Lost an important document? Misplaced your birth certificate, driver’s license, passport, social security card, property deed, title insurance policy, mortgage, car title, marriage license, divorce paper, or diploma?

money

What Is FDIC Insurance?

When checking out all these whippersnapper online banks with their crazy high interest rates, you gotta make sure they’re FDIC Insured so you’re protected if they go under. But what does FDIC Insured actually mean? My Money Blog probes.

Google's Roth IRA Questions Answered

Blueprint for Financial Prosperity is doing a neat thing where he looks at his site stats to see what Roth IRA questions people are typing into Google that direct them to his blog, and then he answers them in a post.

"Save 10%" Rule is So 1990

The personal finance rule-of-thumb regarding saving has historically been that each of us should sock away 10% of our salaries for retirement. But this old rule is coming under an increasing level of scrutiny from all sides — some saying we need to save more, some arguing that we’re already saving too much, and others replying there’s no one answer that fits everyone. Is it any wonder we’re all confused?

5 Bank Fees To Watch Out For

The nice thing about putting your money in a mattress is that it’s never going to charge you a “pillow fluffing fee” or a “paisley-colored sheet fee.” Your bed also won’t pay you interest and it’s not FDIC insured, so SmartMoney has five bank fees to watch out for and how to avoid them.

Watch Out For Hidden Fees With Secure Credit Cards

Earlier we talked about how secured credit cards can be useful tool, but it’s important to be aware of their risks. Disreputable secured credit card lenders are infamous for preying on the unsuspecting with hidden fees and charges. Bankrate writes:

Hey, Bank of America! Your ATM Gave Me A Fake $20

We’d always sort of assumed that someone had to check the to make sure money was real before they put it into an ATM, but apparently a few fake bills have been known to slip by. Wealth Junkie blogger Alexander had $4 in his wallet when he stopped by a Bank of America ATM to get cash for his Costco shopping trip. When a cashier at Costco spotted a fake $20, Alexander knew exactly where it came from.

Just Getting Started With Personal Finance Roundup

“Ramit drew up a clever graph to explain why you can’t keep your long-term savings goals: You’re trying too hard.”

Save For Retirement While You're Young, Live Like Rockstar Later

Smart kids start saving for retirement early.

Save Money On Fees

Frugal For Life has a couple of tips for saving money on fees. For one, she advises swiping debit cards as credit because some stores will charge you to process the transaction otherwise.

Financial Advisors Often Give Poor, Expensive Investing Advice

Want to get some investment advice that is expensive and doesn’t perform any better than other, less costly options? If so, ask your broker or financial advisor for investing advice. They’re much more likely to point you toward an investment with a “load” — a fee that ranges in price but generally runs 3% to 5% of your investment’s value — simply for them “recommending” it (some would say “selling” it is more accurate.)

SNL Skit: Don't Buy Stuff You Can't Afford

SNL offers a revolutionary debt and money-management program. Chris Parnell teaches Steve Martin and Amy Poehler the secret to financial success. It’s all detailed in a new book called, “Don’t Buy Stuff You Can’t Afford.” Every debtor in America should read it.

Spend It All: A Depressing Look A Taxes, Inflation And Saving

If I said to you, “You can have $10,000 to spend now–or $9,500 to spend in 10 years,” which would you choose? Probably the $10,000 now. And in doing so, you would be making the same choice many Americans make when deciding whether to save or spend their hard-earned cash.

The article goes on to consider some strategies for saving money such as T-bills and stocks, as well as proposing some changes to the tax code. The author suggests making long-term savings tax exempt, which sounds like a lovely pipe-dream. —MEGHANN MARCO

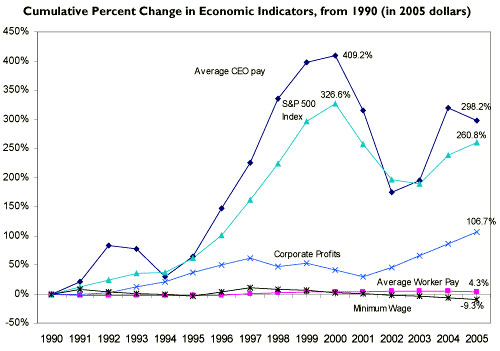

CEO Pay Up 298%, Average Worker's? 4.3% (1995-2005)

There’s been a lot of ballyhoo lately about ballooning executive pay, so here’s a look at how CEO incomes rose over the years in relation to Joe Blow’s paycheck.

Turn An Old Computer Into A Dedicated, Secure, Banking Terminal

Here’s an idea for a spare computer you have lying around: make it into a secure banking device.

Stop Living Paycheck To Paycheck

Tired of living paycheck to paycheck? Here’s some advice on getting your money situation together.