: Nothing)

What do Wachovia customers need to do now that Citigroup owns your ass? Absolutely nothing. You can do all your online and offline banking just like nothing happened. No temporarily held funds, no chained and locked bank branches. Everything is the same. Even your bank’s regulator remains the Office of the Comptroller of Currency. Down the road there will likely be a few alterations, most of them cosmetic. Read our post “Insiders: Probable 1-Year Timeline For Customers In WaMu To Chase Transfer” for some of the changes you can expect.

Back To The Basics: What Is Money?

Since pundits are convinced we’re headed for the next Great Depression, let’s be optimists and fast-forward to post-depression boom times when America will return to the basics and once again learn about money. Join little Tommy and his crisp new $5 bill as they travel through America’s financial system, circa 1947…

Michael's: "It's Store Policy Not To Accept Change"

Hayden wanted to buy a $4 wood plaque for his mother as part of a last-minute birthday gift, but Michael’s wouldn’t accept 16 quarters as payment. “It’s store policy not to accept change,” a cashier explained, forcing an embarrassed Hayden to borrow a few bucks from his younger sister.

VIDEO: WaMu Ad Has New, Dark, Meaning

Now that Washington Mutual completely imploded on its garbage-pile avalanche of home mortgages, this old WaMu commercial from August 2006, starring Scott Adsit pre-30 Rock, takes on a new, darker, meaning…

Advanta Raises Your 8% Credit Card To 20% Because The Economy Is Bad

I have had an Advanta Credit Card for a little over a year now. My interest rate prior to a few days ago was 8%. My credit rating is very good, and I have always made my payments on time. As I was looking over my bill for September I noticed a fee of $75 dollars. A few clicks later I found that my interest rate had been raised to 20%.

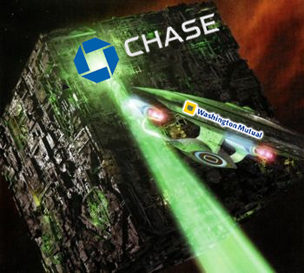

Insiders: Probable 1-Year Timeline For Customers In WaMu To Chase Transfer

One of our commenters, mavrick67, who says they have over 20 years banking experience and have witnessed 8 takeovers throughout the years, provided a timeline as to what you can expect.

Update: Not On CNBC's "On The Money" Tonight

8pm eastern, I’m going to be on CNBC’s “On The Money” tonight hosted by the fastest-shootin’ personal finance expert in the West and East, Carmen Wong Ulrich. We’ll be fielding questions from consumers wanting to know what money moves to make and I’ll chime in with the Consumerist.com perspective. Should be interesting! Got bumped, but should be back on again sometime soon.

WaMu Customers, Office of the Comptroller of the Currency Is Your New Regulator

As an aside, WaMu’s charter was under the Office of Thrift Supervision (OTS). Chase’s bank regulator is the Office of the Comptroller of the Currency (OCC). Whether being a Chase customer was your choice or not, if you ever have a major complaint about Chase regarding what you feel is on the bank’s part malfeasance, you’ll want to send it to the OCC.

WaMu Fails, Feds Seize It, JP Morgan Buys It, Your Accounts Are Ok

The Feds seized Washington Mutual and JP Morgan bought it, but don’t fret, all your accounts ok. Online banking is completely functional. If you held WaMu stock, on the other hand, it’s now effectively worthless. Depositors began fleeing WaMu on September 15, the day Lehman Brothers filed for bankruptcy. In all, they took out about 9% of WaMu’s deposits, or $16.7 billion. Regulators say this left WaMu without enough capital to keep functioning. The shakedown and bailout continues apace. What new surprises will the government bring us today, Monday, or even over the weekend? At least this one didn’t require taxpayers to foot the bill.

Readers Share Stories Of Trying To Save By Threatening To Cancel

Yesterday we told you about a man who saved $238.92 per year on his Comcast bill by threatening to cancel and getting a discount to keep him around. Numerous readers chimed in in the comments with their tales of victory using the same method, tales of failure, and a few company employees shared their insider perspective. Ive rounded up the comments and sorted them by the aforementioned categories so you may learn from their tips and tricks to save on your cable bill. Some of the same tactics can be applied to other services, like cellphone or credit cards, as well…

Personal Finance Roundup

Bank crisis: 10 things to know now [MSN Money] “If your bank goes bust, how do you get your money out? Are credit unions protected? What about investments? It’s time to get your ducks in a row.”

Poll: Do You Support The Bailout?

Lawmakers are hashing out the details of a huge taxpayer-funded bailout of Wall Street in an attempt to keep afloat the system of banks whose willingness to lend drives this economy’s growth. Constituents have flooded their representatives phone lines and inboxes with with their heated reactions. What do you think?(Photo: Getty)

Leaving IKEA Empty-Handed

I was in IKEA last night to replace a file cabinet. They didn’t have the right one but I picked out a close approximation. While I was waiting in line I thought, what the hell am I doing dropping $160 on a stupid box just to hold my hanging folders? So I got out of line and abandoned my flat-packed box and resolved to see what the nearby STAPLES has to offer tomorrow. Have you found yourself abandoning stuff in the checkout line more often? Or otherwise reevaluating and cutting back on certain kinds of purchases lately that in the past you might have made without thinking?