New items on the back-to-school lists this year include cleaning spray, baby wipes, and cotton balls. It’s not for making a diorama or some kind of cheap puppet. Rather, with budgets slashed all over, schools have had to resort to asking the kids to pick up basic cleaning supplies for the school along with their usual TrapperKeepers and notebooks. [More]

money

Does The "S. Larson" Who Always Signs Citibank Customer Letters Really Exist?

For decades, “S. Larson” has been the named that signed the bottom of Citibank’s letters to customers. But does this person actually exist or are they a construct? [More]

Branch Manager Quits Rather Than Trick Bank Customers Into Signing Up For Overdrafts

The bank branch manager who felt uncomfortable that his bank was making him choose between misleading customers into signing up for overdraft protection and keeping his job has decided to quit. [More]

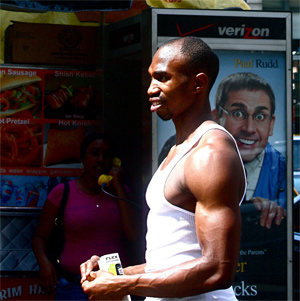

To Build More Muscle, Pump Lighter Iron

Lots of people use free weights and weight machines as part of staying fit and trying to build muscle, but a new study finds that contrary to popular belief, it’s not really the heaviness of the weights that build the most muscle. Rather, you can build more muscle mass by using something much lighter but just keep lifting until you reach fatigue and can’t lift it anymore. [More]

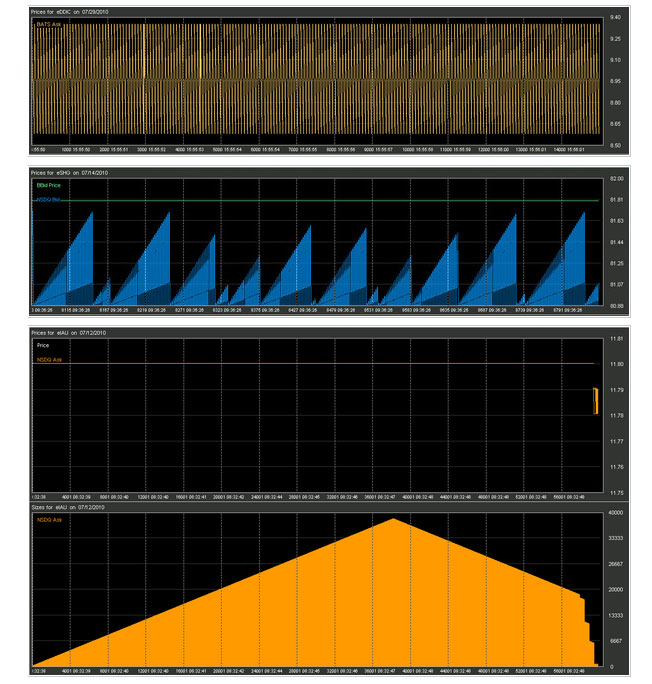

Robot Traders Leaving Behind Bizarre "Crop Circles" In Market Data

Following the May 6 “flash crash” in which the market plunged 1,000 points in just a few minutes, a data firm started looking at the trades being made by the high-frequency computerized trading bots that have come to loom over over the stock market. By zooming into the trades being placed by the millisecond the firm spotted several strange algorithmic patterns. Plotted on a chart, they look like the freakin’ the stock market equivalent of crop circles. [More]

Wells Fargo Ordered To Pay $203 Million For Processing Transactions High To Low, Maximizing Overdraft Fees

A California judge ordered Wells Fargo to pay California customers $203 after finding that the bank had deliberately manipulated the way it processed transactions in a way that turned one overdraft fee into as many as 10, at $35 a pop. [More]

Personal Finance Roundup

Trying to time the market has cost investors big-time [The Washington Post] “A groundbreaking study by Morningstar shows what a terrible price investors pay for market timing.”

How to Tame College Costs–It’s Not Just Tuition [Wall Street Journal] “Here are five areas where you can cut college costs.”

Three Steps to Break a Car Lease Without Getting Rear-Ended [Money Talks News] “These days you can go to any number of websites that will help you find someone who can assume your lease.”

Investment Psychology: Top 5 Ways Investors Go Broke [The Digerati Life] “Have you committed any of these?”

How rich is rich? [CNN Money] “Experts peg the figure to be somewhere around $2 million to $12 million in savings.”

Citibank Yanks Your 87,000 Rewards Points And Closes Account Without Warning

Andy and his wife were just about to use their 87,000 accumulated rewards points to take a vacation when all of a sudden Citibank closed the account and took away all their points. According to customer service, there’s nothing that can be done. [More]

Banks Told To Target Financially Unsavvy For Overdraft Reup

Consulting firms are telling banks to hone in on the financially precarious to sign back up for costly overdraft protection that will only further erode their bank account. Here are some quotes from their strategies: [More]

Before I Strategically Default, Can I Get A New House? Pwease?

Old news: homeowners strategically defaulting on their loans. New news: They first want to get financing for a new house. [More]

Stocks Rise, Betting Feds Will Vote To Buy More Mortgages And Treasuries

Markets edged upwards Monday, betting that the Federal Reserve will vote tomorrow to inject more money into the system by buying up more mortgage-backed securities and Treasuries. [More]

Starwood American Express Card Hikes Annual Fee To $65

The annual fee for the Starwood American Express card is going up from $45 to $65. Is it worth the price to pay for the right to use a credit card? [More]

Rare Superman Comic Saves Home From Foreclosure

See through walls, bounce bullets off his chest, save homes from foreclosure, is there anything the man of steel can’t do? [More]

What's Your Net Worth?

You can’t get where you’re going if you don’t know where you are. In order to accomplish your long-term financial goals, like saving up for travel, a home, or starting your own business, you should sit down and assess your net worth. [More]

Don't End Up In Jail For Debt

Friend of the show Caveat Emptor has advice on how to not get thrown in jail for your debts. (Yes, this is happening in America). [More]

Mortgage Broker Told Me To Open Up A Bunch Of Credit Cards, Should I?

One of our readers is looking to buy a house and his mortgage broker suggested that he open up about four credit cards to establish some credit history. Should he? [More]

Personal Finance Roundup

Try as Investors Might, So Much Depends on Chance [Wall Street Journal] “Investors saving for retirement can find mutual funds that invest in almost any kind of asset, but they can’t buy the one thing that will have the biggest impact on their nest egg: luck.”

How to Cut Your Textbook Costs in Half — or More [Kiplinger] “Students have plenty of more-affordable options than the campus bookstore.”

30 ways to save money on a cruise [Smart Spending] “Cruise lines use every means at their disposal to get you to spend more. Here’s how to avoid the traps.”

Why spend $300 a night for a hotel? [CNN Money] “Why spend so much, when you can rent a place, swap houses, or arrange a home stay for a lot less?”

The good life is not only about money [MarketWatch “In difficult financial times, having a sense of purpose is key to staying happy.”