As we prepare to talk credit card reform with the Obama folks, we want to make sure you’re all able to follow along at home. Inside, we present a cornucopia of fact sheets, charts, and links about the fight for credit card reform.

money

Austan Goolsbee Confirmed For Consumerist Interview

We’ve got the senior policy guy we’re interviewing on Thursday in DC about credit card reform confirmed, it will be Austan Goolsbee, senior economic adviser to Obama. We’ll be shooting it in the Eisenhower Executive Office Building next to the White House. This should make for a good interview! Besides lengthy academic credentials in business and behavioral economics, Goolsbee often acts as Obama’s surrogate, is an extemporaneous debate champ, Skull & Bones member, and from Chi-town, so Meg can rap with him about sport peppers.

../../../..//2009/05/07/can-you-get-swine/

Can You Get Swine Flu From A Dollar Bill? “A study published by Swiss researchers shows that an infectious virus can survive for three days on bank notes, and 17 days ‘in the presence of respiratory mucus.'” [Consumer Reports Money]

If You Do What You Love, Will The Money Follow?

“Never buy the most expensive home in a neighborhood.” “Your age is the percent of your portfolio you should have invested in bonds.” “You can withdraw 4% of your retirement savings every year.” Many of these sort of short, quick personal finance rules-of-thumb have become so generally accepted that most people don’t even question their validity. In many cases, the guidance these sayings offer are quite good. Yet some of them have morphed from solid money advice to almost zen-like statements that are just as likely to be untrue as true. For example, here’s one that sparks a lot of debate:

Top 10 Reasons Your Chargeback Will Be Denied

A reader who works in the chargeback section of a major credit card company has just about had enough with people tossing around “chargeback! chargeback!” as the solution to every customer service problem. While it is a great tool, you gotta make sure you use it right. To help you do that, here’s our credit card company insider’s guide to the top 10 reasons why your chargeback will get rejected.

../../../..//2009/05/05/now-your-money-can-be/

Now your money can be at work in a different way, helping predict outbreaks as you spend it. Researchers at Northwestern University are testing a new computer modeling program that tracks the flow of dollar bills across the US as a way to predict the spread of swine flu. [New York Times]

Got Debt So Bad It's Defaulted? 3 Ways To Deal

Getting into debt is easy. Winding up in default is easier yet; all you have to do is not pay your bills for several months! So how do you deal when the lender doesn’t want to wait around for you any longer and has moved on to more drastic action? Here’s three ways, only two of which are advisable.

Would You Like To Get Charged For A Bill You Already Paid?

Definition: Double-cycle billing or two-cycle billing: When the credit card company calculates finance charges not just for the past cycle (month), but the past two.

How Does The Chrysler Bankruptcy Impact Your Mutual Fund?

What impact does the Chrysler bankruptcy have on regular investors who hold bond funds? Most likely little to none, it turns out. Consumer Reports points out that most mutual funds have been avoiding Chrylser, GM, and Ford debt for years now—and if your fund does include Chrysler, it’s probably a tiny portion of your overall investment.

Not Everyone Is Having a Financial Meltdown

For all the financial news of doom and gloom, the Money Crashers blog reminds us that not everyone is hit hard. In fact, they say that for every person struggling right now, there are a majority of people who are doing just fine in this economic climate (note: no data is presented for this claim, but it does sound at least directionally correct). As such, they list five money-related tips for those out there who are not struggling in this recession as follows:

Never Get A Chase Over-The-Limit Fee Again

Stop the presses! You know how most banks are glad to let you charge more than your credit limit and then charge you fees for the “courtesy?” CreditMattersBlog reports it turns out Chase will let you block these “over-the-limit” purchases. You just gotta call and ask for it, 1-800-432-3117. If you’re a Chase credit card customer and sometimes find yourself going over your credit limit and incurring fees, putting an over-the-limit block on your account could be just the thing.

Spread It Around: A Low Balance On Each Card Is Better

When the little trolls with the green visors determine your credit score, a big factor in their abacus-shuffling is how much percent of your credit limit you’re using. However, it’s not just your total credit utilization, all of your credit limits added together and divided by how much of that you’ve tapped, but also how much of each credit line you’re using, the individual credit utilization. Say what?

6 Major Banks Fail Initial Stress Tests

6 of the major 19 banks failed the Treasury’s “stress tests” and need more cash as a buffer against losses, according to leaked preliminary results.

Is It Cheaper To Make Or To Buy? Six Foods Tested

Jennifer Reese decided to make six common food items and then determine whether it was better to go the homemade route or to buy from the store. We briefly considered making our own crackers last month in a fit of anger over how expensive generic saltines have become, so we’re glad someone did the research for us.

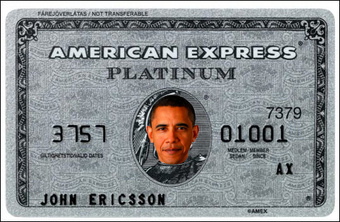

Would You Use A Government-Issued Credit Card?

With President Obama and Congress threatening to tag-spank credit card issuers, Slate is left wondering why the government doesn’t just issue its own credit card. Before you scream “SOCIALISM!,” consider the government’s heavy involvement in the banking sector, not just through the recent bailouts, but through long-standing institutions like Fannie and Sallie Mae, and Freddie Mac. Credit-worthy borrowers in Germany, France, and India all have access to low-interest, no-fee credit cards issued by their central banks. Would you ever be interested in an Obama-backed credit card?

No, You Should Not Sell Your Five-Month-Old To Raise Money For A New Apartment

19-year-old West Virginian Rebecca Sue Taylor is facing felony charges after trying to sell her five-month-old son for $10,000 to raise money for a new apartment. Taylor was in talks to act as a surrogate mother for Leigh Burr, but then realized she could skip a few steps and still turn a buck. When it looked like negotiations weren’t going well, Taylor, who claimed she had been “unable to bond with the infant,” dropped the price of her son to $5,000.