In football, a cornerback is tasked with defending against pass offenses. It appears one former NFL player wasn’t doing much defending on behalf of investors off the field. Instead, the Securities and Exchange Commission alleges former New York Giants player Will Allen used his big league connections to assist in the operation of a $31 million Ponzi scheme based on making loans to cash-strapped pro athletes. [More]

loans

![The CFPB's electronic version of its Know Before You Owe Mortgage Toolkit includes interactive forms to help consumer find the right mortgage for them. [Click to Enlarge]](../../../../consumermediallc.files.wordpress.com/2015/03/screen-shot-2015-03-31-at-2-08-15-pm.png?w=300&h=225&crop=1)

CFPB Releases Mortgage Toolkit Aimed At Making The Home Buying Process Easier

In January, the Consumer Financial Protection Bureau released a report suggesting that many homebuyers spend more time looking for a TV than shopping around for the right mortgage. In an attempt to make things a little less daunting for prospective borrowers, the Bureau today released the “Know Before You Owe” mortgage shopping toolkit. [More]

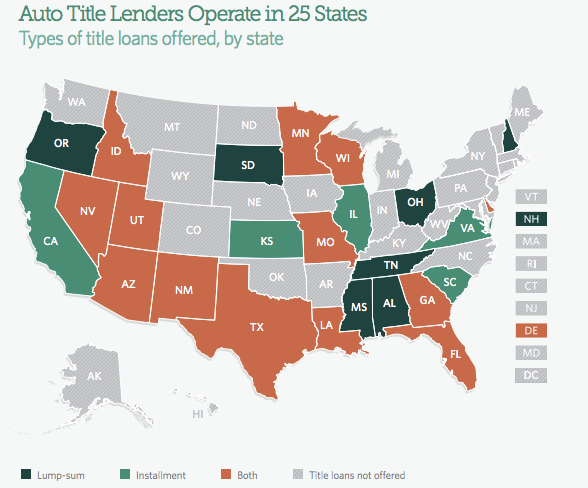

Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions. [More]

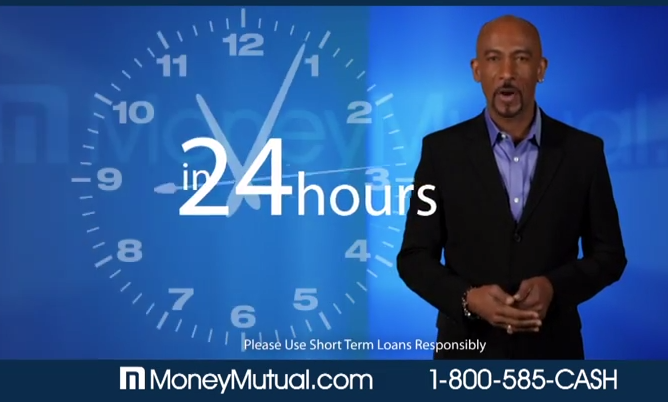

Montel Williams Defends Hawking Payday Loan Generator Money Mutual

By now we know that celebrities (and pseudo-celebrities) often lend their names to products that may or may not have devastating effects on consumers. Of course, hawking a product for a paycheck doesn’t automatically make the spokesperson in question an expert on the product or the consequences of using it. [More]

Discover, Wells Fargo To Offer Private Student Loan Modifications

Consumers facing difficulty in paying back their private student loans often have a difficult time receiving any relief from lenders. While some smaller banks have relaxed their repayment terms for good borrowers in the past, two of the nation’s largest private lenders are set to make the same opportunities available to private student loan borrowers. [More]

CFPB: Mortgage Lender Must Refund Consumers $730,000 for Steering Them Into Costlier Mortgages

Taking out an expensive loan is often the only option when it comes to financing a new home. And while most prospective home buyers might expect their mortgage lender to find them the best deal, that isn’t always the case. Take for example a California-based mortgage lender being ordered to provide $730,000 in consumer redress for an illegal compensation system that offered bonuses to employees for steering borrowers into higher interest loans. [More]

USA Discounters: Where A $650 Laptop Ends Up Costing Army Private $8,626

A discount retailer that sells itself as being friendly to military borrowers has been pushed into the spotlight, thanks to a report highlighting questionable lending and marketing tactics that lead some borrowers into lawsuits where they can’t reasonably defend themselves. [More]

Feds Warn Consumers Against Taking Pension Advances

Unfortunately, not everyone currently in retirement has enough cash on hand to stay afloat, even those fortunate enough to receive a pension from their former employer. That’s why it might be tempting to solve a short-term money problem by taking out a pension advance, which pays you a lump sum now for signing over your pension payments to the lender for anywhere from a few years to a decade. Today, the Federal Trade Commission warned consumers to think twice before agreeing to one of these loans. [More]

Banks Working With HELOC Borrowers To Prevent Potential Loan-Default Disaster Before It Happens

The housing bubble that imploded spectacularly in 2008, taking a big chunk of the U.S. economy with it, has a second wave waiting to strike in the form home equity lines of credit (HELOCs). Having learned from the lesson that preventing a disaster rather than recovering from one might, in fact, be a better way to go, lenders — at the urging of regulators — are now working proactively with borrowers to stave off potential doom before it happens. [More]

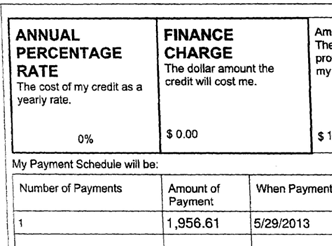

Getting Ahead On Paying Down Student Loans Is A Good Plan, But Not Without Problems

For people looking to get out from under student loan debt before they have grandchildren, paying more than is owed each month has traditionally been an option. But according to a new report from the Consumer Financial Protection Bureau, questionable practices and a lack of transparency at loan servicing companies have resulted in prepayment causing undue headaches. [More]

Auto-Title Lender Skirts Law By Giving Away Cash For Free

Several cities in Texas have recently enacted laws intended to drive out or rein in short-term, high-interest lenders offering auto-title loans, in which borrowers put up their cars as collateral for short-term loans averaging around $1,500. But one lender has figured out a way to get around those laws — by giving away free cash and redirecting customers elsewhere when they need to refinance. [More]

How Predatory Lenders Get Around The Law To Loan Money To Military Personnel

In spite of the Military Lending Act, a law intended to prevent predatory lenders from gouging military personnel with exorbitant interest rates and mountains of fees, some of these lenders have figured out ways to work around the very specific limits of the law, targeting active-duty service members with loans that are almost indistinguishable from the ones forbidden by the Act. [More]

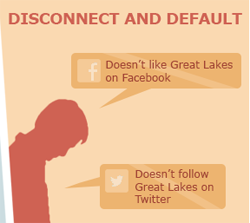

Student Loan Company Implies That If I Don’t Friend Them On Facebook, I Will Default

Great Lakes Higher Education Corporation is a large student loan servicer/guarantor, and a not-for-profit company. Their goal is a worthy one: they want to keep their customers engaged and get them to pay their student loans back. This is for the good of their customers, the good of the company, and really for the good of our entire economy. A recent e-mail they sent to their customers bothered a few readers, though, because it seemed to imply that if they didn’t follow the company on Twitter, they will default on their student loans. [More]

State Lawmakers Consider Limits On ‘Payday’ Lawsuit Loans

We’ve written a lot over the years about standard payday loans — short-term, high-interest loans from non-bank lenders — and similar deposit-advance loans offered by some of the nation’s largest banks. But there is a growing form of short-term loan that lawmakers are concerned about — loans to plaintiffs of pending lawsuits. [More]

GAO Calls Out Bank Regulators For Mucking Up Foreclosure Reviews

Back in April 2011, in the wake of the robosigning scandal and in light of numerous instances of erroneous seizures, the Office of the Comptroller of the Currency and the Federal Reserve System ordered independent reviews of the foreclosure process at the country’s 14 largest mortgage servicers. Now, two years on, the Govt. Accountability Office is saying these regulators allowed the review process to become inconsistent and overly complex. [More]

Credit Card Delinquency Rate At Lowest Since Today’s College Students Were In Diapers

In spite of the fact that many Americans are still feeling the headache, nausea, and exhaustion from the Not-So-Great Recession, it looks like we’re becoming more responsible about paying our loans on time. According to a new report, the delinquency rate on bank-issued credit cards is now at its lowest since 1994. [More]