The news from the hacked third-party payment processor for MasterCard and Visa got worse over the weekend, as early reported estimates of around 50,000 card numbers put at risk turned out to be wrong by 1.45 million. [More]

mastercard

MasterCard, Visa Payment Processor Says Violation Occurred In Early March; 50,000 Cards At Risk

Earlier today, we wrote about how MasterCard and Visa had begun notifying banks about a possible data breach at a third-party company that processes credit card payments. Now more information has come out regarding when the breach occurred and how many people may be affected. [More]

MasterCard, Visa Warn Banks Of Possible Data Breach

MasterCard has notified law enforcement and banks that issue its cards of a possible data breach at a third-party payment processing company. [More]

Intel Wants To Make It Easy (And Safe) To Pay For Purchases By Swiping Your Card Against Your Ultrabook

The big story, in terms of a technology that is here and that consumers seem to actually want, is super-thin Ultrabook laptops that contain Intel-produced processors. And the folks at Intel tell me they don’t just want to provide users with a faster, lighter-weight computing experience; they also want to make it safer and easier to shop online. [More]

Credit Cards To Sell Your Buying History So Online Advertisers Can Target You More Precisely

How about a world where you swipe for a Big Mac and then the next time you go online you get an ad for Slimfast? That’s the big idea behind Visa and Mastercard’s new business foray: selling off all your swipe data to online advertisers so they can more precisely target their ads to what’s going on in your skull. It’s another nail in the coffin for the quaint fiction we call “online privacy.” [More]

Bank Of America, Chase, Wells Fargo, Visa, MasterCard Sued Over ATM Fees

Have you ever glared angrily at the ATM, knowing that you’re going to be saddled with fees and wishing you could sue everyone involved? Well, it looks like more than one person has followed through on this idea. [More]

ATM Council Sues Visa And Mastercard For Forcing Them To Charge Consumers Set Fees

Visa and Mastercard have been accused of price fixing in a lawsuit filed Wednesday by the the National ATM Council. The suit alleges that nonbank ATM operators could charge customers lower ATM fees when they use other, cheaper payment networks, but are prevented from this by the set access fees Visa and MasterCard charge. [More]

Credit Card Marketer Uses Clever Way To Circumvent New Regs

Looks like at least one credit card marketer has cooked up a clever way around regulations that forbid unsolicited credit cards from being issued and showing up in your mailbox. [More]

VISA And Mastercard Plan To Hike Debit Card Fees On Small Items For Merchants

VISA and Mastercard are planning to sharply raise the debit card transaction fees for small purchases for merchants, according to an analyst note. A $2 cup of coffee incurs about an 8 cent fee currently, but under the new policy, the fee will hike to 23 cents. [More]

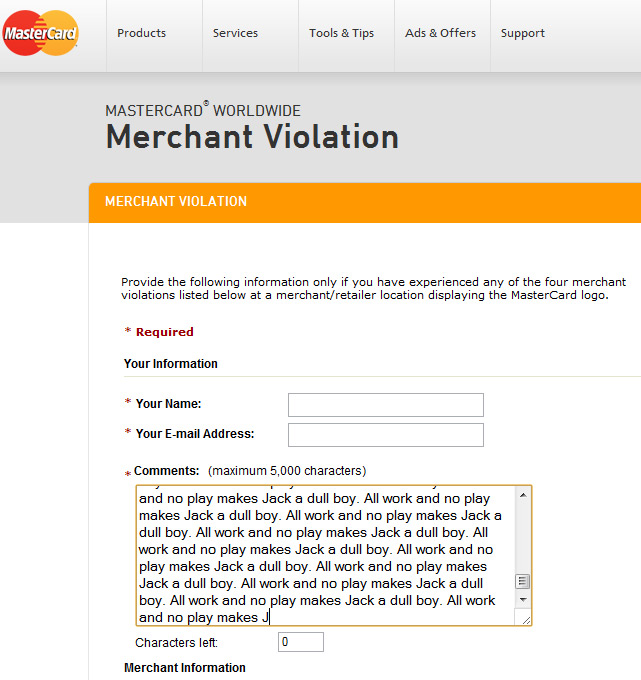

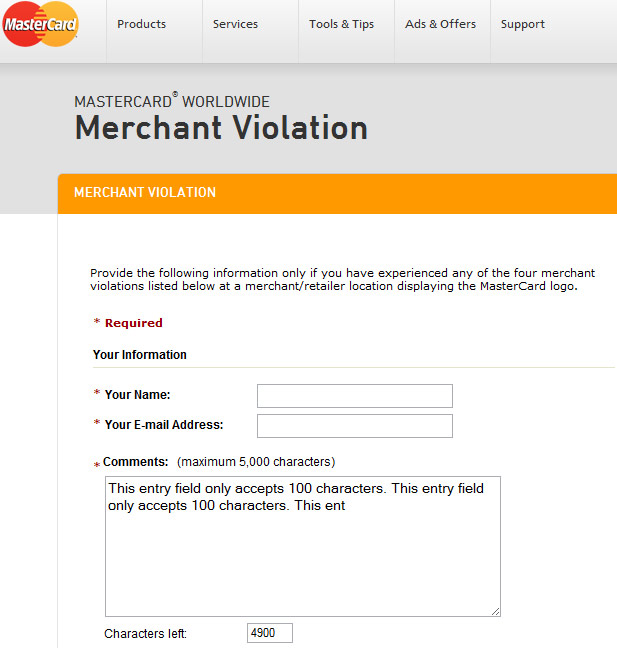

MasterCard Fixes Merchant Violation Form

After a reader noticed that Mastercard’s Merchant Violation report form for consumers only let you put in 100 characters even though it said you had 5,000, we wrote a post about it (in addition to using the form itself to report the error). Now Mastercard has informed us that they fixed it, and indeed it passes our test. Finally, “As a point of reference, consumer questions and issues can be raised on our Twitter page at @MasterCard, as well as the web forms,” the MasterCard rep pointed out via email. That’s right, there’s now at least two ways to talk to MasterCard using over 100 characters. [More]

Mastercard's Merchant Violation Form Only Accepts 100 Characters

I guess Mastercard has gotten tired of hearing long-winded consumer complaints about stores breaking their merchant agreement with them. The form on their website where you’re supposed to make complaints says that you can use a max of 5,000 characters, but when you actually go to type something in, it won’t let you enter in more than 100. Perhaps they would rather consumers tweet their complaints? [More]

Bill Introduced To Delay Swipe Fee Reform

Bills were introduced in both the House and Senate to delay “swipe fee reform” by at least a year and they call for a study of its potential effects. The new rules, scheduled to take effect July 21, would cap the fee banks can charge merchants for processing debit card fees at 12 cents per transaction. [More]

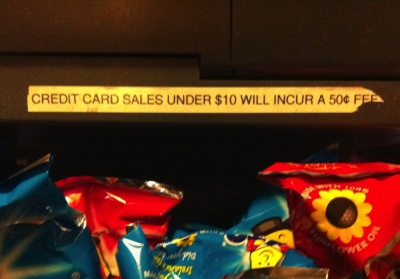

Shop Charges $.50 Fee For Credit Card Purchases Under $10

I spotted a coffee shop charging customer a $.50 for using a credit card on any purchase that is under $10. It doesn’t break any laws, but it does violate their agreement with the credit card companies. [More]

Amex Slapped With Antitrust Suit, Visa & Mastercard Settle

The Justice Department sued Amex today, saying that the restrictions it places on merchants were anti-competitive. According to the complaint, the rules “impede merchants from promoting or encouraging the use of a competing credit or charge card with lower card acceptance fees.” [More]

Fee For Paying With Plastic? Decision Nears

The US Justice Department is said to be close to a decision on whether credit card companies can continue to forbid merchants from charging extra to customers who use credit cards to cover the cost of the credit card processing fees (usually 1-5% of the price). [More]

Why Won't Walmart Tell Its Employees They Can't Demand ID For MasterCard Purchases?

Even though — as recently as last week — executives at both Walmart and MasterCard confirmed that it is against both companies’ policies to demand ID for credit card purchases, Consumerist readers and Walmart shoppers are letting us know that the hassle continues. [More]

MasterCard: Walmart Should Not Have Demanded ID For Purchase

A couple weeks back, we brought you the story of Michael, a Walmart customer who was told it was company policy to require a photo ID on all credit card purchases over $100, even though that appears to be in violation of MasterCard’s merchant agreement. After trying to get someone at MasterCard to clarify/confirm their stance on ID-checking, Michael finally got the reply he was looking for. [More]

China To Exceed US Credit Card Use By 2020

We don’t need to worry about China getting ahead, Mastercard said today that China is set to surpass the US by 2020 in America’s favorite pastime: using credit cards. It will only be a matter of time after that they implode on a consumer credit bubble, muahaha, exactly as we planned. See, you’re not the only ones that can export poison! [More]