Without telling him there would be a fee, Comcast charged Tom $30 to fix the cable wiring going to his house. By simply questioning the charge and expressing his disappointment he wasn’t notified about it, Tom was able to get $20 back. Here is the chat transcript of his success, which is also enjoyable for the inane interjected advertisements that try to sound like human conversation. [More]

money

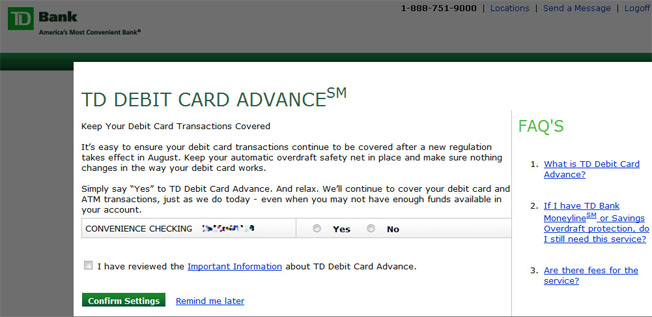

Get Customers To Sign Up For Overdraft Fees Or Get Fired

One of our readers is a bank teller branch manager and he feels queasy. His bank is making him trick customers into signing back up for overdraft fees, and if he doesn’t, he’ll get fired. [More]

Paypal's New Security Card Fits Inside Wallet

Like the idea of the Paypal security key fob, which auto-generates a 6-digit code that must be entered every time you use your Paypal account, but not so hot on its bulky shape? This year Paypal introduced a credit-card sized design that fits inside your wallet. [More]

Crooks Crack Check Image Sites, Steal $9 Million

Know how when you go into your online checking account you can click on checks that you’ve written and see the scanned image of them? Well, those pictures have to be stored somewhere, and they’re not always secure. Russian crooks broke into three sites that store archival check images, stole the information, and wrote over $9 million in phony checks against over 1,200 accounts. [More]

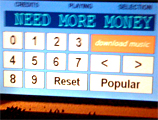

Guy Hacks ATM To Spew Money, Play Music

Whether it’s a steel door or an encrypted network, thieves are always finding ways to break down the barriers that protect money. And the new technologies are also enabling bank robbers to invent new ways to jack cash with flair and razzle dazzle. Exhibit A, a security researcher at the Black Hat conference in Las Vegas demonstrates on-stage how one can remotely hack an ATM to make it spew money while playing a lively tune. [More]

Oops, You Didn't Buy A House, You Bought Its Worthless 2nd Mortgage, And Now It's In Foreclosure

A couple thought they were snagging a $97,606 foreclosure fixer upper at a courthouse sale, only to find out months later they had actually bought its worthless second mortgage. The original was in arrears, and now the house would be sold at another courthouse auction. [More]

Personal Finance Roundup

Two Mind Hacks to Lower Your Expenses [Free Money Finance] “Two mind hacks that will make you look at money differently from this day forward.”

7 Secrets to a Happy Retirement [US News] “Seven traits happy retirees share.”

Which college grads snag the best salaries [CNN Money] “Attending school in California and becoming an engineering major can really pay off for college graduates — by thousands of dollars a year.”

Financial Aid 101: How to get more cash [MSN Money] “Even well-off families may find they’re expected to pay more for college than they can really afford. But with the right financial moves, they can qualify for more aid.”

24 Top Legitimate Home-Based Business Ideas & Opportunities [ChristianPF] “Even if you don’t have aspirations of working full-time from home, having a little supplemental income would be nice – wouldn’t it?”

Oracle, Apple, Capital One CEOs Rank Among Decade's Top Earners

Being POTUS makes you age prematurely, and Lady Gaga is stuck in a 360 deal that takes a cut of everything she does. Screw that, I wanna be CEO. The Wall Street Journal has listed the top paid CEOs of the last decade, which is topped by Oracle CEO Larry Ellison at $1.84 billion. Steve Jobs comes in fourth with $749 million, and Capital One’s Richard Fairbank is fifth at $569 million. The WSJ also notes that “four of the top 25 CEOs worked at financial companies, two on Wall Street.” [More]

Five Things To Do Before Losing Your Wallet

Look, it’s going to happen eventually. Whether it’s pickpockets or carelessness, you’re going to lose your wallet. When you do, you’ll be glad you took these five steps to make recovery simple and painless. [More]

Do You Have What It Takes To Be A Cheapskate?

Jeff Yeager, Wise Bread blogger and author, has just published a new book titled The Cheapskate Next Door, where he interviews over 300 self-described cheapskates to find out what makes them tick. In an interview over at Daily Finance, he says that for most of his subjects, the choice to live frugal lifestyles wasn’t primarily about money. [More]

Personal Finance Roundup

A Frugal Fact: The 6 Most Valuable Grocery Store Products Known to Man [Len Penzo] “Here is my official list of the six most valuable grocery store products – along with a partial list of their many uses.”

How to Save Money While Traveling [Get Rich Slowly] “Here are some easy ways to save while traveling.”

Shopper’s guide to used-car bargains [MSN Money] “Good deals are harder to find now, but the right strategies can help you get the most for your money.”

Secrets of extreme savers [CNN Money] “You can put away a lot more than the average American without living a deprived life.”

To retire comfortably, under-40 workers need to seriously bulk up savings [Washington Post] “I am going to try to scare some sense into you with three words about life in retirement: The paychecks stop.”

Wedsafe.Com Insures You Against Wedding Disasters

Putting on a wedding is a lot like putting on a show. A very expensive stressful show that’s for one night only. [More]

Personal Finance Roundup

5 things to know about energy rebates [CNN Money] “In many locales the money is already gone.”

4 Strategies to Make ETFs Work for You [Kiplinger] “We show you how to use exchange-traded funds to boost your returns and hedge your bets.”

7 stupid retirement myths exposed [MSN Money] “Subscribing to unfounded beliefs can make your retirement harder — if not impossible — to reach.”

What Exactly Are 12b-1 Fees, Anyway? [Wall Street Journal] “Here’s where your dollars are going.”

Organic Groceries on a Budget [Wise Bread] “Here are some strategies for affording organic groceries.”

Wiring Money Is A Ripoff Red Flag

One good way to get ripped off in a transaction is to agree to wire the other person money. Whether it’s through your bank, money order, or Western Union, wiring money has zero protections against loss. Which is why con artists love it dearly. [More]

Debt Collectors Discover New Levels Of Relentlessness

It makes sense that as the economy has soured that the rapacity of debt collectors would rise, but this much? [More]

TD Ratchets Up Overdraft Opt-In Push With Pop-Up Scare Tactics

TD Bank is really stepping up its efforts to try to get customers to sign back up for “overdraft protection,” which really just protects their right to charge you $35 if you want to buy a $2.00 candy bar and only have a $1 in your account. Now they’re greeting customers accessing their accounts online with pop-up ads trying to scare them into agreeing to signing up for the service. [More]

Is "Consideration" The Magic Word For Getting A Refund?

Is using the word “consideration” in customer service interactions a magic incantation that opens up doors to a world of refunds, rebates, and discounts? [More]

Letting Mortgage Go Delinquent To Qualify For Short Sale Damages Credit

In order to qualify for a “short sale,” in which the lender agrees for the house to be sold for less than the remaining amount owed and takes a loss, the lender sometimes requires the homeowner to be several months delinquent on their mortgage payments. But while getting out of a house you can’t afford can be a good idea, bear in mind that the delinquency will stain your credit report. [More]