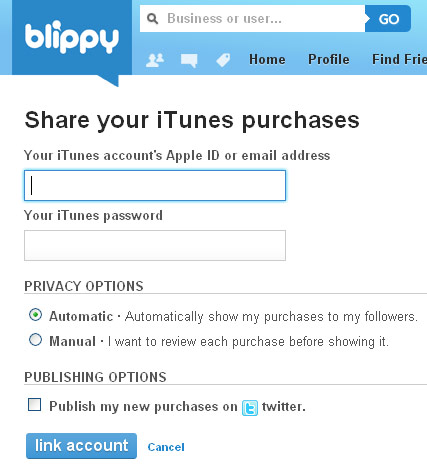

A new study finds that the young and the feckless are the most at risk for identity theft. 18-24 year olds are more likely to be victimized because they don’t check their accounts frequently or thoroughly enough. You can beat the statistics, though, if 1 in 20 times you’re tempted to check your friend’s Facebook updates you instead scrutinize your account statements. [WashingtonPost] (Thanks to Timothy!) [More]

money

Personal Finance Roundup

Nailing the Interview [Wall Street Journal] “Here are some tips on how to nail a job interview — whether it’s in person, via the Web or even on the phone.”

Secret tips for buying a new car [CNN Money] “A new service called TrueCar…informs the customer where the best deals are.”

How to win the March Madness pool [Smart Spending] “The experts offer some suggestions for increasing your chances of winning the pot.”

IRS offers help paying taxes [Washington Post] “The agency will hold 1,000 open houses on Saturdays where taxpayers can work out payment problems with IRS officials.”

US sales tax rates hit record high [MSN Money] “In jurisdictions large and small, sales taxes have continued a steady climb. States and cities see them as a way to make up for budget shortfalls.”

TD Bank Will Pay Off Your Mortgage

Free house! TD Bank is running a new contest: apply for a new mortgage, get a chance to have them pay it off in full for you. [More]

Faux-Hawked Wells Fargo Manager Allegedly Embezzled $900,000+ From Elderly

An ex-Wells Fargo bank manager is accused of embezzling more than $900,000 from customers, most of whom were frail and elderly. [More]

Reach Chase Executive Offices For Mortgage Modifications

Here is a fun-pack of executive escalation contact info you can use if you’re trying to get Chase to modify your mortgage. With the bureaucracy and indifference staring you down, you’ll need every vector you can get your hands on. [More]

Stay On Top Of New And Overlooked Deductions

Are you up-to-date with all the tax code changes this year? The TurboTax blog rounds up some of the newest tax credits and highlights deductions that people sometimes sleep on, like the long-term resident credit and unemployment and job search deductions. More coin in your coinpurse means you can buy all the churros you want this year! Update: Looks like we broke their blog. Here’s a cached copy of the post in question. [More]

Use This Calculator To Set Your Paycheck Withholdings

Tax refunds are fool’s gold, because they’re interest free loans you’ve been floating to the government all year long. The ideal move is to have just the right amount deducted from your paycheck each week so you’ll pay a small amount come tax time. [More]

Consumer Protection Agency May Exempt Payday Lenders, Pawn Shops, Entire Point

The Washington Post reports that thanks to legislative compromise, banks and mortgage brokers may be the only financial institutions regulated by the proposed federal Consumer Financial Protection Agency–leaving entities that loan money but don’t hold bank charters, such as auto dealers, pawn shops, and payday lenders, unregulated by the industry. Now an unholy alliance of banking industry groups and consumer advocates are fighting the proposal, each for their own reasons. [More]

Personal Finance Roundup

Making the Most of Your Most Valuable Financial Asset [Free Money Finance] “Consider this post a reminder that what we do with our careers can make a tremendous amount of difference to our net worths.”

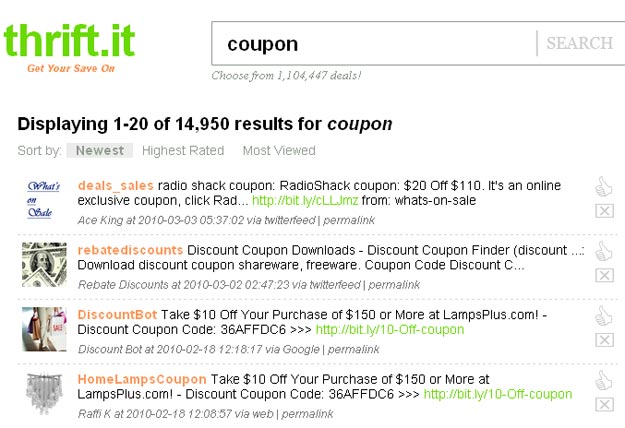

Hard Times Turn Coupon Clipping Into the Newest Extreme Sport [Wall Street Journal] “Penny pinchers deal for discounts.”

Ten Tips for Maximizing Your Savings at a Warehouse Club [The Simple Dollar] “You really can do much better on some items by utilizing a warehouse store, but you’ve got to follow a good plan. Here’s how.”

Is your retirement fund leaking? [MSN Money] “Frequent trading by fund managers can inflate costs that aren’t reflected in the numbers most investors watch. That’s money from your retirement kitty.”

5 Smart Uses for Your Tax Refund [Kiplinger] “Use the influx of cash to improve your financial situation.”

BoA Kills Overdraft Fees On Debit Purchases

Bank of America announced they will stop charging overdraft fees on debit card purchases. If you don’t have enough money to buy the item, the transaction will be declined. [More]

2 Dead Economists In An Epic Rap Battle

An oddly high-produced music video rap battle between economists John Maynard Keynes and F. A. Hayek. It crystallizes and communicates the differences between macroeconomic and classic liberal free-market capitalism through the magic of hiphop. It seems weighted towards Hayek but it’s entertaining nonetheless, even though I’m sure Tea Party folks probably email it to their friends with lots of dancing emoticons and angel gifs. What side do you fall on, Keynes or Hayek? [More]

BoA So Messed They're Incapable Of Taking Your Money

It’s a real junkyard over there at Bank of America. We have yet another complaint about their online system being so jacked up that it won’t even take your money. That’s the last thing you want to happen when you’re trying to pay your mortgage in these foreclosure-happy times. Jason has already escalated to the executive office, and they still suck. [More]

Arrest Warrant Issued For JPMorgan Chase CEO Jamie Dimon

Last week, JP Morgan Chase CEO Jamie Dimon was a wanted man in the city of Atlanta. The city solicitor issued a warrant for his arrest. [More]

Go Ahead And Cancel Your Credit Card, The Score Ding Is Minimal

New answers pried from the secretive FICO corporation that overlords our credit scores kill a longstanding myth. It turns out that cancelling your credit cards won’t destroy your credit score. [More]

Personal Finance Roundup

7 Sneaky Savings Strategies for Generation Y [Kiplinger] “Try these tricks to build a better financial future.”

10 Things Your Mechanic Won’t Tell You [Smart Money] “1. You might be in the wrong garage.”

10 tips for spending less and saving more [Washington Post] “Here are 10 surefire ways to trick yourself into spending less and saving more.”

4 reality checks for your finances [MSN Money] “A few simple calculations can tell you whether you’re doing fine or staring at debt disaster.”

The price you pay for frothy assets [CNN Money] “Nothing affects your future returns more than the price you pay for your investments.”

VIDEO: Should I Go Credit Union Or Bank?

Sick of interest rate hikes, new hidden fees, and their credit lines cut, more consumers are trying their local credit union a shot. This CBS video takes a look at a credit union in Michigan who bought back their credit card program that they had sold to large bank after members started complaining. [More]