The latest Census Bureau results show that 17.45% of homes in Florida are vacant. That’s 1.558 million houses sitting there soaking up the sun. Florida’s housing bubble was one of the hottest and now their vacancy rate is the highest. [More]

money meltdown

Scams: Do You Know About Mortgage "Flopping?"

You’ve heard of “flipping” houses, well now there’s “flopping.” While the first was speculative, this one is outright fraud. [More]

U.S. Home Values Set To Plummet By $1.7 Trillion This Year

Property valuation site Zillow says that signs of stability in the housing market are vaporizing, and U.S. home values are poised to drop another $1.7 trillion this year. [More]

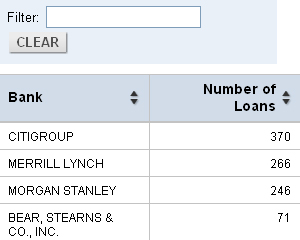

See Exactly How Big Your Bank's Bailout Was

Just how big exactly was the bailout? And which banks got which kinds of loans? And how many did they get? It’s been hard to figure out, but now the Fed has released deep data on the over 21,000 different loans it made during the financial crisis—loans that were supposed to help encourage the banks to resume lending again. ProPublica has put all the numbers together into a searchable and filterable database so you check and see what kind of treasure chest your bank got. [More]

Why Savings Account Rates Suck Right Now

You may have noticed it’s dang hard to get a good rate for saving money right now. Used to be you could get an online savings account with 5%, no problem. Now if you can get in the upper 1% you’re doing pretty good. So what’s the dilly? [More]

Foreclosures Drop 9% Over Fudged Paperwork Fallout

For the first time in a long while, foreclosures actually dropped in October, falling 9%. The big drop came about as several big banks halted foreclosures across the board after news about the robo signers began to emerge. Foreclosures are expected to pick back up again November, albeit at a softened pace. It may be 3-4 months before the rate fully resumes. So take a gasp, homeowners behind on your mortgage, you just caught a temporary break. [More]

Squatters Spoil Dream Home With Fake Deed Claims

A Seattle couple were 10 days from closing on their new house when they discovered squatters had moved in who claimed they had seized “free land.” [More]

Banks Paper Over Robo-Signer Errors, Structural Problems Remain

After the foreclosure fraud scandal broke, banks scrambled to fix what they described as “procedural” errors and “technicalities.” But the lawyer whose deposition of a former robo-signer sparked the uproar says all the banks have done is put bandaids over bandaids. [More]

JPMorgan Chase Suspends 56,000 Foreclosures

JPMorgan became the second major lender after GMAC/Ally Bank to halt pending foreclosures, halting proceedings on 56,000 homes. This follows revelations that “robo-signer” “foreclosure mills” were filing paperwork that would be gracious to call “sloppy,” at the rate of 10,000 a day. [More]

Wells Fargo Says It Won't Foreclose For 30 Days, Then Does So Within A Week

A week after Wells Fargo rejected a couple’s loan mod app and said it wouldn’t start foreclosure proceedings any sooner than 30 days later, a guy showed up on their steps. He said he was with an investment firm that had just bought the house at a real estate auction, and if they would leave within 2 weeks, he would give them $1,500. [More]

New Trailer For "Inside Job" Financial Crisis Documentary

Get ready to slake your thirst for populist rage. Inside Job is a new documentary coming out in October that aims to expose the truth about the true architects of the financial implosion of 2008. You can probably guess from the title whom they’re fingering. Matt Damon is the narrator and it’s released by Sony Pictures Classics. Here’s the trailer: [More]

Chase Foreclosing On 90-Year-Old Even Though Son Is Willing To Pay

Chase is proceeding full steam ahead with foreclosing on a 90-year-old woman’s condo even though her son has offered to pay it off. Rather than get the full amount of the mortgage paid in full, they prefer to incur the expenses of a foreclosure and sell it at a loss. [More]

30,000 Storm Atlanta Parking Lot To Get Public Housing Apps

The last time public housing rosters were opened up, the city got 2,400 apps. This time, they thought maybe 10,000 would show up. Instead, an estimated 30,000 people descended on an Atlanta parking lot last week so they could pick up an application for public housing. 60 had to be taken to the hospital after fights or just from heat exhaustion. It was 90-100 degrees. And this is just to get on a waiting list. To get an actual voucher can take 8-10 more years. [More]

265,000 Homeowners Stuck In "3 Month" Trial Loan Period For 6+ Months

Newly released data shows 265,000 homeowners are trapped in loan mod limbo, stuck in “3 month” trial loan periods for over 6 months, reports ProPublica. [More]

White House Says CFPA On Your Side: "Anything Is Fair Game"

The new Consumer Financial Protection agency will be a place you can go to with your complaints and they will be taken seriously, the White House said this afternoon during a conference call in which Consumerist took part. While, “It’s not totally worked out who’s going to be manning the 1-800 number,” said senior economic adviser Austan Goolsbee, [More]

Some Homeowners Worse After Getting Rushed Into Gov't Loan Mod Program

Despite fulfilling every obligation under trial government-sponsored loan modification programs, some homeowners can end up far worse off than if they had never joined up at all, Propublica reports. That’s because if they’re denied a permanent modification, they have to pay the entire amount that was being discounted, often within a very short period of time. This pushes already strapped families past the breaking point. [More]

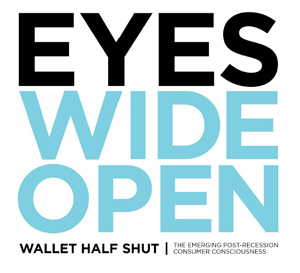

America: Eyes Wide Open, Wallet Half Shut

Like a tempered blade, America has passed through the fires of recession and emerged stronger and sharper, albeit with some pieces of itself permanently oxidized. What is on our minds? How do we feel and how are we acting in the new economy? Researchers at Communispace surveyed more than 1,200 U.S. consumers, spoke with 694 online community members, and came up with some very interesting results and insights. Here they are, in chunky infographic form: [More]

BoA Sued For Taking TARP $ But Not Helping Foreclosures

A class action lawsuit has been filed against Bank of America for taking $25 billion in federal TARP bailout money but intentionally failing to live up to its part of the bargain. The deal was that banks were supposed to use use the money to allow struggling homeowners to reduce their payments to affordable levels. “Bank of America came up with every excuse to defer the Kahlo family from a home loan modification, from stating they ‘lost’ their paperwork to saying they never approved the new terms of the mortgage agreement,” said the plaintiff’s attorney. “And we know from our investigation this isn’t an isolated incident.” Bank of America declined to comment.

Washington homeowners file class action against Bank of America [Seattle PI]