File-sharing and copyright infringement have been a bugaboo among lawmakers since internet speeds got fast enough to swap music in the late 1990s. No tactic so far has actually yet stopped audiences from swapping music and movies among themselves, and while some sites and services have been shuttered, another two or three are always ready to pop up. So now a lawmaker is trying a new strategy: appealing to the middlemen who actually move the money. [More]

mastercard

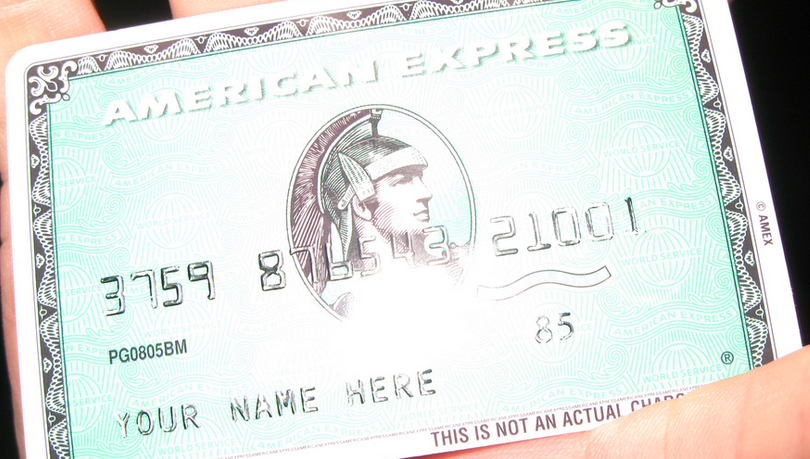

Costco May Finally Start Accepting Something Other Than American Express

Costco may be very generous with the free food samples and might have a very forgiving return policy, but when it comes to paying with a credit card at the warehouse club, customers have only one option: American Express. But a new report claims that we could be seeing the end of Costco customers being forced to use their AmEx when buying 872 lbs. of steak and enough toilet paper to keep a small nation clean. [More]

Bogus Credit Card Charges Look Like They Were Made With Chip-Enabled Cards

As banks begin rolling out new credit cards embedded with microchips intended to help prevent fraudulent use, some financial institutions are reportedly seeing a spike in bogus transaction charges that appear to be coming from these newer cards, even though chip-enabled cards have yet to be sent out. [More]

Why Did CVS & Rite-Aid Stop Taking Apple Pay?

After nearly a week of accepting payment via the recently launched Apple Pay system, both CVS and Rite-Aid suddenly stopped offering this option to shoppers over the weekend. And neither retailer is giving a reason why, though it appears to be part of a retail-industry effort to eventually roll out its own payment system. [More]

What The Numbers On Your Credit Card Indicate

Over the years, countless people have looked at 16-digit credit card numbers and said things like “Why do they need so many numbers? It’s not like there are 9.999 quadrillion bank accounts out there.” Well, that’s true. But the numbers on your card aren’t just about how many accounts or cardholders exist. They also indicate information about your card issuer, its network and tells processors whether or not the number is valid. [More]

10 Answers To Credit Card Questions We Get Asked All The Time

Credit cards come with a lot of fine print. But the scene isn’t just complicated for cardholders; it’s complicated for the retailers that accept them, too. What needs signing, and what doesn’t? When can a store ask for ID? Are they allowed to charge different prices for cash and credit? [More]

MasterCard Extends Zero-Liability Policy To ATM & PIN Transactions

While both MasterCard and Visa have zero-liability policies for fraudulent transactions made by swiping a card or using the card number online or over the phone, that same level of protection has not been afforded to all cardholders for bogus ATM withdrawals or PIN-based purchases. However, MasterCard announced today that it is extending the zero-liability policy in the U.S. to include these two types of transactions. [More]

Walmart Slaps Visa With $5B Lawsuit For Allegedly Fixing Card Swipe Fees

Thought retailers were done fighting credit card companies over those credit and debit card swipe fees? You thought wrong! Or not wrong, because no one can predict the future, but Walmart is steamed up and suing mad at Visa, alleging in a new lawsuit that the card company set ridiculously high card swipe fees. [More]

MasterCard, Visa Form Industry Group To Address Payment Security Issues

In the wake of numerous high-profile data breaches and growing concerns about identity theft, credit card competitors Visa and MasterCard are teaming up to launch a cross-industry effort aimed at improving payment security for consumers. [More]

Visa, MasterCard Endorsement Of Tap-And-Pay Could Replace Your Wallet With A Smartphone

We use our smartphones for everything, from taking photos and video to mobile banking. So why not replace your wallet with your phone? That’s a change that could be coming sooner rather than later now that MasterCard and Visa have endorsed a new mobile payment technology. [More]

Target, Macy’s Reject Fee-Fixing Settlement With Credit Card Companies & File Fresh Lawsuit

Last summer, some of the country’s largest retailers reached a settlment with Visa and MasterCard that was supposed to put to rest qualms the businesses had with the credit card companies’ alleged practice of fee-fixing. The $7.2 billion settlement didn’t sit well with some, including Target and Macy’s, prompting a group of retailers to file a new lawsuit this week, effectively rejecting that previous agreement. [More]

MasterCard’s New MasterPass Seeks To Cut Out That Annoying “Waiting To Checkout” Thing

Who needs a physical wallet anymore? Those old things made of leather or duct tape or whatever? Eww. MasterCard is banking on the popularity of other digital wallet systems with the introduction of its new offering, the MasterPass. It doesn’t shut with velcro and you don’t need one of those chain things to keep it in your pocket. [More]

How Do Different Credit & Debit Cards Stack Up In Terms Of Consumer Protection?

We’ve mentioned any number of times how federal laws offer more protection to consumers who make purchases with credit cards because $50 is the most you can be held responsible for a fraudulent purchase, while the sky could be the limit with debit cards. But how do the various networks compare? [More]

PayPal Blocked Access To My Account After Denying Me A Debit Card

Consumerist reader “A.M.” has a small business running a Minecraft server that brings in a bit of money via PayPal. He recently applied for a PayPal/Mastercard debit card, only to be denied. That wasn’t such a big deal; the real problem was his sudden inability to access the money in his PayPal account. [More]

Having Separate Credit Card Accounts From Your Spouse Can Keep You From Being Stranded Abroad

While many couples consolidate their bank and credit card accounts, there is at least one situation where having a separate account from your spouse can save you some huge headaches. [More]

Visa, MasterCard Agree To Let Merchants Add Surcharges To Credit Card Purchases

Earlier this week, we told you that a settlement in a huge lawsuit between merchants and Visa and MasterCard was in the offing and that it could open the door to retailers tacking on surcharges to credit card customers. Well, that proposed settlement has come to pass, meaning you may soon be paying more for the privilege of using your credit card. [More]

Get Ready To Pay Surcharge Every Time You Pay With Credit Card

Visa and MasterCard know there is nothing that American consumers love more than fees and surcharges. That’s why the credit card companies are reportedly looking to do away with longstanding rules that prohibit merchants from adding on extra costs to customers who pay with credit. [More]

Visa, MasterCard Don't Want You Knowing Which Companies Are Failing At Protecting Your Information

If your bank tells you that your credit card information was stolen from an online merchant you bought something from, it only makes sense that the bank also tell you which e-tailer failed at protecting your information. But the banks say they can’t share this info because the folks at Visa and MasterCard prefer to keep that information private lest you stop doing business with the sources of the leaked information. [More]