If you’re a freelancer, or work for a small company, or for some other reason don’t have a healthy start on a retirement plan, Smart Money has some suggestions for how to jump-start your investment before you hit your golden years.

money

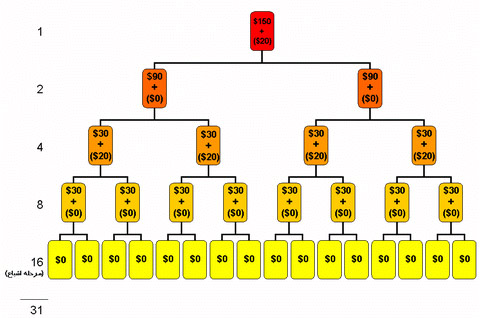

How The Modern Pyramid Scheme Stays Barely Legal

The modern pyramid scheme has undergone slight tweaks in order to stay just with the bounds of the law, and still keep the fun scam times going. When you strip away all the pretty foil and chocolate, though, a naked Ponzi sits in the center, laughing his ass off.

../../../..//2007/10/05/the-recent-shutdown-of-netbank/

The recent shutdown of NetBank is a good opportunity to review what happens when a FDIC insured bank closes and gets taken over by another bank. Basically, you’re safe, as long as your deposits didn’t exceed $100,000. [Kiplinger]

A Little Tax Preparation Now Will Save You Headaches In 2008

Now that 2007 is drawing to a close, it’s a great time to take stock of this year’s income and expenses and see what you can do to lessen your tax burden for the year. Reuters offers several tips to help you increase your refund check (or reduce what you owe, if you’ve had one of those years). They also point out a couple of regulatory issues you might not be aware of that could trip you up if you’re giving gifts or funding retirement accounts.

The Non-Fancy Way To Buy A House

With all the talk about people finding out their no-money-down, interest-only, and option-ARM mortgages weren’t such a great deal, it’s refreshing to hear these pieces of advice about the fiscally conservative way to buy a house, via Moneycrashers:

6 Signs You've Got Too Much Credit Card Debt

Swiping the plastic so much your credit cards have skid marks? Via Kiplinger, here’s six warning signs to watch out for that might indicate you’re abusing your credit cards.

10 Ways To Break A Compulsive Spending Habit

“Addictive spending is often rooted in punishing feelings of low self-esteem and problems with impulse control,” says an addiction specialist in an MSNBC special report on compulsive spending. At its worst, it can wreak as much or more damage on your finances as any full-blown gambling, drinking, or drug addiction—and yet, a lot of people still consider it a moral failing that sheer will-power can prevent (just take a look at half the comment threads on this blog for evidence of that mindset). If you’re a compulsive spender, odds are you already know if you have a problem, even if you manage to hide it from everyone else. But here are ten ways to help get a grip on the situation.

Money Lessons For Your Kids

If you have kids and aren’t teaching them about money, you’re setting them up to be one of those clueless college kids with a free burrito and $12,000 in credit card debt. Don’t do it!

Verify Funky Online Banks

So you just found some awesome interest rate at an online bank. Only problem is, you’ve never heard of the place before. How do you know if your money is secure?

Mint.com Initial Review

Mint.com, a new free personal finance management site, is easy to get started, though we’re not sure we’re completely satisfied with where we end up.

../../../..//2007/09/28/buoyed-by-the-fed-rate/

Buoyed by the Fed rate cut and hope for another, indexes near July’s record levels. [NYT]

5 Ways Credit Cards Can Make You Happy

The ways that credit cards can make you unhappy are legion. Fees, balances, crazy interest rates, universal default, the list goes on. But, even though we just saw Bank of America digging a pit in your backyard, and word has it the zoo is missing 3 tigers and a crocodile, there are a few ways that a credit card can make you happy. (Not all of these tips are unique to credit cards, so check to see which benefits your debit card has.)

Personal Finance Roundup

Getting taken for a ride: Airline fees [CNN Money] “Plans often change and flights must be rescheduled, but airline penalties can be harsh.”

Beware Falling Online Savings Account Rates

Yesterday we bemoaned HSBC’s online savings account dropping by .55 percentage points, and gazed hungrily at Emigrant Direct’s still-holdin’ strong 5.05%, so of course Emigrant Direct to cut theirs to 4.75% today. Until the impact of the federal rate cut sets in, don’t go rate chasing. [Emigrant Direct]

8 Personal Finance Lessons Learned From Monopoly

Remember those cold winter nights when your family stayed up late and fought to bankrupt each other? Recall the number of times you cheered a little metal dog (or hat or thimble) to move around a square board quickly? Recollect regularly screaming “come on seven!” only to roll a six? Who knew that all that time you were really learning about personal finance? Well, Blueprint for Financial Prosperity now knows this was the case. He’s detailed eight personal finance lessons he learned from Monopoly.

HSBC Direct Cuts Rates To 4.5%

We checked HSBC Direct’s front page daily after the Fed interest rate cut, in fear that our fave online saving account would also cut its high 5.05% interest rate. We chuckled as complaints rolled in about people’s various money market accounts getting their rates trimmed. After we were lulled into a false sense of security and stopped checking, a reader pointed out that HSBC has slashing the rate to 4.5%. Noooooooooooo…

Scammers Arrested After Claiming They Could Multiply Money With A Secret Potion

Some scams are clever and some are not. This is one of the not-so-clever ones. Jean-Luc Mbilli and Constant Yao were arrested in Fort Lauderdale, FL after trying to convince Samith Ghazawi, an convenience store employee, that they could use a special potion to multiply money.