Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

loans

Is Volkswagen Violating The Fair Debt Collection Practices Act?

Tim’s neighbor received a call from VW Credit asking her to walk across the street and leave a note on her neighbors’ front door and VW Bug asking them to call back their creditor. Calls like these are known as block parties, and they are a direct violation of the Fair Debt Collection Practices Act.

Ex-Credit Card Bankers: "Every Customer Who Calls In Is A Mark. It's A Great Big Con."

CNN has an interview with two former credit card bankers who are admitting that their job was to get consumers to max out their credit cards and take on as much debt as possible, regardless of the customer’s ability to afford it. They both worked for MBNA at their “sprawling consumer call center in Belfast, Maine.” The bankers say that they were told to aggressively push cash advances, and were trained to convince consumers that they needed the maximum amount of debt at the highest interest rate.

Retailers Like Target May Be In Trouble As Consumers Run Out Of Money

Forbes says that Wall Street is starting to be concerned about Target because of an increase in the amount of delinquencies in its credit card operation. Uh oh…

What Will The Largest Government Bailout Of Private Industry In US History Look Like?

A bailout of some kind is coming, but no one seems to know what it will look like and who it will help. The Wall Street Journal says that Senate Banking Committee Chairman Christopher Dodd of Connecticut has some ideas that might not go over too well with the Treasury Department.

PRBC Helps You Create A Credit Score From On-Time Rent, Bill Payments

Payment Reporting Builds Credit (PRBC) is an alternative credit reporting agency that will record your payment histories for things like rent and utilities bills. PRBC says you can then use this verified credit history to supplement your FICO score and credit history from the big three reporting companies. It’s meant in part as a way to help people who don’t have extensive standard credit histories, or who have always paid monthly expenses on time but have other blots (like medical bills) on their official credit histories.

Personal Finance Roundup

5 Simple Steps to a Successful Cover Letter [Yahoo Hotjobs] “[Here’s] an easy-to-follow, five-step formula for cover letter success”

../../../..//2008/09/18/were-not-the-only/

We’re not the only ones with a credit crunch. HBOS, Britain’s biggest mortgage lender, is going under.

How Hard Is It To Get A Car Loan These Days?

Having trouble getting a car loan? You’re not alone. “Gas at $4 a gallon changed the type of vehicles people buy. The credit crunch, however, has changed their ability to buy,” says a car dealer. Higher interest rates, higher down payments, fewer loans, and high aversion to dings on your credit report, this Kicking Tires post has more from the front lines about banks’ new level of pickiness when it comes to putting you in your next jalopy.

Facing Foreclosure? Buy A Second Home! Wait, What?

ABCNews says that more and more people who are facing foreclosure are just buying cheaper homes and then just walking away from their original mortgage. It only works for people who can afford the down payment on a new home and carry both mortgages until they’re in the new home, but for some people whose payments are about to balloon, it’s the most attractive option out there right now.

Credit Card Junk Mail Decreases By 260 Million

The number of credit card offers clogging mailboxes took a nosedive in this year’s second quarter, 1.54 billion vs 1.8 billion for the same period last year. An aftershock of the credit crunch and sub-prime meltdown, the decrease reflects a shift in the banking industries thinking, trending towards higher standards from its borrowers than merely the fact that they are carbon-based lifeforms. A good way to take that number even lower is to register with OptOutPrescreen.com and stop the tide of credit card offers almost entirely.

If Enough Banks Fail, The FDIC Could Run Out Of Money

Everyone knows that your money is safe in an FDIC insured bank because if the bank fails (Hello, IndyMac!) the FDIC will step in and repay your money (generally, up to $100,000.) But what if the FDIC runs out of money? It doesn’t have an unlimited supply and enough bank failures could completely drain its fund, says ABCNews:

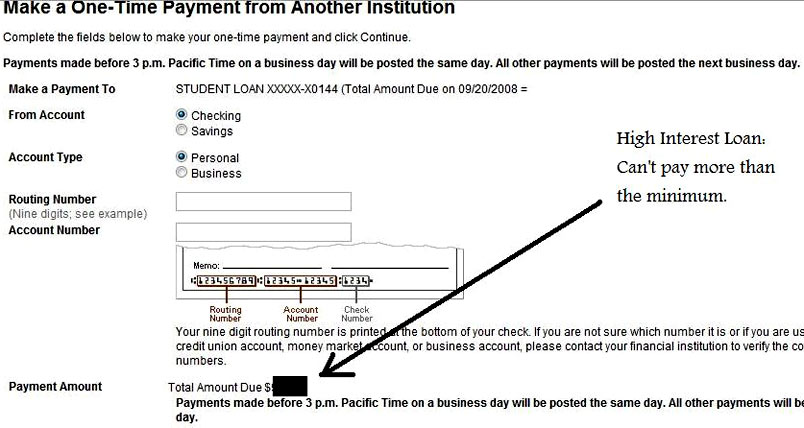

Wells Fargo Forces You To Pay Off Loans Costliest Way Possible

According to reader Caleb, Wells Fargo seems to have recently crippled their loan repayment system in a way that makes it impossible for borrowers to pay off loans the way they want to. That is, unless you prefer to let your highest-interest loans ride for as long as possible while you pay off your lower-interest loans…

Homeowners Sue Countrywide!

Who isn’t suing Countrywide lately? Phuong Cat Le from the Seattle Post-Intelligencer says that a group of homeowners are now suing Countrywide, alleging that the lender steered them toward high-risk loans without disclosing the inherent risks.

Don't Fall For Mortgage Infomercials Masquerading As "News Networks"

Reader Brian says he saw the above pictured infomercial on CNBC this Sunday, and is wondering how they get away with such a “blatant attempt to take advantage of those same mortgage consumers who where hoodwinked in the first place.”

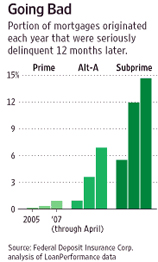

The Only Thing Worse Than '06 Mortgages: '07 Ones

Man, remember those mortgages made in 2006? That was some bad juju. Whooee. But if you thought those were bad, wait till you get a load of the mortgages made in 2007. As the graph shows, people are defaulting on them at an even higher rate than the ’06 ones. How could this be? By 2007 the bubble was popping and lenders could all see that they needed to stop giving making loans to underqualified borrowers, right? That was exactly the problem: “Mortgage originators who profited handsomely from the housing boom “realized the game was completely over” and pushed mortgages out the door,” reports WSJ.